In recent years, banks have been primarily focused on cost cutting. However, as the U.S. economic recovery continues to gain momentum, banks are identifying opportunities for revenue growth. As banks look to capture this, they will obviously be looking at the size and composition of their marketing budgets.

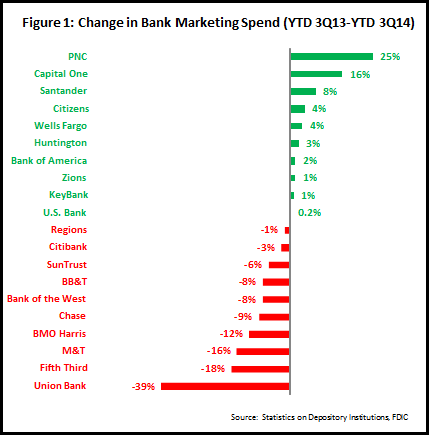

EMI’s analysis of the latest FDIC data for 20 leading retail banks found little evidence that banks are growing their marketing budgets. In fact, marketing spending for these banks over the first 9 months of 2014 was 2% lower than the same period in 2013. As seen in figure 1, 10 of the 20 banks reported growth in their marketing budgets, led by PNC and Capital One.

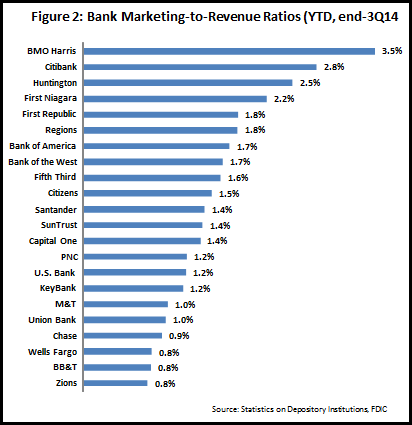

These 20 banks invested an average of 1.5% of their net revenues in marketing during the first 9 months of 2014. Although this marketing-to-revenue ratio rose 2 bps y/y, it is well below the 2% average that existed prior to the financial crisis. For banks looking to grow revenues, they will need to return marketing-to-revenue back to this 2% level.

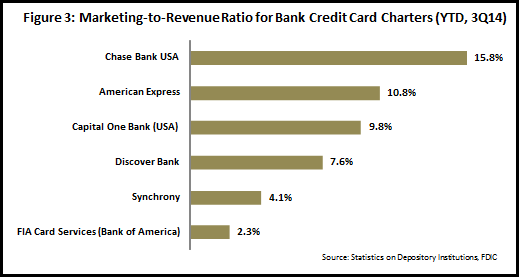

Figure 2 shows that 14 of the 20 banks have marketing-to-revenue ratios of between 1% and 2%. For Chase, Bank of America and Capital One, the ratios are for their retail bank charters; marketing-to-revenue ratios for these banks’ credit card charters are much higher (as seen in figure 3).

Of course, banks looking to increase their marketing investment in order to grow revenues also need to ensure that these marketing budgets are effectively deployed, in order to optimize marketing ROI. The following are some considerations for banks as they prepare marketing budgets for 2015:

- Consumer perceptions of banks have changed. In the aftermath of the financial crisis, banks suffered reputational damage as they were seen as key contributors to the crisis. In recent years, banks have worked hard to change their business models in order to focus on their core competencies (and this has been recently seen in improved customer satisfaction ratings). Marketing will play a key role in communicating banks’ key positioning as trusted providers of financial services and support.

- Consumer banking behavior has changed. Consumer adoption of self-service-channels (online, mobile, ATM) has now attained critical mass and these channels account for a majority of everyday banking transactions. These channels create significant advertising and cross-selling opportunities (and challenges) for banks.

- Bank branches have untapped marketing potential. As everyday bank transactions move to self-service channels, banks are cutting branch numbers and reinventing various aspects of the branch (size, layout, staffing, integration with other channels). Banks should also consider the fact that the branch is the key physical expression of the bank brand, and should allocate a portion of their marketing budgets to capturing branches’ marketing potential.

- Bank need to embrace non-traditional marketing channels. Younger demographic segments (such as millennials) have very different media consumption patterns than their older peers, with significantly higher usage of online/mobile and social media. However, banks’ innate conservatism has resulted in their failure to fully embrace new embrace new media. Banks need to both significantly increase their investment in non-traditional marketing channels, but also find innovative ways to convey their core messages to a new audience.