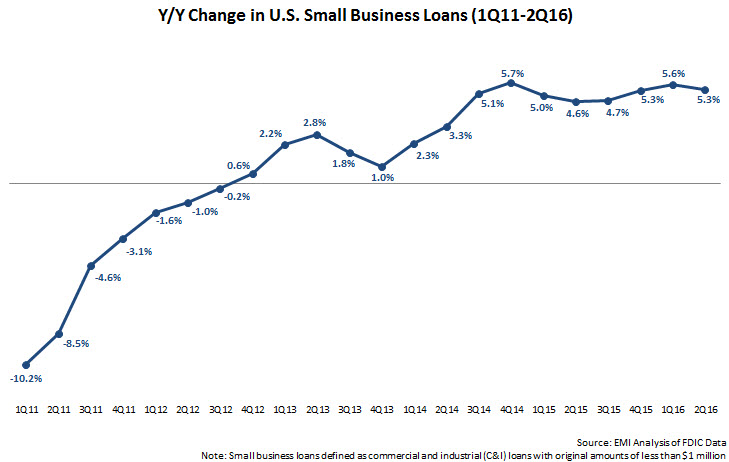

According to the FDIC, small business lending rose 5.3% between end-2Q15 and end-2Q16. Since falling to a post-Financial Crisis low of $279 billion in the third quarter of 2012, small business loans have risen 18%—to $328 billion—at the end of June 2016.

In the light of this steady loan growth, many banks are refocusing attention on the small business market. But how can banks—many of which virtually abandoned the small business credit market following the 2008 Financial Crisis—rebuild awareness, trust and engagement with small business owners? The following are five marketing approaches for banks to consider in (re)building their small business banking franchise:

- Develop a small business brand. In recent years, several leading banks generated significant small business awareness by developing a dedicated small business brand. For some, these brands cover the bank’s entire small business operations. Capital One created the Spark Business brand for its small business solutions, and has launched a number of Spark-branded products and services, the most recent of which is the Spark 401(k) service. Another option is to develop a branded small business portal, and extend that branding into the bank’s small business social media presence. Wells Fargo created the Wells Fargo Works for Small Business portal, and applied this brand to social media platforms, including a dedicated blog and @WellsFargo Works Twitter handle.

- Target small business segments. Banks’ commercial banking units tend to target firms based on size and industry sector, as these are seen to have distinct financial needs. In targeting small businesses, banks are better served by focusing on small business life stages, or by targeting underserved segments, such as women-owned businesses. KeyBank has established Key4Women, a nationwide community of women in business.

- Create content of interest to small businesses. Banks can build trust and engagement with small businesses by developing and distributing information, news, and advice relevant to small business owners. This content should be focused on addressing common business challenges, and should ideally be brief and easy to scan (to reflect today’s content consumption patterns). Two recent good examples of small business-focused content are five tips from First Republic on how to run a better business, and tips from Capital One on buying or leasing office space. And banks should explore a range of content types, such as case studies, articles and blog posts, webinars, videos and succinct reports/white papers.

- Raise awareness through small business surveys. Many leading banks are conducting small business surveys, which aim to both raise awareness and promote their understanding of small business concerns and needs. Many of these surveys are carried out on a quarterly or annual basis, and feature recurring metrics (e.g., Wells Fargo/Gallup Small Business Index and Capital One’s Small Business Confidence Score). Banks also seek to tackle other small business-related topics either in these recurring surveys or in standalone surveys (examples of the latter include TD Bank’s Small Business EMV Survey and Bank of America’s Women Business Owners Spotlight).

- Develop a local presence. There are a number of ways for banks to establish a local presence:

- Partner with key influencers (such as chambers of commerce)

- Market branch presence. Small businesses tend to have heavier branch usage than consumers, and banks can leverage this branch affinity by promoting small business solutions (including technology tools) in branches, deploying branch-based small business specialists, and hosting small business events.

- Promote small business-focused community groups or programs. In August 2016, Webster Bank announced a partnership with the University of Connecticut and Connecticut Innovations to establish a $1.5 million UConn Innovation Fund for new business startups.

Before developing and implementing these small business initiatives, banks should conduct research to understand how and how well they are perceived by small business owners, and to identify deficiencies in their product and service capabilities relative to competitors. Banks should also gain insights from key internal stakeholders to assess its ability to address these issues using existing resources. These analyses support investment decision making, and inform small business banking program development and implementation.

Subscribe