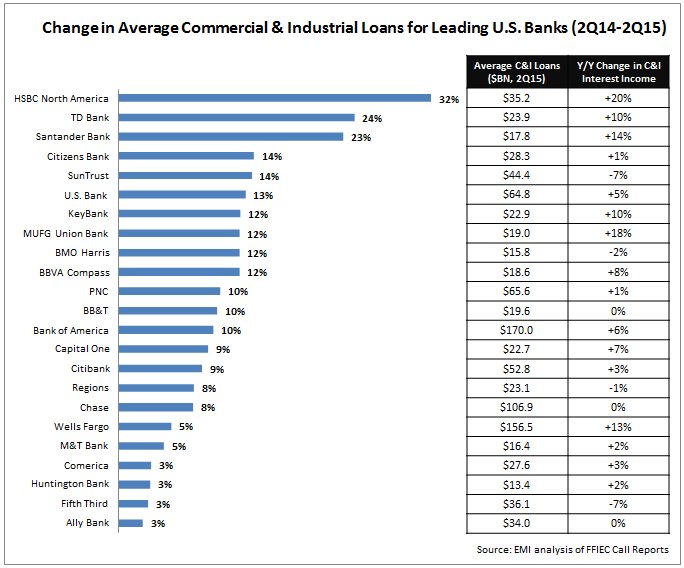

The leading U.S. banks reported a 10% y/y rise in average commercial and industrial (C&I) loans in 2Q15, based on an EMI analysis of the FFIEC call report data.

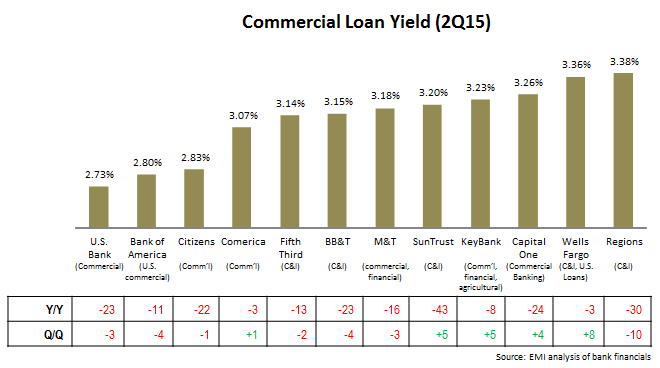

Interest income on C&I loans rose 5% y/y, indicating that downward pressure on commercial loan pricing persists. This is reflected in the following table, which shows consistent y/y declines in commercial loan yields. However, there are signs that yield are now stabilizing.

Most leading banks report that the commercial loan market is highly competitive. So, how are banks managing to grow their C&I loan portfolios at double-digit rates?

- Banks are targeting specialty segments. Many leading banks reported that targeted vertical segments drove overall commercial loan growth in the second quarter. Comerica’s average technology and life sciences loans rose 20% y/y, compared to only 3% for total Comerica middle market loans. And while KeyBank grew its commercial, financial and agricultural loans by 12%, loans to the transportation sector grew by a hefty 42%. A bank’s selection of target segments depends on a number of factors, including segment size and growth, concentration of specific segments in their footprint; and the bank’s heritage in serving this segment. To more effectively build a presence in specific vertical markets, many banks are now creating dedicated teams that include industry experts. In addition, a number of banks are developing segment-specific content, which both establishes bank credibility and creates opportunities for prospect engagement.

- There are signs of growth in commercial loan utilization. As the economy and business optimism improves, companies are more inclined to invest to grow their businesses. A number of banks are now reporting a slow-but-steady rise in commercial loan utilization. Regions reported a 97 basis point increase in line utilization during the quarter. Equally, Fifth Third’s commercial line utilization rose from 32% to 33% in the second quarter.

- Banks are increasingly focused on optimizing commercial client lifetime value. As in consumer banking, banks are seeking to optimize relationships with commercial clients by taking a lifetime value approach and focusing not just on acquisition, but on all key stages of the relationship (including onboarding, retention and cross-sell). The effect of this approach for banks can be significant. Since the start of 2010, Huntington Bank has grown commercial relationships by 36%, but commercial relationship revenue by 72%. The percentage of Huntington’s commercial clients with 4+ services rose from 32.6% to 43.4% over the past three years. This long-term perspective may also help explain why yields on new commercial remain low. In discussing its quarterly financials, KeyBank claimed that “if we believe we have a client who wants a broad relationship and the credit metrics look good for us, we know that over time we can generate a profitable relationship, even if we are pressured a bit on the loan pricing.”