The impact that the COVID-19 pandemic has had on our society and economy is huge, and the effects are likely to persist for some time to come. This blog looks at some of the most important changes affecting the credit card sector, how issuers have responded to these challenges in the short term, and what they need to do as the economy starts to reopen and they look to get the sector back on an even keel.

Spending

The trend. The pandemic has led to significant changes in consumption patterns. Overall spending fell as the lockdowns took effect. Spending in categories like travel and entertainment registered huge declines, which were partially offset by increases in everyday spending categories like grocery. There were also changes in purchase methods. As a result of stay-at-home limitations, digital commerce growth rose strongly. And at the point of sale, consumers moved decisively away from cash and embraced contactless payments. According to Mastercard research from the end of April, 51% of Americans are now using some form of contactless payment. The switch to contactless is likely to persist: according to the 2020 American Express Digital Payments Survey, 58% of consumers who have used contactless say they are more likely to use contactless payments now than before the coronavirus outbreak.

The response. Issuers initially responded to the change in spending patterns by:

- Changing bonus earning categories to encourage consumers with travel-centric cards to use these cards for everyday spending. Chase introduced higher earn rates for grocery spending on its Sapphire Cards and most of its travel-oriented co-branded cards.

- Extending the eligible period to meet a spending threshold and qualify for activation bonuses on new cards. American Express and Citi extended this period by three months.

Next steps.

- Issuers need to ensure that contactless payment functionality is available on all of their credit cards.

- Card networks and issuers should increase the spending limit for contactless payments. Note that this has already taken place in most European countries in response to the pandemic.

- Issuers should switch from chip-and-signature to chip-and-PIN. A recent Mastercard survey found that 72% of consumers would prefer to avoid signatures.

Borrowing

The trend. The economy retrenched in recent months, and cardholder borrowing has fallen, due to both decreased spending and a desire to reduce debt. This was evident in issuers’ credit card outstandings for the first quarter. EMI analysis of 22 leading issuers found a 4.4% y/y rise in average credit card outstandings in 1Q20. However, the y/y rise in end-of-period outstandings was just 1.7%, indicating a pull back in balances towards the end of the quarter.

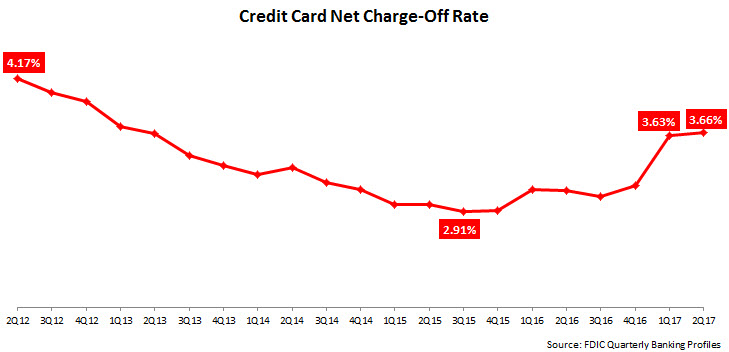

In terms of key credit quality metrics, there was no dramatic upsurge in delinquency or charge-off rates, but these metrics take time to register and many consumers have taken advantage of payment relief programs. According to TransUnion, 3.2% of card accounts were in financial hardship programs in April, up from less than 0.01% in March.

The response. At the onset of the pandemic in mid-March, most issuers were quick to introduce payment relief programs (mainly deferrals on minimum payments and waivers on late fees) and they also engaged in the following activities:

- Dramatically raised their provisions for loan losses in their 1Q20 financials.

- Scaled back credit card solicitations. Bank of America reported that card loan origination fell 55% between February and the first two weeks of April.

- Tightened underwriting. In its 1Q20 financials, Discover reported that it significantly tightened underwriting and pulled back on credit line increases and balance transfer offers.

- Cut credit limits. According to an April 2020 CompareCards survey, 25% of credit cardholders said that their credit limits were cut involuntarily, or that their cards were closed in the previous 30 days.

Next steps.

- In the near term, issuers will likely need to continue existing actions, such as extending relief programs. However, as the economy returns to some degree of normality, issuers will scale back or end relief programs, inevitably leading to increased delinquencies and charge-offs.

- Issuers should redeploy staff to engage directly with cardholders on their repayment plans.

- Issuers should develop information/advice for consumers on how to improve their debt management and make the materials easily available by publishing on various media.

Channel Usage

The trend. Because the pandemic has forced banks to close many branches, there has been a significant rise in digital channel usage for financial needs. More consumers are trying digital channels for the first time, and existing users are depending on digital channels for a broader array of financial activities. This migration to digital channels is likely to persist.

The response. Issuers actively directed cardholders to digital channels for their customer service needs.

Next steps. To consolidate the recent gains made in digital channel usage by credit cardholders, issuers should:

- Accelerate the promotion of digital channel benefits on websites, in social media and in monthly statements.

- Ensure that digital channels are providing a positive user experience.

- Expand digital channel functionality.

- Promote human channels for cardholders who need to engage directly with the issuer.