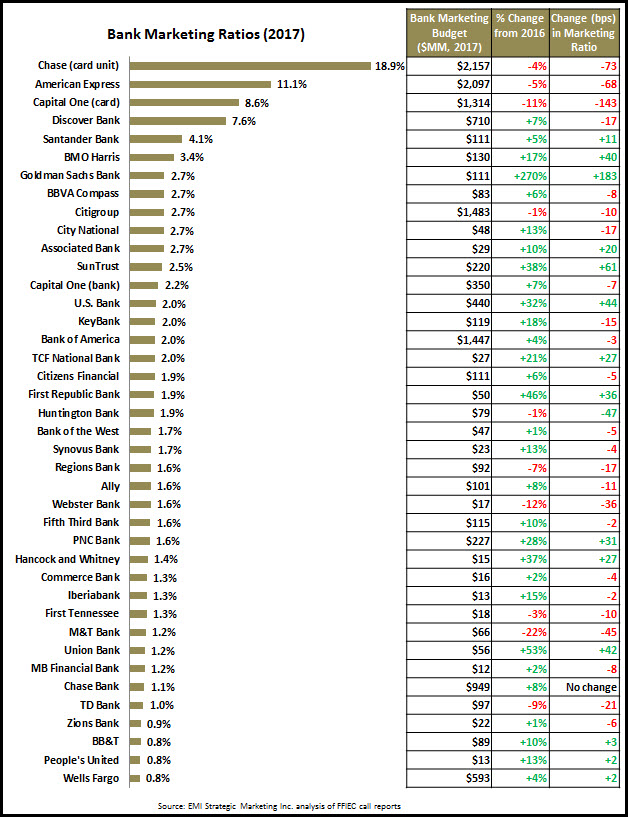

Marketing spend by the top 40 banks reached nearly $14 billion in 2017, up 1.8% on average from the previous year–and once again, 5 banks spent over a billion dollars on marketing. EMI analysis of bank spending reveals:

- 30 of the 40 largest banks grew marketing spend in 2017, with 17 reporting double-digit growth.

- As in past years, banks with national credit card franchises lead all others, in both absolute terms and in their marketing intensity (marketing spend relative to revenues). In 2017, spending among these card leaders declined, as focus shifted from acquisition to portfolio marketing.

- Two banks notable for substantial 2017 marketing increases are Goldman Sachs Bank focused on promotion of its online lending platform, Marcus by Goldman Sachs, and U.S. Bank capitalizing on brand-building around the Super Bowl, held last week at the Minneapolis stadium bearing the bank’s name.

EMI annual analysis of Federal Financial Institutions Examinations Council (FFIEC) call report data for 40 leading U.S. banks distills both absolute spending and marketing intensity ratios, as measured by spend percentage of net revenues (net interest income plus noninterest income). Results are reported below.

Advertising and Marketing Spending Highlights

19 banks/bank charters had advertising and marketing budgets of more than $100 million. 5 had billion-dollar-plus budgets (JPMorgan Chase, American Express, Capital One, Citigroup and Bank of America).

Of the 17 banks reporting double-digit growth, the two with the largest absolute increases in their marketing budgets were:

- U.S. Bank: +$107 million, with a focus on growing national profile behind the increased marketing spend, including heavy branding around the Super Bowl, which was held last Sunday at the U.S. Bank Stadium in Minneapolis.

- Goldman Sachs Bank: +$80 million, driven by an advertising campaign to promote Marcus by Goldman Sachs, its online personal lending platform.

- First Republic was also notable for its 46% increase–a strategy that seems to have paid off with 18%+ revenue growth reported by the San Francisco-based bank in 2017.

Other banks boosted marketing spend to support new campaigns in 2017.

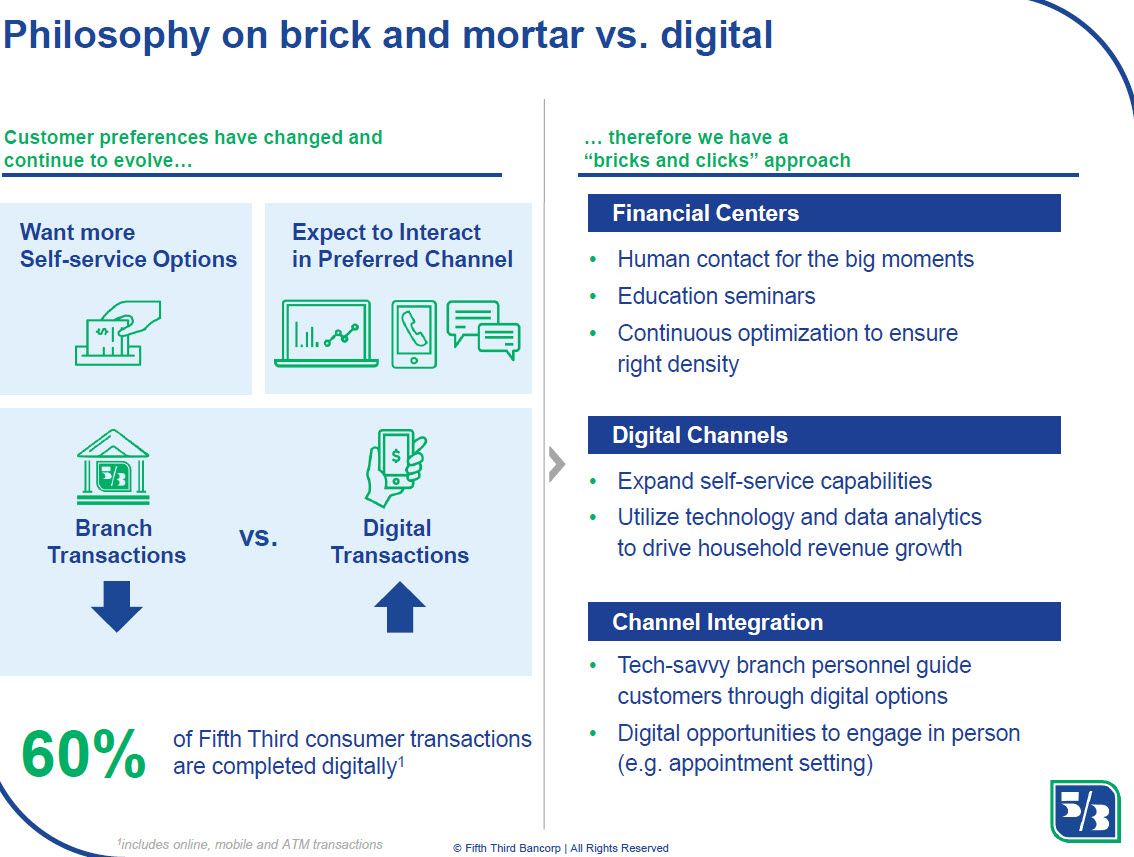

- Fifth Third (+10% to $115 million) launched a campaign in May 2017 that played on its “5/3” name, promoting “Banking that’s a Fifth Third Better”

- BB&T (+10% to $89 million) introduced a new brand campaign and tagline (“All we see is you”) in September 2017.

- SunTrust (+38% to $220 million) rolled out its ‘Confidence Starts Here’ ad campaign in March 2017, building on its onUp movement focused on building financial well-being.

Marketing spend declines were led by:

- Capital One: decline of $139 million, with a strong drop in spending in its card unit partially offset by a $23 million rise in its retail banking unit.

- American Express: down $111 million, although this follows a ramp up of marketing and promotion spending in recent years. American Express is also increasing its focus on targeting existing clients, which typically involves lower marketing spend.

Marketing Intensity Highlights

Even though 30 banks increased their marketing budgets in 2017, only 14 increased their bank marketing ratios, meaning that growth in marketing spend did not match the rise in net revenues. Banks with the strongest growth in their marketing ratios were Goldman Sachs Bank (+183 basis points), SunTrust (+61 bps) and U.S. Bank (+44 bps).

Most retail banks have marketing ratios of 1-3%. Those with the highest marketing ratios include Santander Bank (4.1%, due to continued growth in the bank’s U.S. marketing budgets in recent years) and BMO Harris (3.4%, following a 17% rise in marketing spend in 2017). 4 banks have marketing ratios of less than 1%. Most notable in this category is Wells Fargo, which has traditionally–and infamously–focused on sales and required much lower advertising budgets than its peers. Wells Fargo did launch a new integrated marketing campaign in April 2017, which it reported was focused on “rebuilding trust.” This contributed to a 4% rise in its advertising and marketing budget in 2017, but its spend levels remain well below comparably-sized banks.

We expect that banks will maintain or even increase their marketing budgets in 2018 to build brand awareness and affinity, as well as to promote new products and services–in particular those focused on digital transformation. However, many banks remain focused on improving efficiency ratios, and marketing budgets are often on the firing line when banks look cut costs. However these cuts–when executed without a careful strategy for maximize marketing ROI–often sacrifice market share gain and longer-term growth.