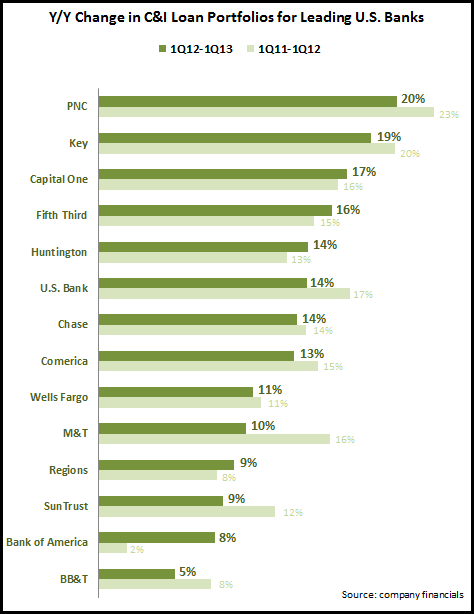

EMI analysis of recently-published financial results for 14 leading U.S. banks revealed that that strong growth in commercial and industrial (C&I) loan portfolios continued in the most recent quarter. These banks grew their C&I loan portfolios by an average of 12% y/y, which was the same growth rate as in 4Q12, and up from an 11% portfolio growth rate in 1Q12.

Strongest growth was reported by regional banks like PNC (boosted by the acquisition of RBC Bank), KeyBank, Fifth Third and Huntington, as well as Capital One. However, it is worth noting that 9 of the 14 banks reported lower C&I loan y/y growth rates in 1Q13 vs. 1Q12. The overall growth rate increased from 11% to 12% during this period, as Bank of America (which has the largest C&I loan portfolio) increased its C&I loan y/y growth from a paltry 2% in 1Q12 to a more robust 8% in 1Q13.

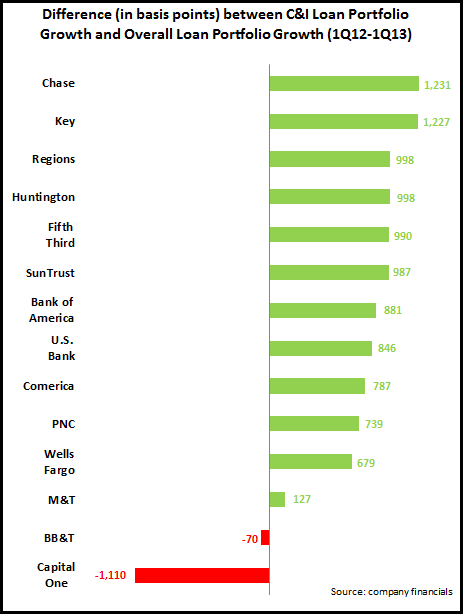

The bar chart below shows that gap between C&I and overall average loan portfolio growth rates, with 12 of the 14 banks reporting higher C&I loan growth. The bank with the largest gap was Chase, which grew average commercial banking loans by 13.7% y/y, while its overall loan portfolio only grew by 1.3%. The two exceptions were Capital One (whose non-C&I growth was boosted by some recent acquisitions) and BB&T. In fact, three banks (Regions, SunTrust and Bank of America) reported declines in their total loan portfolios between 1Q12 and 1Q13, even though C&I loan portfolios rose by high single-digit rates.

C&I loan charge-off rates continue to improve, with an average rate of 0.22% in 1Q13, down 19 basis points (bps) y/y and a reduction of 7 bps from the previous quarter. However, there is evidence that competition for C&I loans continues to increase, with an average yield of 3.63% in 1Q13, which represents declines of 40 bps y/y and 9 bps q/q. A recent EMI blog identified a number of banks that are leveraging innovative marketing approaches to differentiate from competitors in this increasingly competitive space.