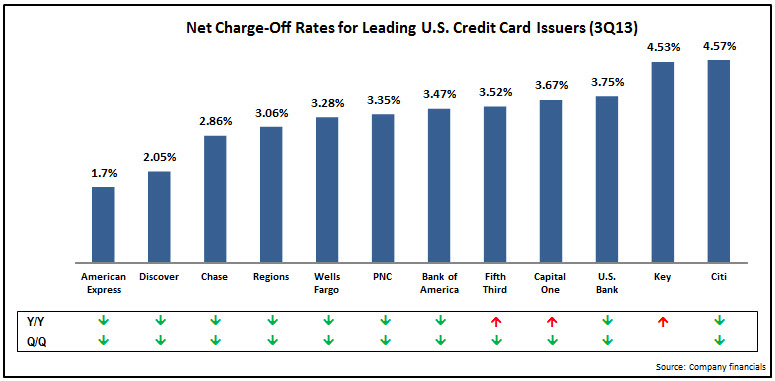

The leading U.S. credit card issuers continue to benefit from historically low charge-off rates, but they have struggled to shift the needle in terms of revenue growth. This is mainly due to anemic outstandings growth, as consumers remain reluctant to borrow, and issuers continue to have strict underwriting criteria.

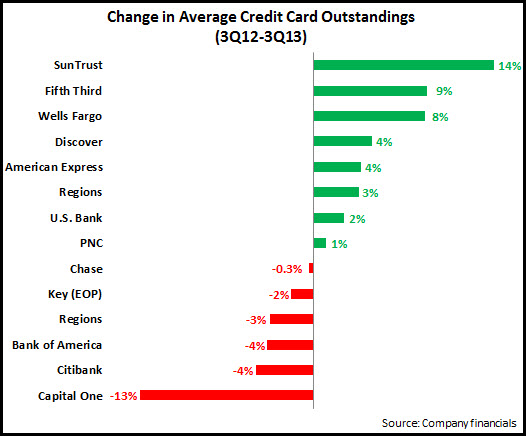

There are now signs that issuers are looking to build their credit card loan portfolios. Issuers like Discover, Wells Fargo and SunTrust reported strong y/y growth in end-of-period credit card loans. And although outstandings for the three leading issuers—Chase, Bank of America and Citi—continued to decline, they have indicated that they expect their portfolios to grow in the coming quarters.

As issuers look to drive outstandings growth, they will need to change underwriting criteria that has resulted in the composition of portfolios switching significantly towards higher FICOs. And our analysis of the most recent issuer data shows a continuation of this trend.

The following graphic presents changes in outstandings by FICO segment for leading issuers between end-3Q12 and end-3Q13, separated into three issuer categories: big three; fast-growth second-tied issuers; and regional bank card issuers. We see that most issuers continue to focus growth efforts on the higher FICO segments.

As issuers look to catalyze credit card portfolio growth, they need to focus marketing investments on a broad range of consumer segments. Issuers must continue to optimize relationships with affluent consumers, through cross-sell campaigns, loyalty programs, as well as targeted offers to drive acquisition, retention and ongoing usage. They also need to re-engage with lower FICO segments, with new products and pricing, more flexible underwriting, information and advice to help cardholder manage debt, as well as programs to enable secured cardholders qualify over time to be upgraded to an unsecured credit card. And for all consumer segments, issuers need to develop a balanced positioning of credit cards as effective tools for both making payments and accessing credit.