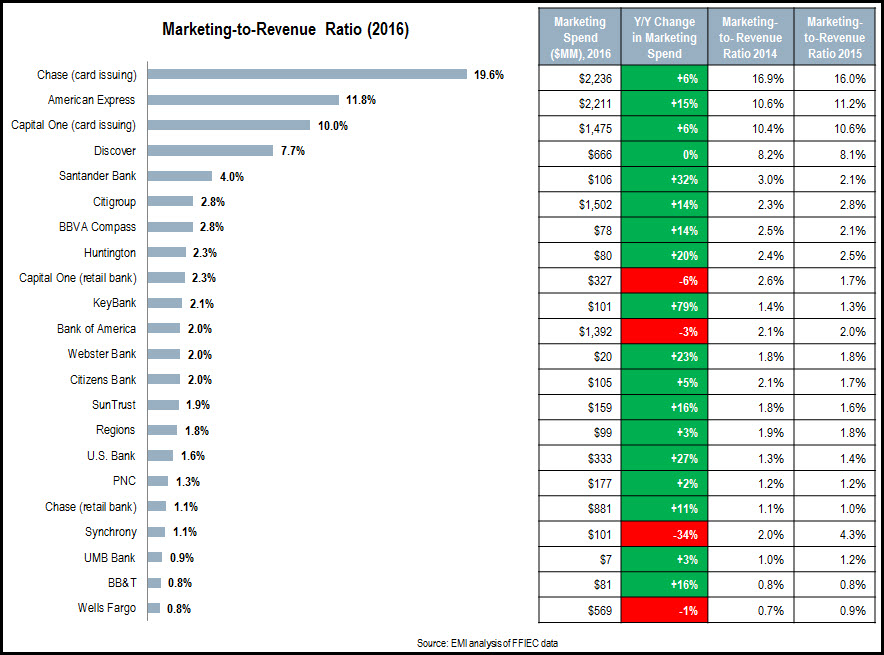

According to EMI Strategic Marketing’s analysis of data from the Federal Financial Institutions Examination Council (FFIEC), U.S. banks spent $17.1 billion on advertising and marketing in 2016. This expenditure represented 2.4% of bank revenues. Five banks (JPMorgan Chase, American Express, Citigroup, Capital One and Bank of America) each spent more than $1 billion, and together accounted for more than half of the industry’s total expenditure. The following chart looks at 2016 marketing-to-revenue ratios for 20 leading U.S. banks (note that for JPMorgan Chase and Capital One, marketing spend data is provided for both their retail bank charters and card-issuing units).

Most banks grew their marketing spending in 2016, as they looked to drive revenue growth in an improving economy. 10 banks reported double-digit percentage rises in their advertising and marketing budgets. In some cases (e.g., KeyBank and Huntington), the strong increases were in part the result of significant bank acquisitions.

13 banks grew their marketing-to-revenue ratios in 2016.

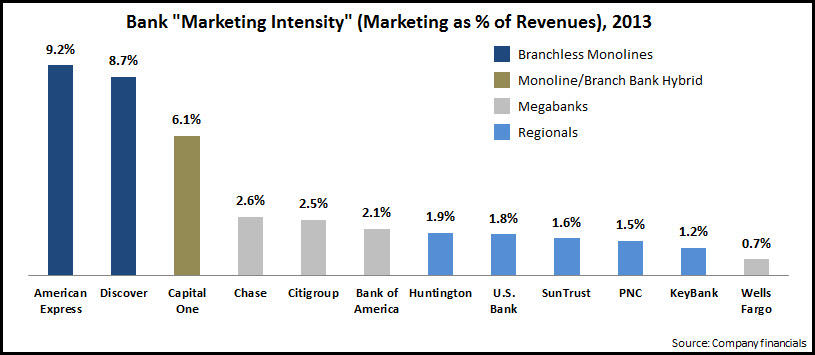

- Half of the banks in the chart (mostly branch-based banks) have marketing-to-revenue ratios of between 1.5% and 3%.

- Several banks have been ramping up their marketing spend in recent years. Between 2014 and 2016, Santander Bank’s spend nearly doubled between 2014 and 2016, and its 2016 marketing-to-revenue ratio of 4.0% was the highest among branch-based banks.

- At the other end of the scale, both Wells Fargo and BB&T have ratios consistently below 1%.

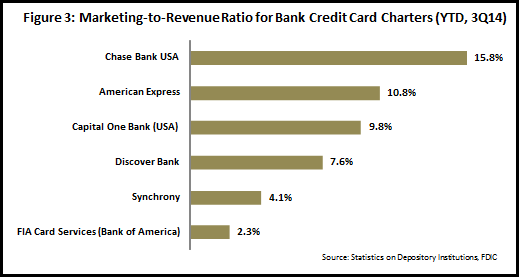

Credit card-focused banks/bank charters have the highest marketing-to-revenue ratios.

- Chase Bank USA (JPMorgan Chase’s card-issuing bank) had a ratio of almost 20% in 2016. The sharp rise in the ratio from 2014 and 2015 was due to both a 6% rise in advertising and marketing spend (to support the launches of Freedom Unlimited and Sapphire Reserve), as well as a sharp decline in noninterest income.

- American Express increased in its advertising and marketing spend by 15% in 2016, and its ratio rose to nearly 12%.

As banks look to scale back their branch networks both to save costs and adapt to changing bank channel usage (in particular for everyday banking transactions), they are also cognizant of the potential loss of the branch’s role as a branding beacon in local markets. Therefore, it’s likely that a portion of the cost savings from branch network reductions will be diverted to advertising and marketing budgets. As a result, we may expect banks’ marketing-to-revenue ratios to gradually increase in the coming years.