As the banking ecosystem moves to a digital-first profile, we have identified the following five trends that shaped digital banking during the most recent quarter. Furthermore, we expect that these trends will persist into 2022.

Not only has digital banking achieved critical mass, recent surveys have found that it has become an indispensable tool in people’s lives.

- A Citizens Banking Experience Survey found that 90% of consumers and 86% of small businesses use digital banking channels. Moreover, 40% of consumers claim that digital banking capabilities are the most important factor when choosing a banking provider.

- Chase’s Digital Banking Attitudes Survey found that 63% of consumers say that mobile banking is a service they cannot live without.

- A recent Capital One Banking Behaviors 2021 Survey found that 67% of consumers list their banking app as their most trusted financial tool.

Recent years have seen digital challengers engaged in a land grab in a market characterized by very strong growth and relatively low barriers to entry. Several digital banks have attained significant scale while others have established a strong presence within a specific market niche. However, we are now seeing signs of a shakeout in the digital bank sector in 4Q21 with pullbacks, market departures and consolidation.

- Monzo and N26 both announced during the quarter that they were quitting the U.S. market.

- MoneyLion announced the acquisition of Even Financial for $440 million.

- Google dropped plans to offer bank accounts to its users.

Traditional banks are addressing the threat from digital banks by continuing to grow their digital user base, adding new digital functionality, improving the digital user experience (UX) and acquiring/partnering with fintechs.

- Bank of America continues to lead the way in digital banking engagement among the main U.S. banks. In October, it reported that 5 million clients were using Life Plan, its personalized digital financial planning experience.

- U.S. Bank is also a leader in driving digital banking penetration among its customer base; digital customers represented 70% of its total active customers at the end of 3Q21.

- According to an Atos survey, 66% of bank leaders named transforming the digital experience as a top priority.

Younger demographic segments represent the key battleground between traditional and digital banks.

- Traditional banks tend to have higher levels of trust and loyalty among older segments, a fact that is increasingly recognized by the banks themselves; a Bank Director survey found that 95% of financial executives believe that they have the tools in place to effectively serve baby boomers. However, only 43% believe that this is case for Millennials.

- According to a Plaid survey, younger segments have the highest fintech adoption, led by Millennials at 95%, followed by Gen X at 89%, and Gen Z at 87%. (Boomers’ fintech adoption rate was 79%.)

While traditional banks migrate to a digital-first approach, they believe that clients will continue to value the branch channel.

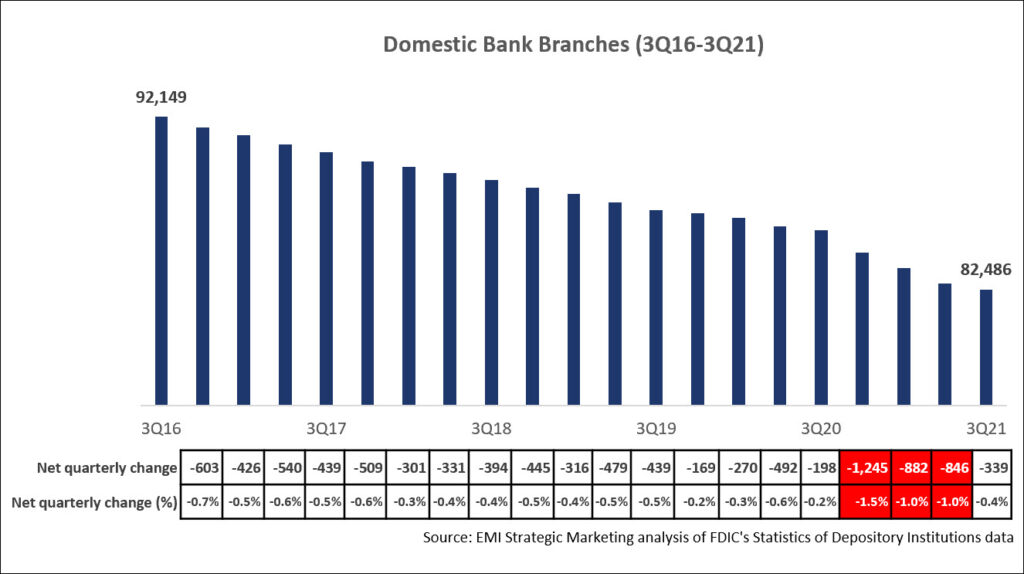

Many banks are announcing branch reductions as they reduce branch density. Our analysis of FDIC SDI data on domestic U.S. branches shows that there has been a decline of almost 10,000 branches over the past five years, with some evidence in recent quarters that the rate of bank closures has accelerated (a decline of at least 1% of total branches in three of the past four quarters). However, it is important to note more than 82,000 branches remain in operation.

- According to a Capital One survey, 42% of consumers reported that they missed being able to visit their bank branch during the pandemic.

- Branches are also crucial to establishing a foothold in new markets. Citizens’ CEO Bruce van Saun claimed at a December 2021 conference that the bank could not target the New York City metro market without the branches it is acquiring from HSBC. JPMorgan Chase has similarly used flagship branches to gain a foothold in expansion markets.

We expect that many of these trends will continue and even intensify in 2022 as both established and emerging players adapt their product offerings, channel strategies and customer experiences to changing customer behaviors and preferences as well as an increasingly dynamic competitive environment.

Subscribe