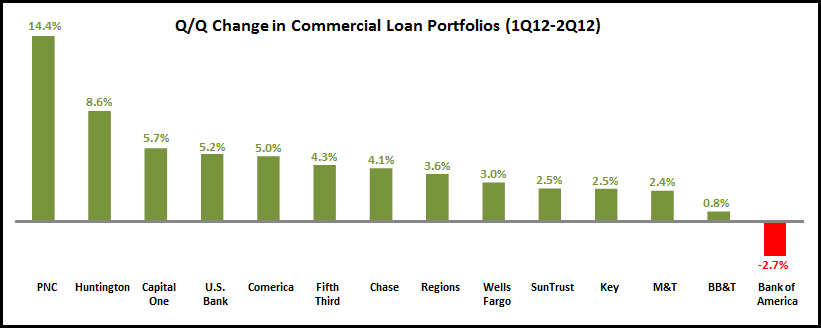

In spite of the continued economic uncertainty, U.S. banks continue to enjoy strong growth in commercial lending. A study of the 2Q12 financial results of 14 leading U.S. banks revealed that 11 grew average commercial loans by double-digit rates. In addition, 11 banks had higher year-over-year growth rates in 2Q12 than in 1Q12.

13 of the 14 banks reported growth in commercial loan portfolios between 1Q12 and 2Q12.

Looking at specific banks:

- Commercial loan growth was led by PNC, although it should be recognized that PNC completed the acquisition of RBC Bank in 1Q12, which significantly skews the data. PNC recorded above-average growth rates for financial services and health care loan portfolios.

- U.S. Bank had the second-largest y/y growth rate, at 24%, led by a 52% rise in its specialized industries portfolio.

- Comerica increased its average commercial loan portfolio 20% y/y, driven by a 46% rise in its specialty lending portfolio. (Over the past year, Comerica grew its energy loan portfolio by 68% and its tech and life sciences portfolio by 36%.)

- KeyBank’s average commercial, financial and agricultural loan portfolio grew 19% y/y. KeyBank reported that its commercial loan utilization rate has been increasing in recent quarters, from 43.4% in 2Q11 and 46.9% in 1Q12 to 47.3% in 2Q12.

- Chase grew commercial banking average loans 16% y/y, driven by a 42% rise in its corporate client banking loan portfolio (which covers clients with $500 million to $2 billion in annual revenue).

- Bank of America was the only bank to report a quarterly decline in its average commercial loan portfolio (-2.7%). In addition, it had the second-lowest y/y growth rate (of 6.1%).

Most of the banks are reported improvements in commercial loan charge-off rates. However, yields on commercial loans continue to fall. All 12 of the banks reporting commercial loan yield data had y/y declines, but it’s important to note that 4 of the 12 (PNC, Wells Fargo, BB&T and M&T) reported an increase in commercial loan yields between 1Q12 and 2Q12.