Over the past week, leading U.S. credit card issuers have been publishing their 4Q12 and full-year 2012 results. After we reviewed these financials, we detected the following trends, which are largely consistent with our recent blog on top credit card trends for 2013.

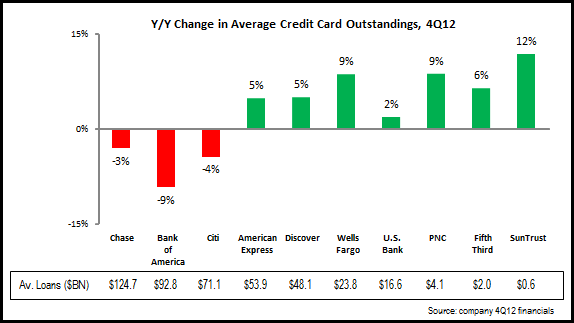

- Outstandings: The top three issuers continue to report y/y declines in average outstandings, while traditional monolines and regional banks are driving growth. Both Wells Fargo and regional banks focus on cross-selling credit cards to their existing customer base. Wells Fargo reported that credit card penetration of retail banking households rose from 27% in 1Q11 to 33% to 4Q12. Bank of America indicated in its 4Q12 earnings call that it would be focusing on marketing credit cards through the franchise.

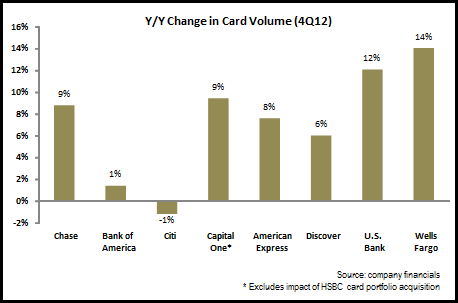

- Volume: Most leading issuers reported strong y/y growth in volume in 4Q12. However, there is evidence that this growth rate is slowing down. American Express‘ 8% y/y growth in 4Q12 was down from 12% in 1Q12. And during the same period, Chase y/y volume growth fell from 12% to 9%.

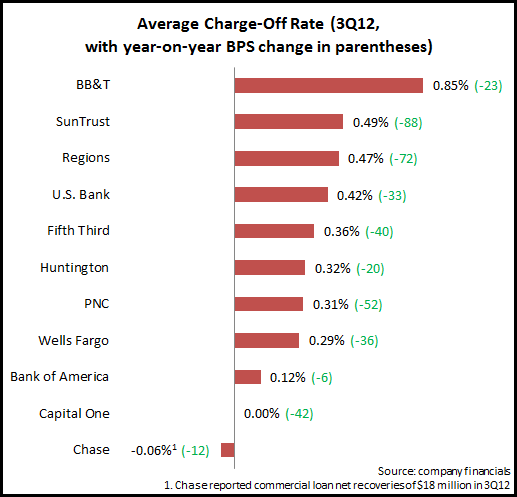

- Charge-off and delinquency rates: Charge-off and delinquency rates continue to trend downwards. Of the 11 issuers studied by EMI,

- Only Capital One reported a y/y rise in its charge-off rate, and this was due to the acquisition of the HSBC card portfolio.

- 6 of the 11 reported linked-quarter declines in the charge-off rate. 9 of the 11 have rates below 4%, with two issuers (American Express and Discover) reporting 4Q12 charge-off rates of below 3%. Even Bank of America (which is one of the two issuers with a rate above 4%) reported that its charge-off rate is at its lowest level since 2006. In many cases, charge-off rates are now below historic norms, which points to a fundamental change in consumer attitudes to carrying credit card debt.

- Delinquency rates also declined y/y, although some issuers did reported linked-quarter increases, driven perhaps by both seasonality, as well as some upward movement as issuers start to pursue loan growth.