Leading U.S. credit card issuers continued to roll out new credit cards, as they look to attract new clients, cross-sell and upsell existing clients, and win a greater share of clients’ spending.

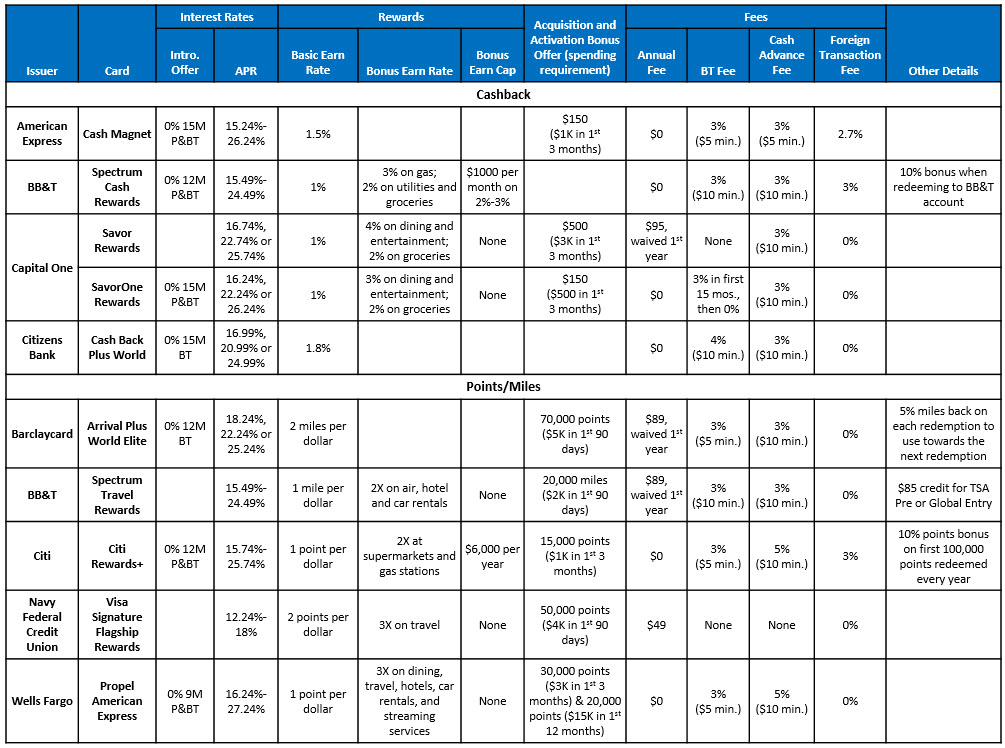

The following are the common trends or standout elements that we identified among these new cards. (Note that the table at the end of this blog provides a comparison of features/benefits of 10 cards that were introduced over the past 12 months.)

- Introductory offers are focused on generating balance transfer volume. 7 of the 10 cards have 0% introductory offers on either purchases and balance transfers or balance transfers only. 6 of these 7 introductory offers have a duration of at least 12 months.

- Go-to APRs continue to be prime-based and operate in a broad range. The APR range of many of the new credit cards is at least 7 percentage points. Two cards (American Express Cash Magnet®, and Wells Fargo Propel® American Express) have an APR range of 11 percentage points.

- Some cards offer a high earn rate on all purchases. One approach to using rewards to attract and retain cardholders as well as drive more spending is to have an earn rate of more than 1% on all purchases. The Citizens Bank Cash Back Plus® World Mastercard® stands out with an earn rate of 1.8% on all purchases with no limit and no annual fee. The Barclaycard Arrival® Plus World Elite Mastercard® offers 2 miles per dollar on all spending, but carries an $89 annual fee (waived first year).

- Issuers continue to offer tiered earning structures. To drive card preference and grow spending in categories where cards have traditionally had a low share, many new cards continue to use tiered rewards structures, with higher earning on categories like travel, gas, dining and groceries. It is worth noting that these bonus earn rates do not come with monthly or annual spending caps.

- Acquisition-and-activation bonus offers persist. Issuers continue to promote bonus points/miles/cash back for activating the card and meeting a minimum spend requirement within an initial period (typically three months). Higher-end cards that carry an annual fee also tend to have higher bonus levels. Wells Fargo Propel American Express Card is looking to differentiate itself from competitors with a dual bonus structure: acquisition-and-activation bonus of 30,000 points and an additional 20,000 points for reaching a spending threshold in the first 12 months.

- Cards are offering redemption bonuses. Some issuers are looking at rewards redemption as an opportunity to engender loyalty and preference. Cards are offering bonuses:

- For redeeming into a designated bank account (BB&T Spectrum Cash Rewards)

- On total redemption levels over a year (Citi Rewards+℠ Card)

- To be applied towards the next purchase (Barclaycard Arrival® Plus World Elite Mastercard®)

- Most cards have no annual fees, but the cards that do carry an annual fee provide more features, higher earn levels and larger bonuses. Annual fees tend to be waived the first year, although Navy Federal Credit Union’s Visa Signature® Flagship Rewards card has a $49 annual fee and no waiver.

- Most cards apply a fee on balance transfers, usually a rate of 3% with a minimum of $5 or $10. Navy FCU’s Visa Signature Flagship Rewards has no BT fees. For its SavorOne℠ Rewards Card, Capital One imposes a fee of 3% during the card’s 15 month introductory period. After this introductory period, there is no fee on balance transfers.

- Like BTs, most cash advances come with a fee (of 3% or 5%, with minimums of $5 or $10). Again, Navy FCU stands out with no fee on cash advances.

- No foreign transactions fees are quickly becoming the norm, even on non-travel-based cards.