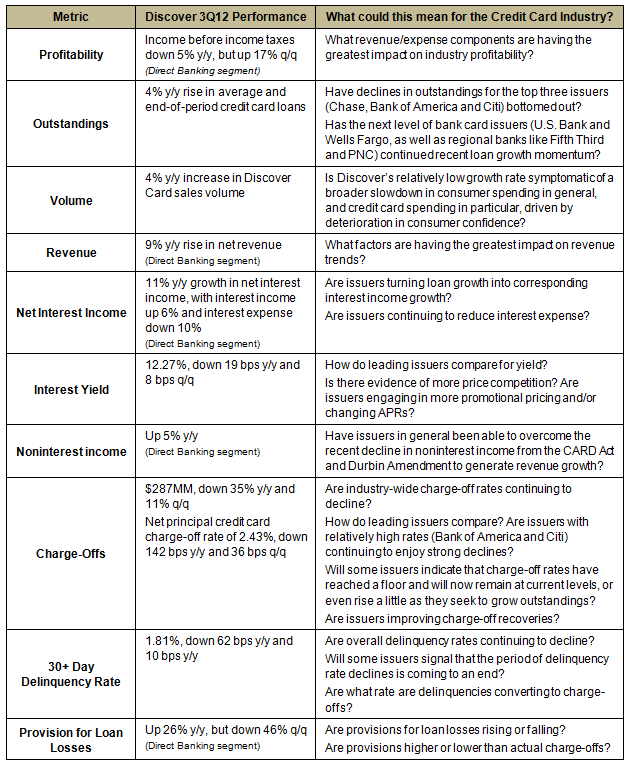

Discover Financial Services reported third-quarter financials this week. As it publishes financials a few weeks before other leading card issuers, Discover’s results often act as leading indicator of broader credit card industry trends. Using Discover’s results as a benchmark, the following are 10 key credit card metrics to follow when other issuers report over the next month.

Monthly Archives: September 2012

10 Ways That Banks Can Build Small Business Customer Relationships

As the U.S. financial system emerges from the financial crisis and the resulting recession, leading banks are refocusing on the small business banking sector, with some banks reporting strong growth in small business loan originations.

Following the financial crisis, banks are seeking to have a more equal balance between new customer acquisition and optimizing existing customer relationships. With this in mind, here are ten tips that banks should consider in growing their relationships with small business customers.

- Communicate small business commitment. Feature small business in advertising campaigns and other communications (e.g., in-branch merchandising and on their bank website) to demonstrate their commitment to the small business segment and rebuild the trust that was damaged during the financial crisis.

- Target high-potential segments. Identify and target segments that are underserved or have significant growth potential. Examples include KeyBank focus on women-owned businesses, Wells Fargo’s marketing to minority-owned businesses, and Fifth Third’s targeting of healthcare firms.

- Market bundles. Generate greater revenue per customer, while also reducing propensity to switch, by bundling products and services. Banks that are currently prominent in marketing small business bundles include Wells Fargo, U.S. Bank and M&T Bank.

- Deploy dedicated staff in branches. As small business owners migrate to self-service channels for day-to-day banking transactions, the branch’s role to selling and relationship development through dedicated small business staff. Compensation structures for these business banks should reflect customer relationship goals. Bank of America recently hired 130 small business bankers in Florida, as part of a broader plan to add 1,000 small business bankers nationwide.

- Market special offers. Leverage small business customer data to develop targeted cross-sell offers. These offers can be based on different factors, such as customer firmographics, activities, milestones (such as anniversaries) and external events (e.g., Wells Fargo markets Appreciation Offers to coincide with National Small Business Month in May every year).

- Reward relationships. Develop rewards programs that recognize the totality of the small business customer relationship. A standout example is the KeyBank Relationship Rewards program, which enables the business owner to generate points from various activities and business product ownership. The program also gives anniversary bonuses and allows small businesses to combine business and personal points.

- Develop customer outreach. Develop and implement a communications plan to build engagement with small business customers. Focus on key stages of the customer life cycle (first 90 days, anniversaries, etc.).

- Provide information and advisory tools. Enhance your positioning as a trusted financial advisor by providing a range of resources to help small business manage their business. A number of banks are leading the way with online small business portals that combine information, advice and networking opportunities. Examples include Associated Bank’s Associated Connect, Bank of America’s Small Business Community and U.S. Bank Connect.

- Market online and mobile banking. Reflect small business owners’ comfort with using Internet-based tools to manage their business by continuing to add online banking functionality, while introducing/enhancing mobile banking. Integrate online and mobile banking with other customer service channels to provide a consistent user experience. Where appropriate, incorporate sales functionality into service channels.

- Sell personal financial services to small business owners. Capture significant revenue opportunities and reduce the propensity to switch by cross-selling personal banking and wealth management services to small business owners. This opportunity has been greatly facilitated by recent moves by many leading banks to dismantle their silo-ized organizational structures, which has led to improved communication and data-sharing among different business units. In addition, banks are changing compensation structures to reflect the value of generating referrals and cross-sell revenues.

Banks Targeting Verticals to Drive Commercial Loan Growth

In recent quarters, most U.S. banks have been reported double-digit commercial loan growth, and most bank executives claim that commercial lending will continue to be a key driver of overall loan growth in the coming quarters. With so many banks targeting commercial loan growth, competition has increased, which is leading to declines in commercial loan yields.

To differentiate from their competitors and capture strong commercial loan growth opportunities, banks are increasingly targeting specific industry sectors. Presentations by leading regional banks at this month’s Barclays Global Financial Services Conference highlighted this trend:

- Comerica is enjoying very strong growth in targeting two industry sectors: energy (loans up 68% y/y in 2Q12) and technology and life sciences (+36%).

- Fifth Third’s deployment of a national healthcare team has led to a 40% y/y rise in outstandings. Specialized products include the RevLink solutions platform, which supports healthcare organizations in streamlining collections and managing costs, as well as improving liquidity and working capital. Over the past year, RevLink accounts have risen 30%.

- Regions has five specialized lending groups headquartered in different cities throughout its footprint: energy in Houston, healthcare in Nashville, technology/defense in Charlotte, and both transportation and restaurant in Atlanta.

- Like Regions, Associated Bank has an energy (oil and gas) group based in Houston.

Banks looking to pursue a vertical marketing approach need to develop a comprehensive understanding these industries in order to identify which industries to target, and how to do so. The following are some key questions that banks need to answer in this regard:

- How many firms from specific industries are in the bank’s footprint?

- What is the projected industry growth rate?

- Are firms clustered in specific geographies?

- What are current and projected levels of profitability?

- Do these firms have unique financial needs?

- What is the current level of competitive intensity? Do other banks have dedicated resources to target this vertical?

- What is the customer decision-making process?

- Does the bank have sufficient in-house expertise to effectively target and serve this vertical?