There is a wealth of evidence that consumers are using online and mobile channels as the primary channels for their everyday banking needs:

- Having reached critical mass in online banking penetration, the largest U.S. banks continue to report strong growth in active mobile banking customers (Chase +23% y/y to 17.2 million; Bank of America up 17% to 15.5 million; and Wells Fargo +22% to 13.1 million)

- Regional bank customers are also growing their usage of non-branch channels. 45% of PNC customers use non-branch channels for a majority of banking transactions. Fifth Third reports that ATM and mobile channels’ share of deposit volume rose from 12% to 31% over the past two years. KeyBank claims that online and mobile transactions are growing by 9% annually, while branch transactions are declining by 3%.

The rise of self-service channels for everyday banking transactions is leading banks to re-assess their investment in their branch networks. For example, banks are changing traditional assumptions as to what constitutes optimal branch density within markets. In a recent presentation, KeyBank claimed that branch density is now less relevant as long as a bank can pair branches with a good mobile offering. In addition, in a low-revenue-growth environment, banks are under pressure to cut costs in order to meet earnings expectations. As a result of these factors, banks are cutting branch numbers.

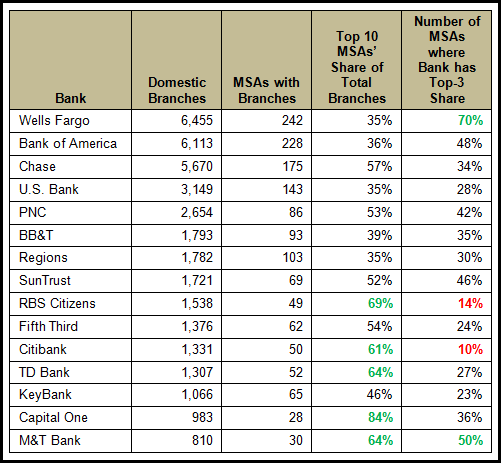

- Bank of America is expected to cut branches to below 5,000 by the end of 2014, compared to more than 5,700 in the second quarter of 2011. It recently announced the sale of branch clusters in North Carolina and Michigan.

- Over the past six months Citibank sold all of its branches in Texas, as it focuses its energies on a select number of large metro markets.

- KeyBank has closed or sold 8% of its branches over the past two years, and plans to cut its network further, by about 2-3% per year.

However, banks remain strongly committed to their branch networks. This is largely due to the fact that consumers continue to value the branch channel, even if usage has declined. A recent ABA survey found that 21% of consumers named the branch as their preferred banking channel, up from 18% in 2013. In addition, banks recognize the benefits in encouraging customers to use multiple channels. Wells Fargo found that customers using its stores as well as online and mobile channels have a 70% higher purchase rate than customers who only use online and mobile. With in this mind, the following are five branch strategies that banks should follow, with examples of banks that have already implemented these approaches:

- Deploy new branch formats. Given lower traffic and transaction volumes in branches, banks should launch branch prototypes with smaller footprints, so that they can maintain their physical presence, but at a lower cost.

- PNC has converted 200 of its branches to a smaller format, with 100 more to follow by the end of 2014.

- Launch flagship branches in selected markets. With changing ideas around branch density, bank can consolidate multiple branches into a large flagship store. These flagship stores act as a brand beacon for the bank in specific markets, as well as providing space for the bank to showcase new innovations

- Citi recently opened a 6,400-square-foot branch in San Francisco, following the opening of similar stores in New York City, Los Angeles and Washington, D.C.

- Reconfigure branch staff. As branch activity is switching from transaction processing to sales and advice, and branches switch to smaller format, bank can reduce the average number of staff per branch, but should also change the functional balance, with fewer tellers and more sales specialists.

- In the 18 months to June 2014, Fifth Third cut 22% of its branch service staff, but increased sales staff by 6%.

- Over the past year, PNC has grown its number of investment professionals in branches by 4%.

- Incorporate technology into branches. As consumers become more accustomed with using technology for their everyday financial needs, banks should showcase customer-facing technology in branches. This can enhance the user experience and capture sales opportunities

- Regions is installing two-way video to enable customers communicate directly with bankers via an ATM.

- Open branches outside of footprint. As having a critical mass of branches in a market is no longer a prerequisite for success, banks can open branches beyond their traditional retail footprint, to target specific consumer or business clusters.

- City National has established branches in New York City, Atlanta and Nashville, dedicated to targeting entertainment firms that are clustered within these markets.