An analysis of 4Q13 and full-year 2013 financial results for the leading U.S. banks reveals that most are continuing to reduce their marketing spend. This is being driven by both economic uncertainty as well as banks’ long-term desire to cut costs and maintain profitability as they struggle to generate revenue growth.

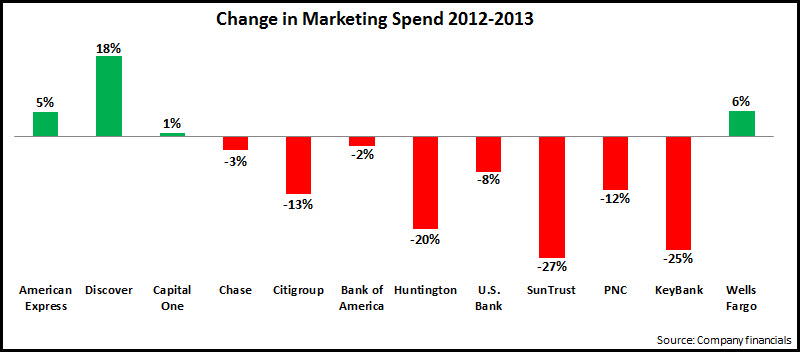

- Of the 12 banks studied, 8 reduced marketing spend between 2012 and 2013, with 5 of these cutting budgets by more than 10%.

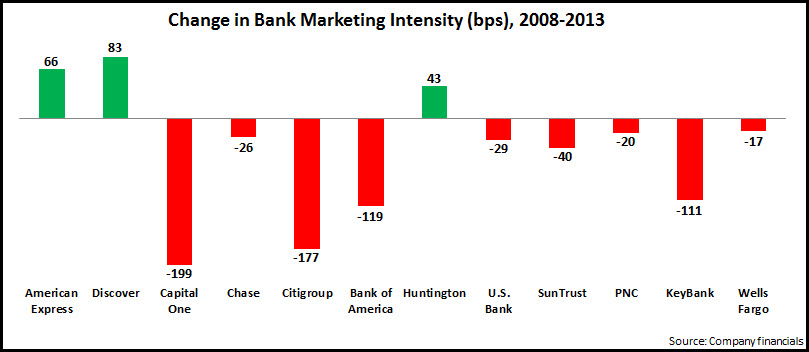

- Taking a longer term view, 8 of the 12 banks increased their marketing expenditure between 2008—when the financial crisis hit—and 2013.

At first glance, this would imply that banks have ramping up their marketing spend in recent years. However, many of these banks have changed dramatically during this period, mainly through acquisition. For example, Wells Fargo acquired Wachovia, Chase bought Wamu, and PNC purchased both National City and RBC Bank. So, to ensure that we are comparing like-with-like, we need to look at “marketing intensity”, which we define as the ratio of marketing spend to net revenue.

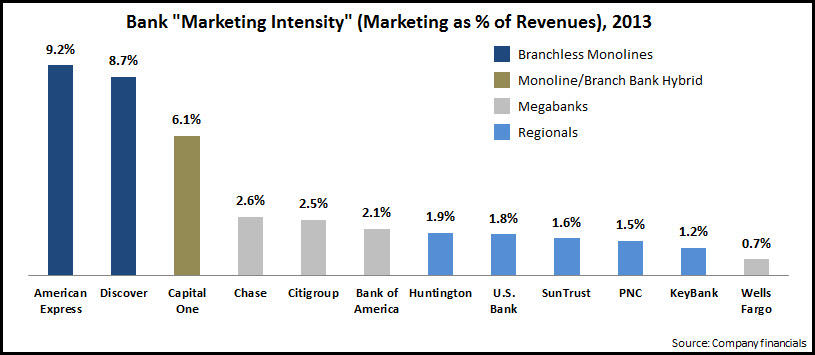

- In 2013, there was a broad disparity in intensity for the various bank categories: highest marketing intensity (>8% of revenues) for branchless monolines, which have no branch networks and which are overwhelming focused on selling credit cards; lowest intensity for regionals (<2% of revenues); and megabanks tend to spend 2-3% of revenues on marketing, with the notable exception of Wells Fargo. Capital One is a monoline/branch bank hybrid, with a branch network but also a continued high dependency on credit cards; this is reflected in the 6% of revenue it devotes to marketing, higher than traditional branch banks, but lower than monolines.

- So, even though 8 of the 12 banks increased their marketing expenditure between 2008 and 2013, during this period, 9 of the 12 banks reduced their marketing intensity levels. It is notable that the two “banks” with the highest marketing intensity—American Express and Discover—have both increased in intensity over the past five years. On the other hand, the largest decline was recorded by Capital One, which has been transforming itself from its credit card monoline to full-service bank.

As there are now signs that economic recovery is gaining strength, increases in consumer and business confidence should translate into a greater demand for financial revenues and opportunities for banks to grow revenues. However, the need for increased marketing investment to capture business growth will be battling against banks’ cost-cutting culture that has become in recent years.