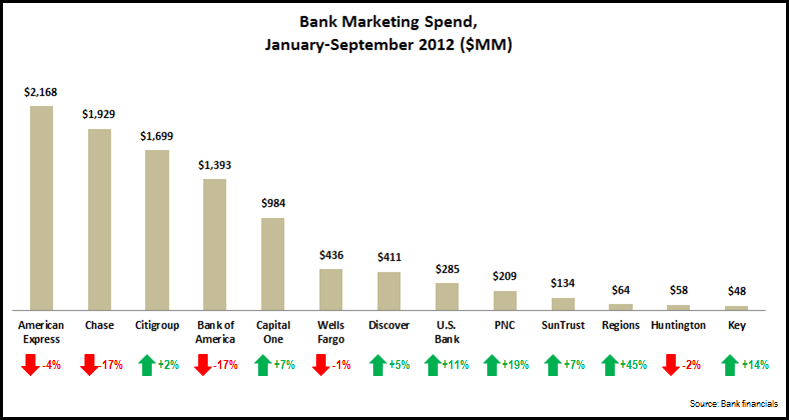

Directions in bank marketing spend have become more difficult to predict, as banks seek to balance the need to control costs with the desire to capture growth opportunities. Bank marketing spending trends for 2012 show these forces in action. Many large banks now have multi-year expense reduction in programs in place. However, there is growth potential in a number of lending categories (e.g., commercial, mortgage, and auto).

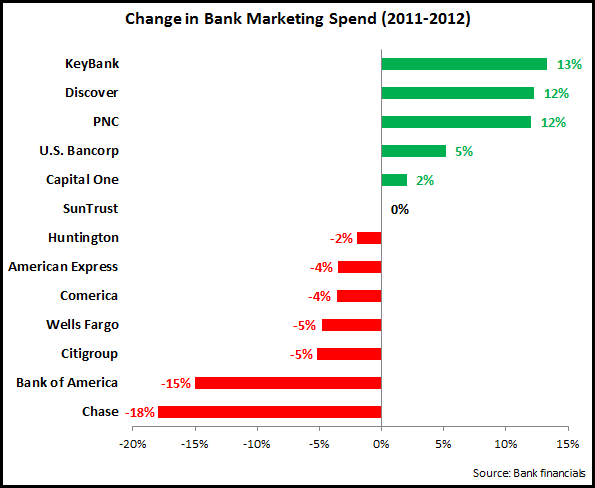

The chart above shows a mixed picture, with double-digit declines in marketing spending for Chase and Bank of America, but double-digit growth by KeyBank , PNC and Discover Financial. So, at first glance, it appears that the largest banks are cutting their marketing budgets, while some regional banks are ramping up their investment.

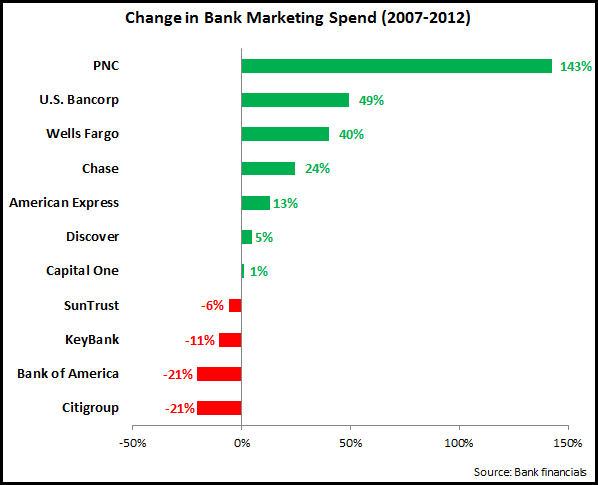

However, this just provides one year’s worth of data. Taking a longer-term view, the next chart looks at changes in bank marketing spending between 2007 (just prior to the onset of the financial crisis) and 2012.

This gives us a rather different picture, with 7 of 11 banks increasing their marketing spend over the five-year period. And different stories emerge for particular banks as we take the longer-term view.

- KeyBank’s $68 million in marketing spend is 13% higher than 2011, but 11% lower than the $76 million it spent in 2007.

- JPMorgan Chase had the largest decline between 2011 and 2012 (-18%), but its $2,577 million spend level in 2012 represented a 24% increase over 2007 levels (and in fact, there were significant shifts in spending during this period, with a 14% fall between 2007 and 2009, followed by a 77% rise between 2009 and 2011).

Even this five-year view does not give us a full picture, as the financial crisis has meant that many banks have changed radically between 2007 and 2012. For example, Wells Fargo and JPMorgan Chase have grown significantly, in large part due to the acquisitions of Wachovia and Wamu, respectively. On the other hand, Citigroup and Bank of America, two of the banks hardest hit by the financial crisis, have embarked on a long-term project to sell off non-core assets.

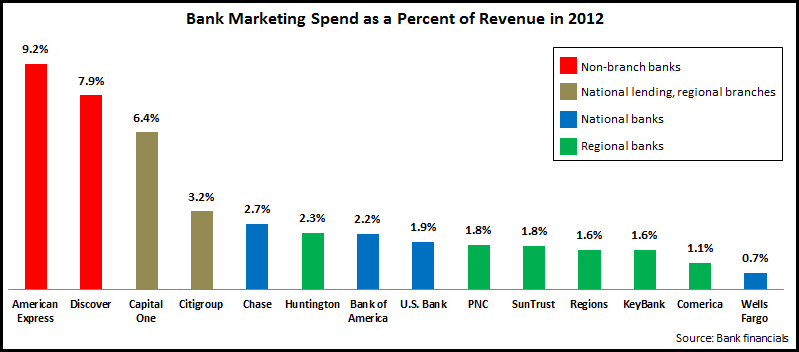

With this is mind, a more effective way to compare bank marketing spend levels is to look at bank marketing spend intensity (marketing spend as a percentage of revenues).

Taking this viewpoint, we can decipher a number of trends:

-

Banks that lack a retail branch presence (such as American Express and Discover) have the greatest marketing spend intensity. American Express recently reported that, even as it looks to reduce expenses (with plans announced in January 2013 for 5,400 job cuts), it plans to maintain marketing spend at 9% of revenues.

-

Next in bank marketing spend intensity are banks like Capital One and Citigroup, which have national lending franchises but relatively small branch networks. In the case of Capital One, its marketing spend intensity has declined in recent years, from 9.2% in 2007 to 6.4% in 2012. This has coincided with its transition from a monoline credit card provider to a more full-service bank.

-

National banks with extensive branch networks and a full range of services (JPMorgan Chase, Wells Fargo and Bank of America) tend to spend the equivalent of 2-3% of revenues on marketing. There has been some reduction in marketing spend intensity by these banks in recent years, most notably by Bank of America, whose marketing spend as a percent of revenues fell from 3.6% in 2007 to 2.2% in 2012. Wells Fargo stands out from its national bank peers, with marketing spend intensity below 1%.

-

Regional banks’ marketing spend intensity tends to be lower than other bank segments, at 1-2% of revenues.

In summary, bank marketing spend levels are set within ranges that are defined by the bank’s size, structure and product focus. Within these ranges, banks increase or decrease marketing spending from year to year based on both their strategic priorities as well as their assessment of their operating environment.