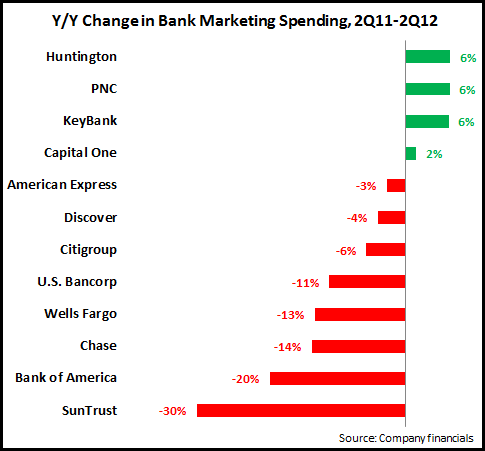

A scan of second quarter 2012 marketing spend data for leading U.S. banks revealed that most reported year-on-year declines. These declines have been driven by both general economic uncertainty, as well as the fact that many banks have recently put ambitious cost-cutting initiatives in place. Of the 12 banks studied, only four reported y/y increases in spending. And Capital One’s spend excluding the impact of the HSBC card portfolio acquisition was also lower than in 2Q11.

The largest declines among the banks studied were at SunTrust and Bank of America.

-

SunTrust reduced marketing and customer development spending 30% y/y in 2Q12. Its spend for the first half of 2012 was also down 30% from the same period in 2011. In the presentation of its financials, the bank provided an update on its PPG Expense Program, which it expects to generate $300 million in annualized savings by the end of 2013.

-

Bank of America is following a similar a pattern, with marketing spend down 20% y/y in 2Q12, and down 19% y/y in the first half of 2012. Like SunTrust, Bank of America devoted a section of its earnings presentation to discussing its New BAC cost reduction program, which has a goal of generating $5 billion in annualized cost savings by the end of 2014.

For other banks, the declines in 2Q12 follow significant recent growth in marketing spend.

-

JPMorgan Chase’s marketing spend in 2Q12 was down 14% y/y. This follows a rise in 28% spending in 2011.

-

Citigroup reduced its marketing budget 6% in 2Q12, following a jump of 40% in 2011.

For some banks, marketing spend patterns can be related to timing of campaigns.

- U.S. Bancorp’s marketing and business development spend was down 11%. However, looking at the first half of the year, spend is up 22% over the same period in 2011).

- Capital One actually grew spending 2% over the same period in 2011, and it reported that spending in the second half of 2012 would increase, due to the timing of some marketing campaigns.

- KeyBank increased marketing spend 6%, which it attributed to a spring home equity lending campaign.

Finally, American Express reduced spend 3% y/y, but (at $773 million) its marketing and promotion expense still represented 10% of net revenues, a much higher percentage than at other leading financial institutions. American Express’s goal is for its marketing and promotion expense to be around 9% of revenues.

Subscribe