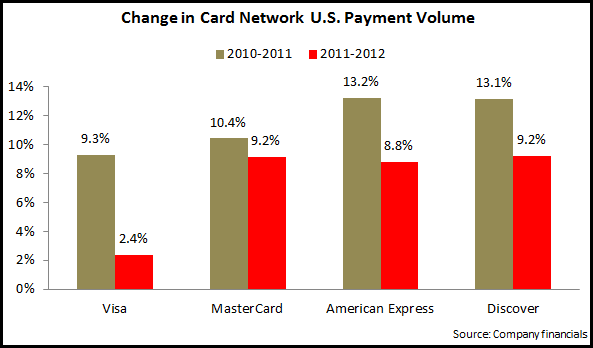

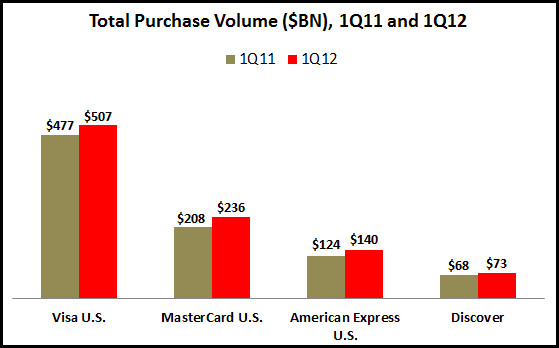

With Visa and MasterCard reporting their quarterly financials this week, we now have a picture of U.S. payment volume for the four main card networks (Visa, MasterCard, American Express and Discover) in 2012. These four networks grew volume 5.3% in 2012. This represented a significant decline from the 10.3% growth rate between 2010 and 2011.

-

Visa reported the largest decline in its volume growth rate, from 9% in 2011 to just 2% in 2012. While U.S. credit card volume growth remained stable at 10% in both 2011 and 2012, debit card volume fell from a growth rate of 9% in 2011 to a volume decline of 2% in 2012. This was largely due to new regulations that impacted Visa’s exclusive debit card network relationships with banks. Visa did report significant improvements in y/y growth rates for both credit and debit volume between 3Q12 and 4Q12.

-

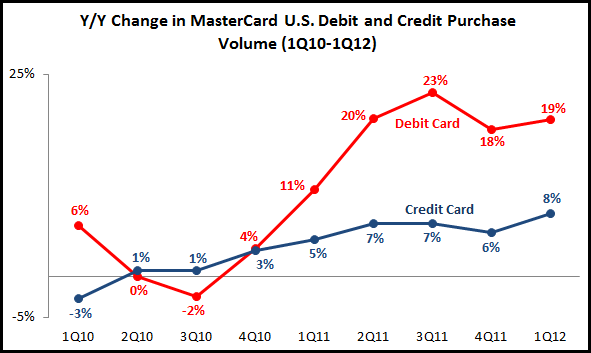

MasterCard credit and charge volume growth fell from 6% in 2011 to 3% in 2012 (although the y/y growth rate improved from 1% in 3Q12 to 3% in 4Q12). Debit volume rose from 12% in 2011 to 15% in 2012.

-

American Express reported its U.S. consumer payment volume fell from 11% in 2011 to 8% in 2012. During this period, small business volume slipped from 14% to 12%, while corporate services volume declined from 14% to 11%.

-

Discover reported declines in growth rates for its two main payment volume categories: proprietary Discover Network (from 8% to 5%); and PULSE Network (from 19% to 14%).

According to the U.S. Bureau of Economic Analysis, personal consumption expenditure rose 3.6% between 2011 and 2012, down from 5.0% between 2010 and 2011. This means that even though card networks’ volume growth slowed between 2011 and 2012, it was still stronger than consumer spending, and so the networks’ share of consumer spending continued to rise. We expect that volumes will continue to rise at moderate levels in 2013, as the leading U.S. issuers seek to balance volume and lending growth.