In the wake of the financial crisis, credit card outstandings fell significantly in all segments of the market in reaction to spiraling charge-off rates. This decline was particularly pronounced in the sub-prime segment.

Over the past two years, the market has stabilized:

- There have been large decreases in charge-off and delinquency rates (these rates are now at or below historic norms for many issuers)

- The rate of decline in total outstandings has slowed, with some issuers now reporting loan growth

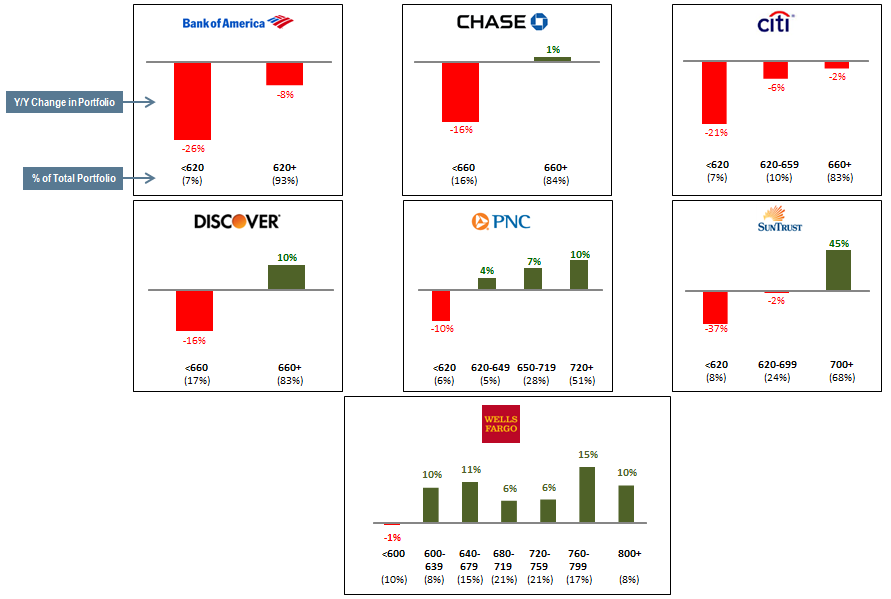

However, the following charts show that there are significant differences in credit card portfolio growth/decline rates for different FICO credit score segments. This indicates that the move away from low- and sub-prime issuance, which began in the financial crisis, has persisted even though the crisis has largely passed. This is driven by a number of factors, include consumer reluctance to borrow and CARD Act restrictions on repricing.

The changes in the issuer portfolios points to a fundamental change in the payments market. Issuers are increasingly focused credit card product development and marketing on the prime and super-prime segments, while using secured and prepaid cards to meet the needs of the near- and sub-prime segments.

The changes in the issuer portfolios points to a fundamental change in the payments market. Issuers are increasingly focused credit card product development and marketing on the prime and super-prime segments, while using secured and prepaid cards to meet the needs of the near- and sub-prime segments.