An analysis by EMI of the latest quarterly financials from the leading U.S. credit card issuers revealed the following trends:

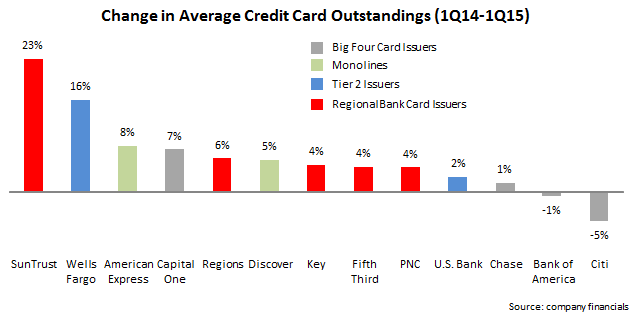

- Growth in average outstandings. Of the 13 leading issuers studied, 11 reported y/y increases in average outstandings.

- The two exceptions were Bank of America and Citi, two of the top four issuers and this continues a longstanding pattern

- Capital One—another top four issuer— reported a strong growth rate of 7%, driven by origination programs and line increases. However, it should be noted that Capital One retains some of the credit card monoline heritage, with card loans accounting for 40% of its total loan book.

- Strongest growth was reported by SunTrust, although it should be noted that this comes from a low base, with average card loans accounting for just 0.7% of SunTrust’s total loans, a percentage that is significantly lower than its regional bank peers. It is also worth noting that SunTrust’s credit card yield was below 10% in 1Q15, lower than regional bank peers like Fifth Third (10.22%) and Regions (11.73%), as well as larger issuers like U.S. Bank (10.81%) and Wells Fargo (11.78%).

- Wells Fargo also reported very strong y/y loan growth of 16%, although this included the acquisition of the Dillard’s private-label portfolio. Its credit card penetration of retail bank households rose nearly four percentage points y/y to 41.8%, although the rise in penetration slowed sharply in the most recent quarter, increasing just 28 percentage points.

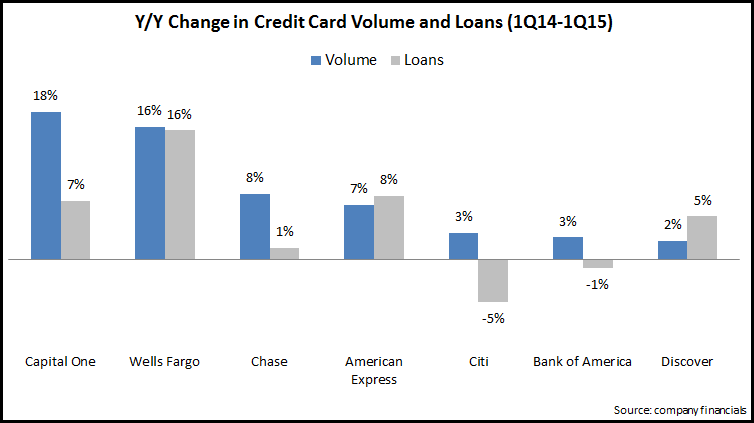

- Outstandings starting to come into line with volume. Since the 2008 financial crisis, the card industry has focused more on increasing cardholder purchase volume rather than outstandings. As you see in the following chart, volume growth continues to outstrip outstandings growth.

- Of the 7 issuers below reporting y/y changes in both volume and outstandings, only American Express and Discover reported higher growth rates for outstandings than volume.

- Ideally, issuers would like outstandings and volume to grow at similar rates; American Express and Wells Fargo were most effective at achieving this in the most recent quarter.

- Some issuers reported that lower gas prices had a depressing effect on volume growth.

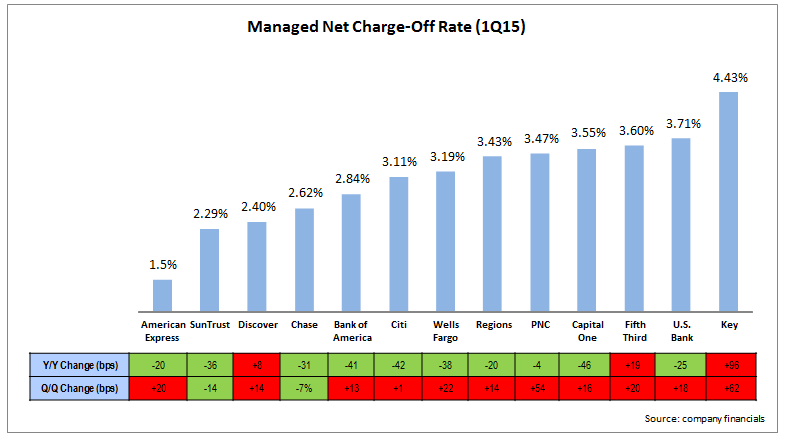

- Charge-offs remain at historic lows. 12 of 13 issuers reported credit card net charge-off rates below 4% in 1Q15, with 5 issuers below 3%. In addition, 10 of the 13 issuers reported y/y declines in charge-off rates. Although most issuers reported growth in charge-off rates between 4Q14 and 1Q15, this is a normal seasonal pattern, and there is little sign of significant upward movement in charge-off rates. Some issuers are revising downward their future charge-off rate expectations: Capital One reported that its rate may fall to the low 3% range in 3Q15 (although it does expect rates to rise in 4Q15 and 2016). And Chase expects that its full-year 2015 net charge-off rate will be less than 2.5%.

- Delinquency rates continue to fall. Of the 8 issuers who reported 30+ day delinquency rates, all reported y/y declines. This indicates that there is little upward pressure on charge-off rates, as delinquencies tend to be leading indicators of future charge-offs.

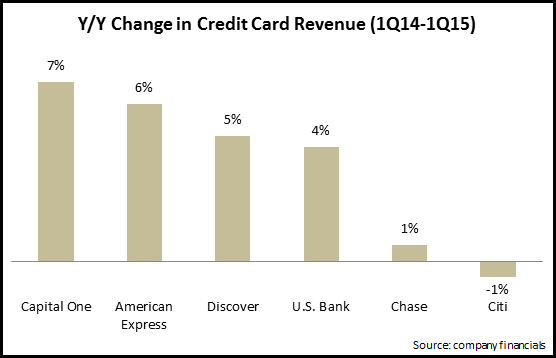

- Signs of revenue growth. in recent years, issuers have reported low/no revenue growth and have instead generated profits from low provisions for loan losses. As issuers have now begun to target outstandings growth, revenues have started to increase. Of the 6 leading issuers providing credit card revenue data in 1Q15, 5 reported y/y growth. In addition, 4 of these 5 issuers reported growth in both net interest and noninterest income.