The 2Q14 financials for leading U.S. credit card issuers had a number of positive elements, notably a return to outstandings growth, along with continued strong performance in volume and credit quality metrics.

Outstandings

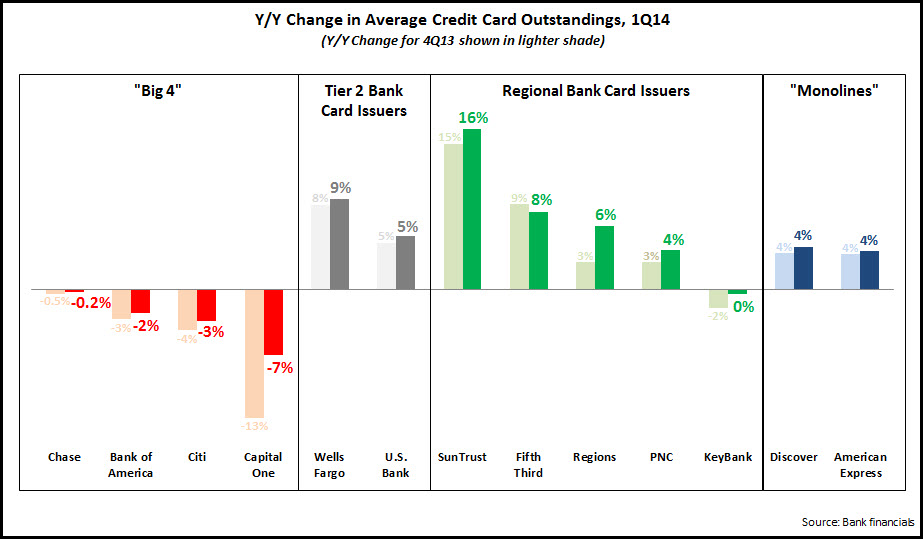

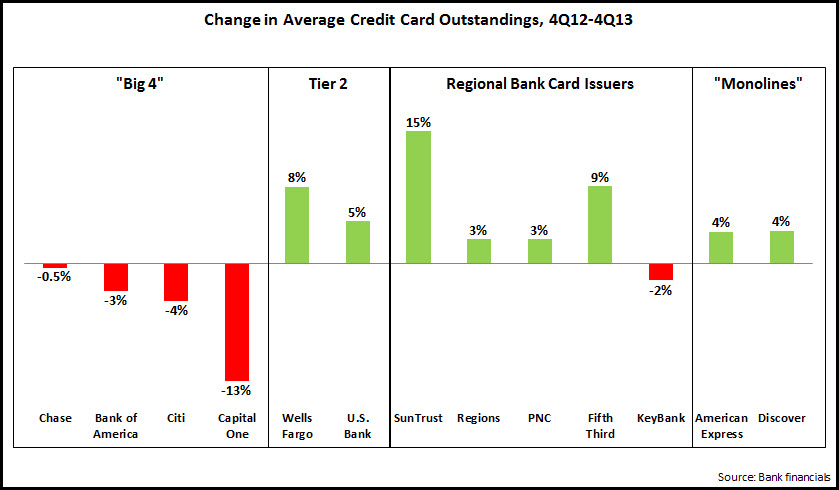

In a recent EMI blog post, we suggested that the extended series of declines in credit card outstandings had bottomed out. The latest quarterly performance metrics for the leading U.S. credit card issuers provides more evidence of this turnaround: EMI’s analysis of 13 leading U.S. card issuers found a 1% year-on-year (y/y) growth rate in average outstandings in 2Q14.

Growth was led by SunTrust, which grew outstandings 19% y/y, albeit from a low base. Wells Fargo continued its strong outstandings growth rate, with a 10% y/y increase as Wells Fargo credit card penetration of retail banking households reached 39% (from 35% in 2Q13). The top four issuers—Chase, Bank of America, Capital One and Citi—once again acted as a brake on overall industry growth. However, even these four issuers are seeing positive signs. Chase’s new account production rose 40%. Capital One reported a 1% rise in end-of-period outstandings, as it returned to growth earlier than anticipated, driven by a combination of rewards, non-high-balance revolvers, and credit line increases. Even though Citi reported a 3% y/y decline, it attributed this to continued run-off in promotional rate balances, whereas full-rate balances have grown for five consecutive quarters.

Volume

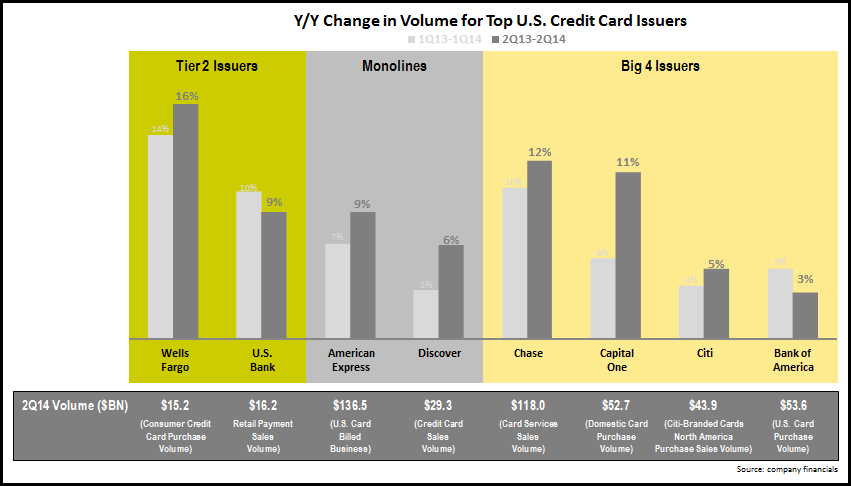

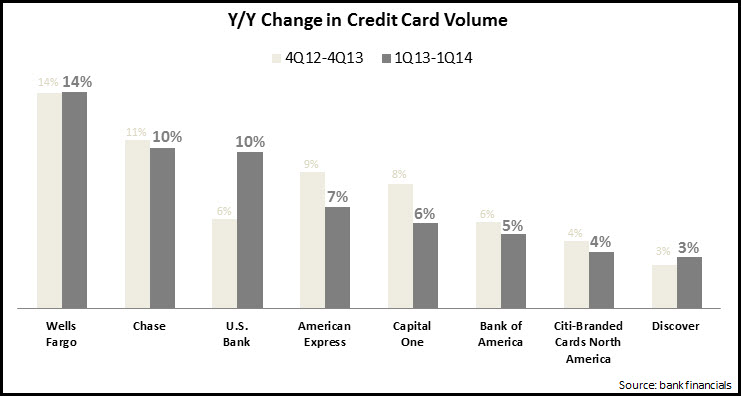

In the absence of credit card outstandings growth in recent years, issuers have focused on volume growth. This growth continued and even accelerated in the most recent quarter (for the eight leading issuers reporting card volume, y/y volume growth rose from 7% in 1Q14 to 9% in 2Q14). Issuers attributed this growth to a combination of new account growth and increases in average cardholder spending.

Six of the eight issuers in the above chart had stronger y/y volume growth in 2Q14 compared to 1Q14. As in previous quarters, Wells Fargo and Chase led the industry. Wells Fargo benefited from both account growth as well as a 14% rise in average spending per account, as more cardholders moved their Wells Fargo card to top of wallet. Capital One reported an 11% growth rate, but claimed that if private-label cards were excluded, its growth rate was 16%, driven by continued marketing and customer experience initiatives.

Credit Quality

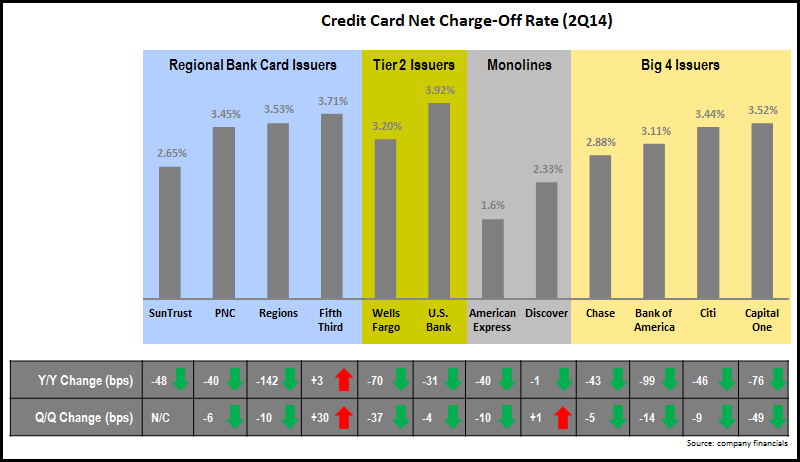

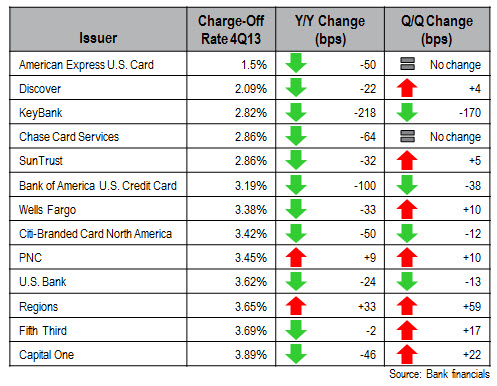

With charge-off and delinquency rates below historic norms for many issuers, one would expect that a push for outstandings growth would lead to upward pressure on these rates. However, this has not been the case, and issuers continued to report significant y/y and q/q declines in charge-off rates in 2Q14.

Of the 12 leading issuers reporting credit-card charge-off data, 10 reported double-digit y/y declines. The two main “monolines”—American Express and Discover—continued to have the lowest rates, but SunTrust and Chase now also have charge-off rates below 3%.

Implications

These positive metrics are clear signs that the credit card industry’s recovery from the 2008 financial crisis and resulting Great Recession, is gaining momentum. For issuers looking to capture a share of this growth, the following are some areas they should consider:

- Cross-sell and upsell existing customers. There has been much coverage in the industry of Wells Fargo’s continued growth in its credit card penetration rate, which has fueled strong outstandings and volume growth. Regional bank card issuers also tend to follow this cross-sell model, although most of these lack Wells Fargo’s cross-sell expertise and experience. However, leading issuers are now taking a growing interest in cross-selling existing customers; for example, Bank of America reported that 65% of its new credit cards issued in 2Q14 were to existing bank clients. Issuers should also commit to regularly assessing existing cardholder qualification for card “upgrades”, and then make appropriate upsell offers.

- Invest in multiple credit card sales channels. For many years, direct mail was the overwhelmingly dominant channel for new account generation. However, a number of factors are leading to a change in the credit card sales channel mix, including:

- A general decline in direct mail as a marketing channel, driven by both lower response and the emergence of lower-cost channels.

- Increased customer usage of online and mobile banking channels, and increased bank industry recognition of the sales potential of these channels. 54% of new Chase credit card accounts in 2Q14 were acquired online.

- The reduced usage of bank branches for everyday transaction processing has led to a redefinition of their role, with banks now looking to realize branches’ potential as sales channels. Wells Fargo recently reported that 83% of its general-purpose credit cards were sold in its Community Banking stores.

- Develop offers to drive desired cardholder behavior. Issuers need to have a series of offers available to drive specific cardholder actions at different stages of the customer life cycle (e.g., activation within 90 days of acquisition; retention during the card expiration period; card usage and referrals on an ongoing basis), which ultimately help optimize customer lifetime value.

- Continue to focus on rewards. Issuers are increasingly aware that rewards products and programs are integral to achieving retention and growth objectives, so there is a need to continually assess how key program elements—such as earn rates (basic and bonus) and user experience—stack up against competitors.

- Invest in credit card brands. It is notable in recent years that many credit card issuers are creating and supporting card brands, both to generate build stronger customer awareness, as well as acting as a point of differentiation from competitors. These new brands apply to both:

- Individual cards (e.g., Santander Bank’s Bravo and Sphere cards, and Huntington’s Voice card)

- Card portfolios; this is especially prevalent in the small business sector, with issuers like Chase (Ink), Capital One (Spark Business) and U.S. Bank (Business Edge) all branding their small business card portfolios.