Many recent surveys have pointed to customers’ reduced branch usage for everyday banking, as they embrace Internet and mobile banking. Many of the leading banks have reported very strong year-over-year growth in mobile banking active users in 2Q12, including Bank of America (+35%, to almost 10.3 million), Chase (+38% to just over 9 million), and Wells Fargo (+ 38%, to 8.3 million). At the same time, many banks are implementing aggressive cost savings programs.

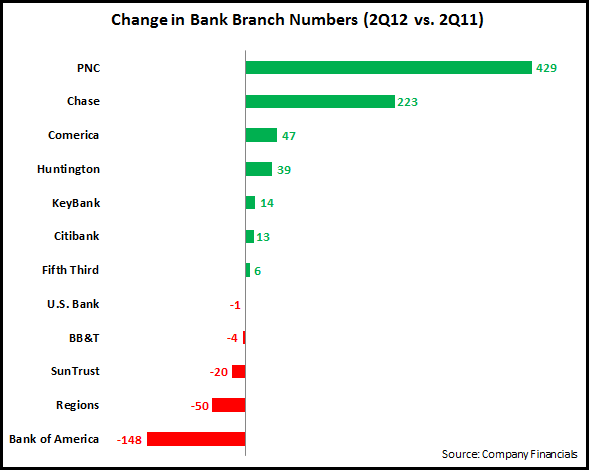

Based on this, one would expect banks to significantly cut back on their branch investment. FDIC data bears this out, with total U.S. bank branch numbers falling by more than 500 in the year to end-March 2012. However, the following chart reveals that this trend is not universal, with many leading banks increasing branch numbers over the past year.

While some banks (such as Chase) have grown their networks organically, the increase in branch numbers for most of the other banks listed above was a result of branch/bank acquisitions.

- PNC grew its branch network following the acquisition of RBC Bank, as well as the purchasing of branches from Flagstar Bank.

- Chase grew its branch network in growth markets like California and Florida. However, it has scaled back ambitious plans to grow its network further in the coming years. Chase has also radically expanded its Private Client locations, from 16 in 2Q11 to 738 in 2Q12.

- KeyBank’s net increase of 14 branches was due to the acquisition of 37 branches in upstate New York, partially offset by branch closures. The bank has reported that branch rationalization is one of the central elements of its new efficiency initiative, and it plans to cut 5% of its branches in the next 18 months.

Factors that impact bank branch numbers include:

- M&A activity (highlighted in the examples above)

- Strategic decisions to increase/reduce presence in specific markets (e.g., grow branch numbers in targeted markets, or reduce branches in other markets where the bank’s branch presence is below a minimum threshold)

- Ability of specific branches to meet performance goals (e.g., growth, profitability)

- Competitive activity

Though surveys indicate that branch usage is declining, a majority of consumers and small businesses still value branches, as they want a multi-channel bank relationship (encompassing physical and virtual channels). This is leading banks to change branch design and staffing models in order to reposition branches to provide a broader role for the bank, in areas like selling, relationship development, product testing, and branding. (See our recent blog on the changing role of the branch.)