A recent EMI blog highlighted the differing outstandings growth rates for different categories of credit card issuers, with the top three issuers (Chase, Bank of America and Citi) all reporting reduced outstandings, while regional banks are growing outstandings, albeit from much lower bases.

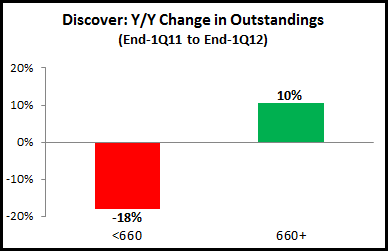

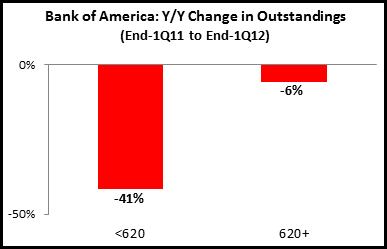

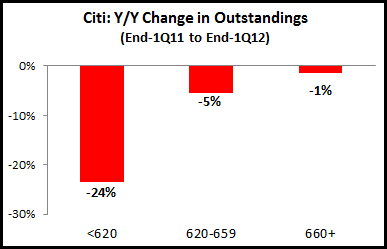

However, further analysis using data from annual regulatory filings reveals significant variations in outstandings within leading bank credit card portfolios for different FICO credit score categories.

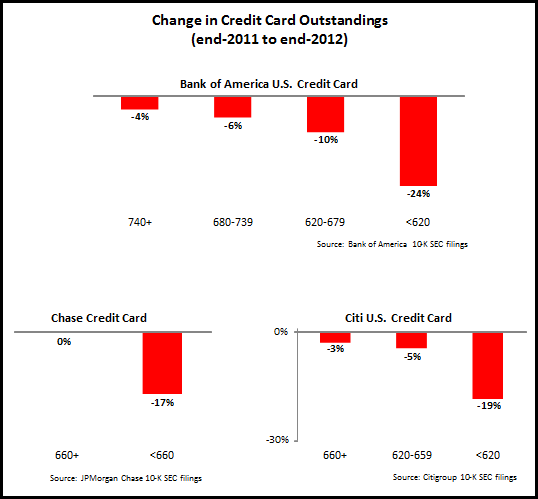

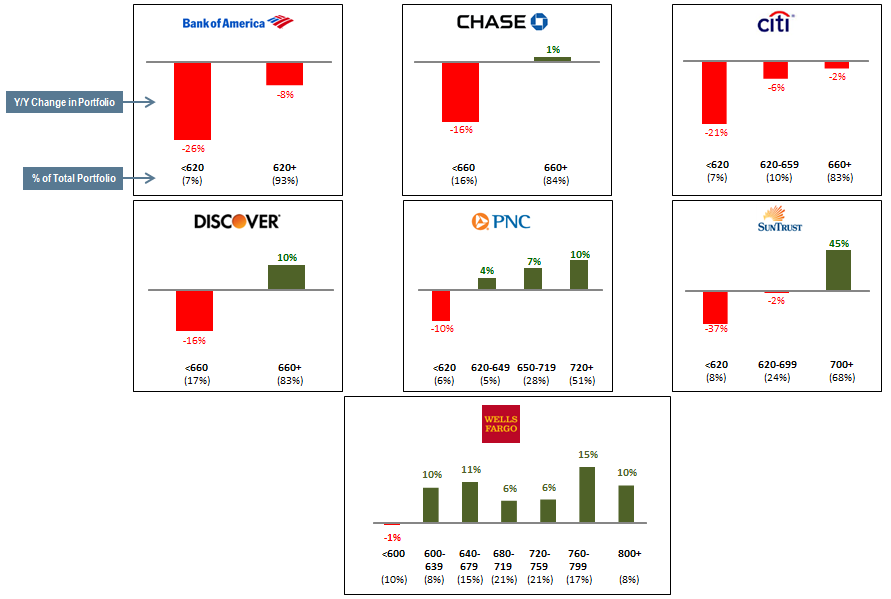

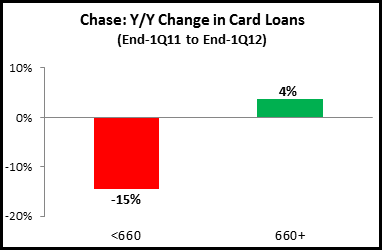

The three leading credit card issuers reported lower outstandings between end-2011 and end-2012. For each of these issuers, outstandings fell in all FICO categories, but the rate of decline was significantly higher for lower FICO segments, which led to higher FICO categories increasing their share of total outstandings.

- 740+ FICO share of Bank of America outstandings rose from 38% in 2011 to 40% in 2012.

- The 660+ FICO segment accounted for 84% of Chase credit card outstandings at the end of 2012, up from 81% in 2011

- Citi has an even high concentration of outstandings held by consumers with FICOs of 660+, at 95% at the end of 2012, up from 91% a year earlier, and only 74% at the end of 2010.

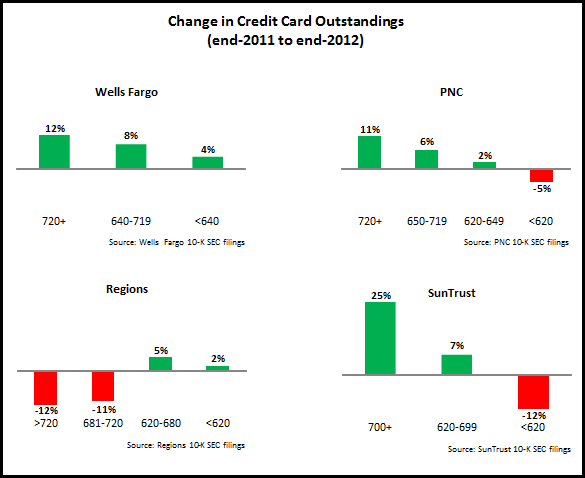

Most of the leading regional bank credit card issuers grew outstandings in 2012, with stronger growth rates for higher FICO segments.

- Wells Fargo reported y/y growth in all FICO segments, even in the lowest FICO segment.

- PNC reported overall outstandings growth of 8% in 2012, fueled by an 11% rise for the 720+ segment, partially offset by a 5% decrease in outstandings held by consumers with FICOs below 620.

- SunTrust followed a similar pattern to PNC, with a 25% increase in the 700+ FICO segment, and a fall of 12% in the <620 segment.

- However, Regions bucked the regional bank trend with outstandings declines in the higher FICO segments and increases in the lower segments.

These trends are increasing competitive intensity for higher-FICO consumer credit card spending and borrowing, with new card launches, value-added features, bonus offers to drive acquisition and activation, and enhanced rewards programs to boost usage and retention, as well as cross-sell initiatives targeted at the bank’s private banking and wealth management clients.

In addition, the extent of the decline in sub-prime credit card portfolios means that many issuers are turning to non-credit card payment methods (including debit, prepaid and secured cards) to meet the payment needs of consumers with lower FICOs.