An analysis of 10-K SEC filings by EMI Strategic Marketing has found that leading credit card issuers are looking to grow outstandings across a wider range of FICO Score segments.

In the aftermath of the Financial Crisis and Great Recession, issuers narrowed their focus, moving away from lower FICO Score segment, and concentrating their efforts on prime and superprime consumers. In recent years, issuers have reduced charge-off rates to very low levels. With the steady growth in the economy and rising consumer confidence, issuers see an opportunity to grow their credit card outstandings and many are willing to take on more risk in order to achieve the desired growth.

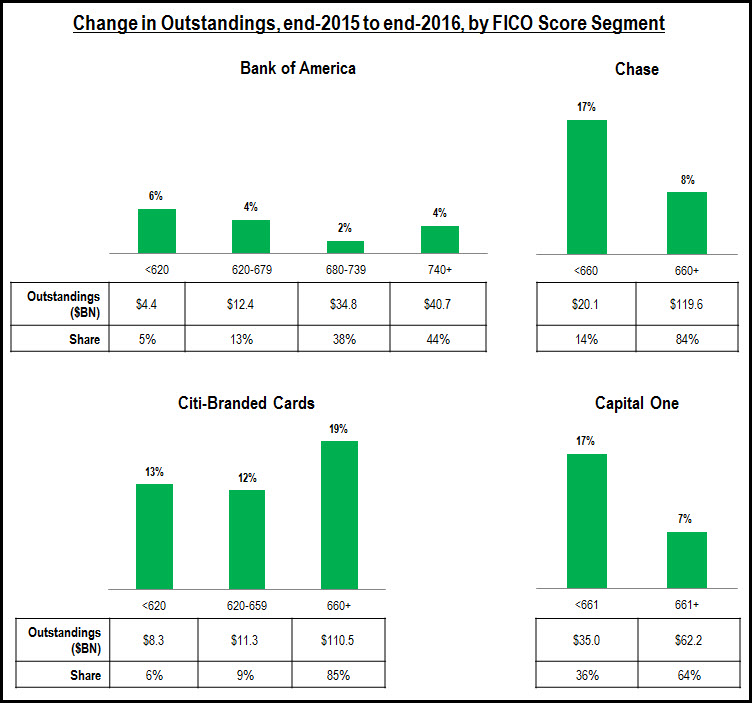

The four largest credit card issuers—Chase, Bank of America, Citibank and Capital One—all reported growth in each of their FICO Score categories in 2016. Three of these issuers (the exception was Citi) had strongest growth in their lowest credit score segment. Citibank had double-digit growth in large part due to the acquisition of the Costco portfolio from American Express, and this acquisition influenced the relative growth rate of different credit score segments. Note that 36% of Capital One’s outstandings are held by consumers with credit scores below 660, compared to only 14% of Chase’s and 15% of Citibank’s (Citi-Branded Cards unit) outstandings.

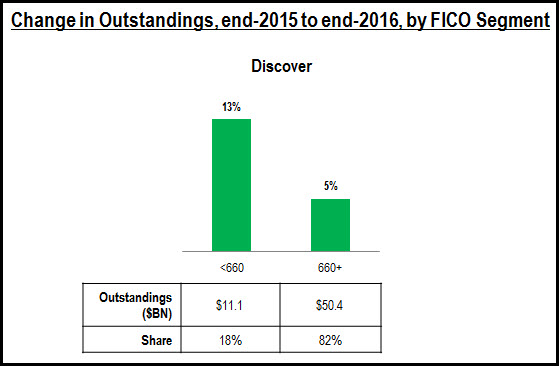

Leading monoline credit card issuer Discover followed a similar pattern, with stronger growth for the <660 FICO Score segment, which accounted for 18% of total outstandings at the end of 2016.

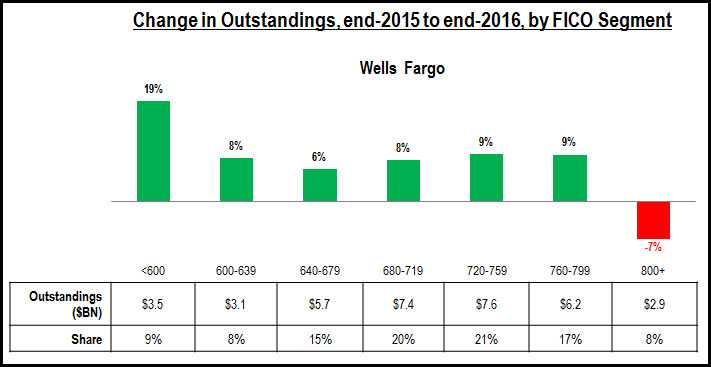

Among the regional bank card issuers, Wells Fargo reported very strong growth (+19%) in the <600 segment, and consistent growth across most other segments. However, it had a 7% decline in the 800+ segment, as it does not appear to have an affluent credit card that can compete effectively with American Express, Chase (which launched Sapphire Reserve in 2016) and Citibank.

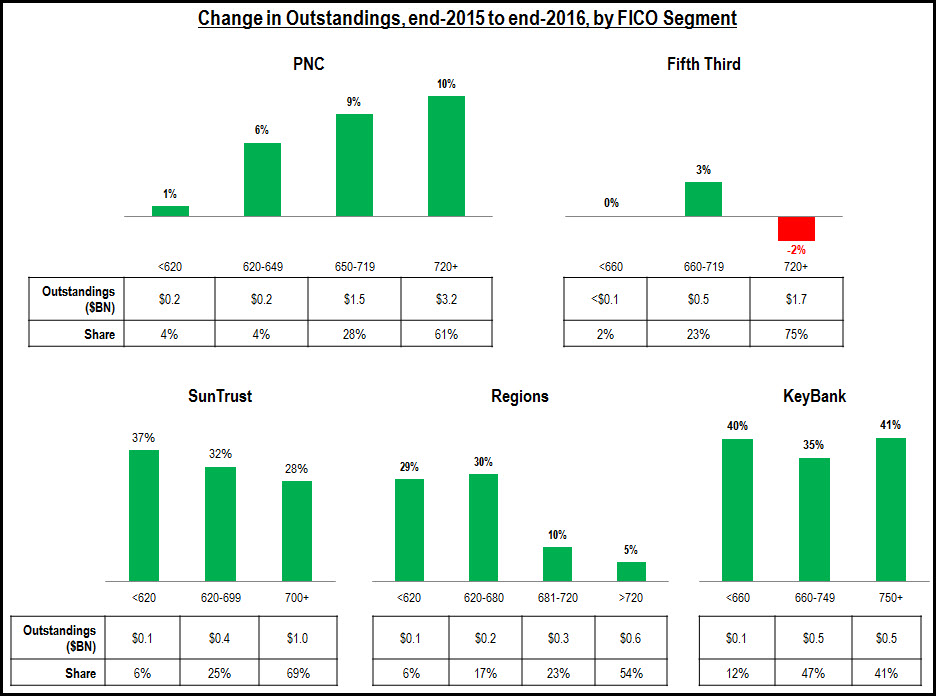

Other regional bank card issuers are also looking to drive growth across the credit spectrum. SunTrust, KeyBank and Regions have some of the strongest credit card loan growth rates in the industry, with very strong growth at the lower end of the spectrum. In contrast, PNC had strongest growth in the 650+ FICO Score segments.

The following are some key considerations for issuers looking to grow outstandings across the credit spectrum:

- Compare the FICO composition of the issuer’s credit card portfolio to its peers. Assess the organization’s appetite to expand into new credit score segments.

- Understand the financial needs, characteristics and behaviors of different credit score segments

- Have products, offers and pricing in place for a range of consumer segments.

- Invest in new marketing channels (and develop messaging) to reach different segments

- Partner with other bank units that have strong connections with particular segments (e.g., wealth management and consumer financing units) in order to drive cross-sell to underserved segments

- Ensure that company underwriting reflecting company objectives (while maintaining underwriting discipline).