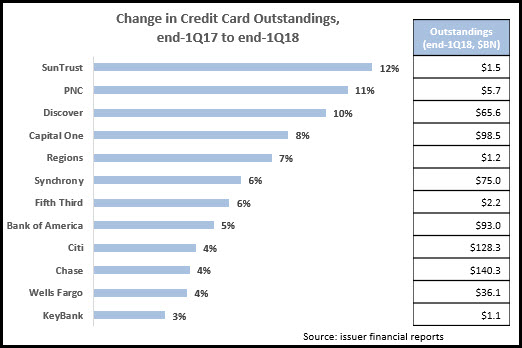

Most leading U.S. credit card issuers reported relatively strong y/y growth in outstandings in the first quarter of 2018.

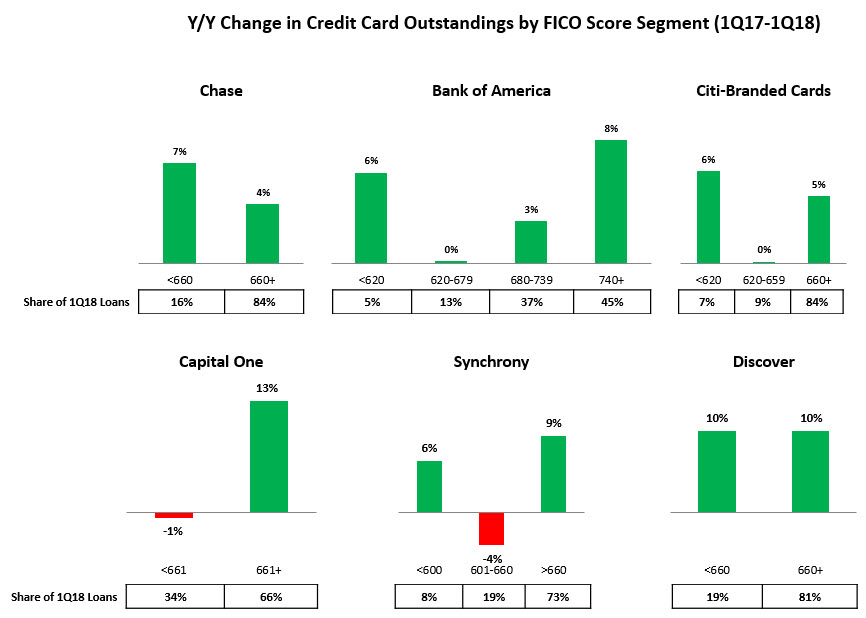

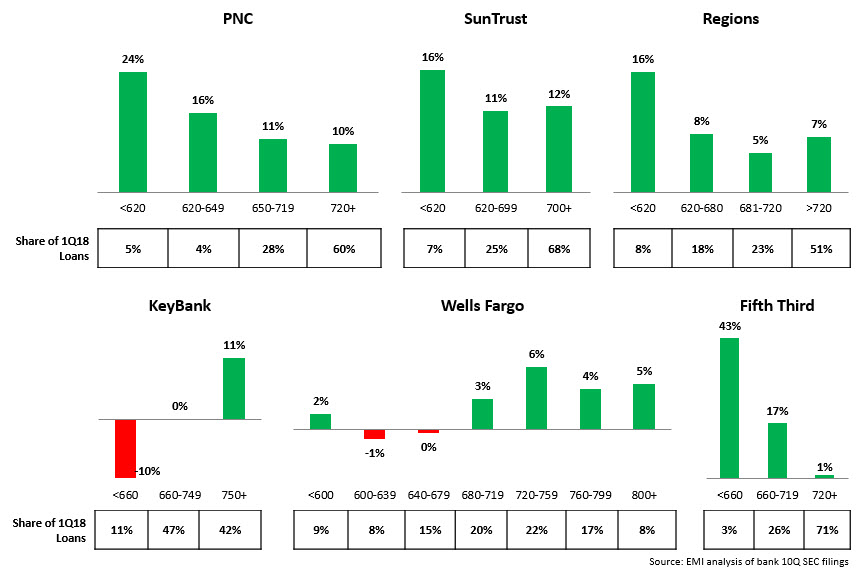

Breaking these growth rates out by FICO Score segment, we see that issuers generated growth across multiple FICO Score categories.

- There are important differences in the FICO composition of card portfolios. The <660 FICO Score segment accounted for 34% of Capital One’s portfolio, a much higher percentage than other issuers, such as Fifth Third (3%), Chase (7%), KeyBank (11%), Citi (16%) and Discover (19%).

- Among the largest issuers, one of the most notable trends was strong growth in the low-prime/sub-prime and super-prime segments, but low/no growth in their prime portfolio. Bank of America grew its sub-prime (<620) outstandings by 6% and its super-prime (>720) increased 8%. However, its loan portfolio held by consumers with FICO scores between 620 and 739 only increased by 2%.

- Most regional bank card issuers (such as PNC, SunTrust and Regions) reported strong growth in their sub-prime and near-prime portfolios. Fifth Third’s <660 FICO Score portfolio rose 43%, but this category only accounts for 3% of the bank’s credit card portfolio, so growth was from a very low base.

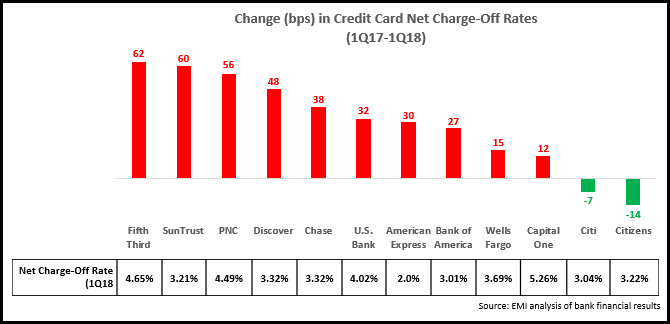

As issuers enjoy strong growth in their credit card outstandings—especially for sub-prime and near-prime consumer segments—it is worth noting that charge-offs are also on the increase. Most issuers reported double-digit y/y basis-point growth in their credit card net charge-off rates. Four of the 12 issuers below now have charge-off rates of more than 4%, and only one (American Express) has a charge-off rate of less than 3%.

So, while issuers want to grow credit card loans across the FICO Score spectrum, they need to ensure that various functions are all calibrated to ensure that cardholder delinquencies and charge-offs remain at manageable levels. These functions include:

- Underwriting

- Marketing: targeting, offer development, and messaging

- Pricing: fees and APRs need to be set at levels that balance cardholder ability to pay with an appropriate margin to offset potentially higher charge offs

- Customer support: onboarding, financial education, as well as early engagement in cases where cardholders experience payment challenges