In a recent blog, EMI discussed some key takeaways from leading credit card issuers’ 3Q16 earnings, one of which was the relatively strong growth in credit card outstandings. In this blog, we look deeper into outstandings trends to identify what FICO Score segments issuers are focusing on to grow outstandings.

Firstly, it is notable that leading issuers reported y/y growth in credit card outstandings across multiple FICO Score segments. However, there were important variations among the issuer categories:

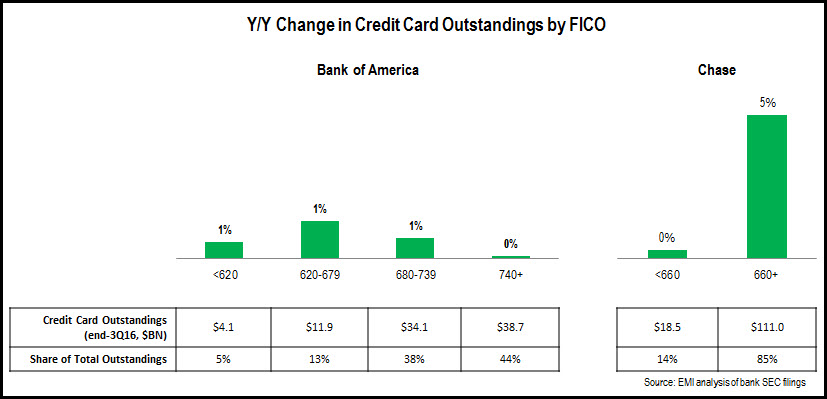

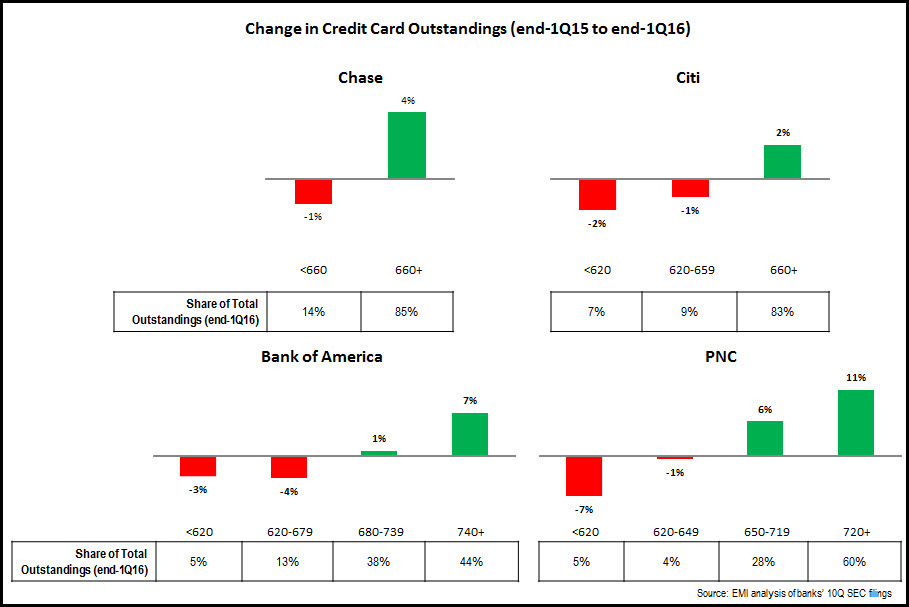

- Largest issuers: The following chart looks at y/y changes in outstandings by FICO Score for both Bank of America and Chase. (Citibank also published data on the FICO Score composition of its credit card outstandings, but these were skewed by the acquisition of the Costco portfolio from American Express, so we did not include Citibank in the analysis.) Bank of America generated low growth across most segments, as it struggles to grow overall outstandings following a protracted period of declines. Chase’s growth was concentrated in the 660+ FICO Score segment, boosted by the recent launches of both Sapphire Preferred and Freedom Unlimited.

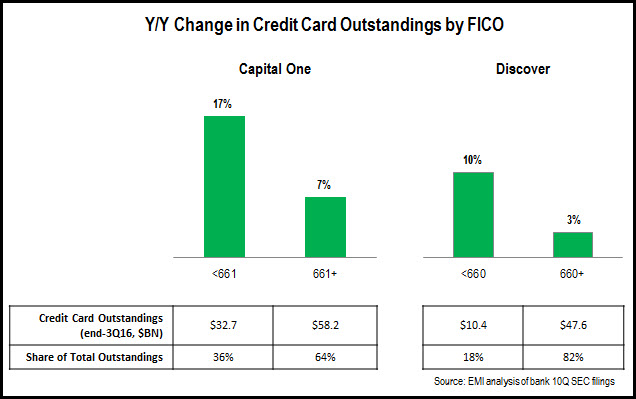

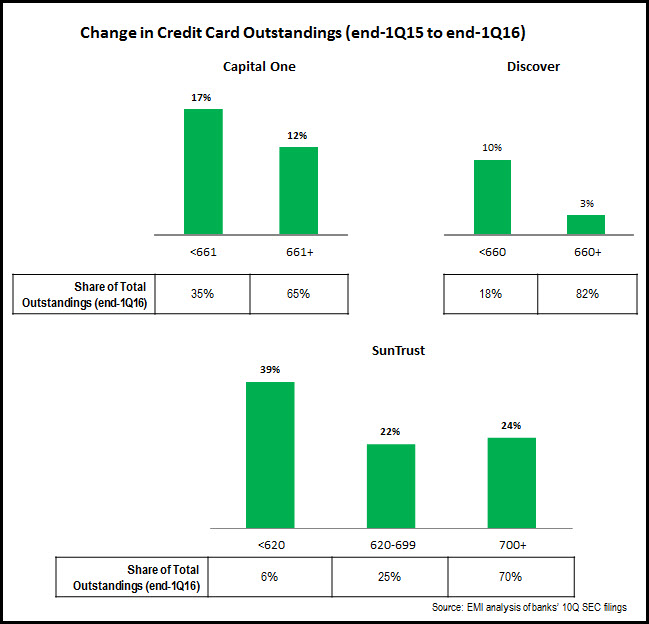

- Monolines: Capital One and Discover both generated strong growth in the lower FICO Score (660 and under) segment. This segment now accounts for 36% of Capital One’s total credit card outstandings, significantly higher than Discover (18%) and Chase (14%).

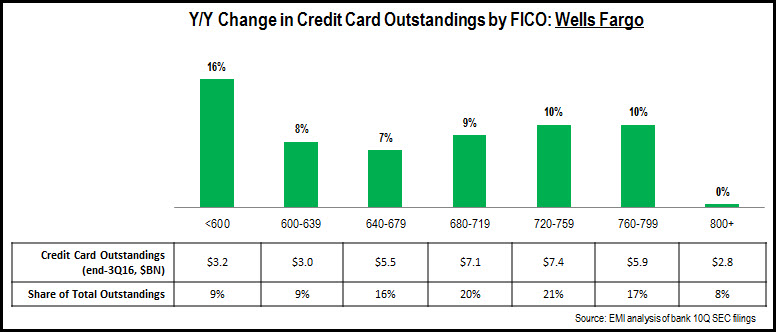

- Wells Fargo: in spite of the fallout from the recent fake-account scandal, Wells Fargo continued to growth credit card outstandings in 3Q16. It reported strong growth across most FICO Score segments, with particularly strong growth in the subprime segment. However, it continues to struggle to grow superprime outstandings, as it lacks a card that can truly compete against high-profile affluent cards like American Express Gold and Platinum, and Chase Sapphire Preferred.

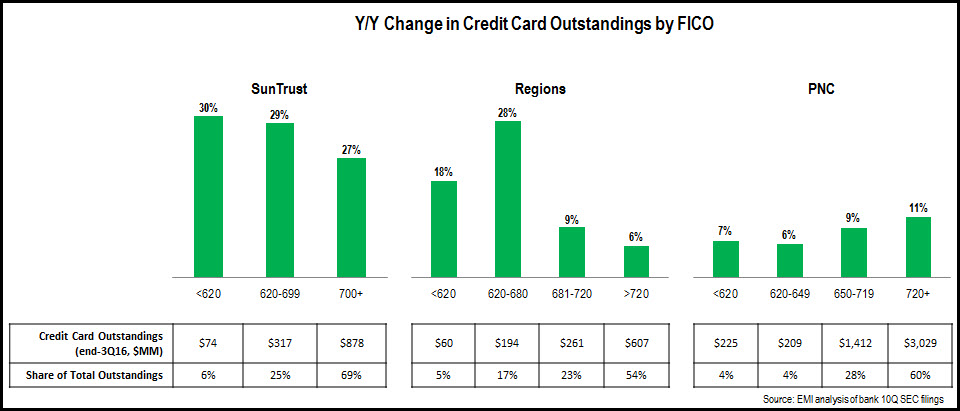

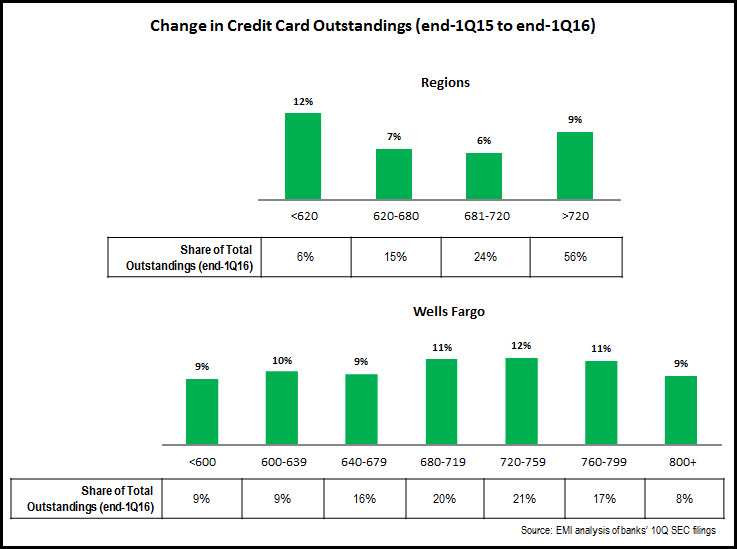

- Regional Bank Card Issuers: SunTrust, Regions and PNC all reported strong overall growth. SunTrust reported very strong growth across all segments. Regions’ outstandings growth was concentrated in the low-prime and subprime segments. However, PNC’s outstandings growth was concentrated in higher-FICO Score segments, driven by the April 2016 launch of the Premier Travelers Visa Signature® card.

As issuers seek to continue to increase overall credit card loan growth, it is likely that they will continue to focus on multiple FICO Score segments. They will also be looking to identify underperforming segments, diagnose reasons for this underperformance (e.g., deficiencies in cards, offers or communications targeting these segments), and develop initiatives to improve performance. Similarly, issuers will want to identify if they are overly dependent on certain segments for outstandings growth or share, and whether this dependence leaves them vulnerable to changes in the macroeconomic or competitive environments.