Consumer transition to digital channels for everyday banking needs reached a tipping point in 2019. A recent ABA/Morning Consult survey found that 73% of Americans access their bank accounts most often via online (37%) and mobile (36%) channels. And more consumers are also now embracing digital channels for more financial activities, from buying new financial products and services to securing financial advice.

Responding to this trend, and the march towards improved efficiency, many financial providers are “chasing digital” from the boardroom to the back office. Some take an incrementalist strategy, doggedly adding functionality or product sets to online and mobile platforms. Some have bought or built standalone digital brands, or layered digital over thin branch networks out of footprint. And, of course greenfield revolutionaries continue to dive in to the fray. We look at four models that are working, and what marketing mix and methods matters most for each.

National Banks Double Down on the Human-Digital Model

Banks with a national or quasi-national branch footprint and strong brand equity – including JPMorgan Chase, Bank of America and Wells Fargo – have focused less on driving digital deposit growth to date and taken evolutionary approaches to driving digital banking. Take Erica, for example, Bank of America’s AI-based personal assistant, launched in June 2018. Over the past 18 months, Bank of America has systematically expanded Erica’s capabilities, and methodically marketed it to customers. The platform recently reached 10 million users. The same month that Erica appeared, JPMorgan Chase launched Finn, a standalone digital banking platform designed to appeal to a younger demographic. Just one year later Finn was shut down in a “fail fast” move, and Chase now appears to be doubling down on both digital banking evolutionary enhancements and selected branch expansions.

- These national banks have significant technology budgets, and they are using them to launch a steady stream of new digital banking capabilities, citing increased customer satisfaction, higher share of wallet and reduced attrition. Bank of America calls it “moving from digital enrollment to digital engagement.”

- Bigger banks are also pointing marketing budgets at digital adoption. We see an increasing number of multi-channel programs promoting digital capabilities and driving trial, including broadcast advertising, online banking ads, in-branch demos, social media and more.

- While technology and marketing budgets are driving results, national banks will benefit most from a long-term channel-agnostic approach that emphasizes the strength of physical channels in acquisition, advice and complex product sales. Treating the digitization of human channels with the same attention as customer capabilities will yield higher return for banks with big branch horsepower. Too often, the glamour and appeal of digital banking pushes training and tooling for branch and contact center staff down the annual project queue. Putting next-best product predictors, automated diagnostic tools and intuitive digital solution finders in the hands of client-facing humans has high ROI.

Regional Banks Expand Reach with Digital Models

Regional banks by definition are deep in their footprints, and see digital banking as a lower-cost geographic expansion play–in some cases supported by a thin physical network. This strategy typically starts with a high-yield savings account, then adds other products (e.g., checking, lending) and digital tools. Whether regionals find the equation to manage cost of acquisition, driven by high marketing costs and NIM pressure, will be key to delivering on the promised cost-efficiency plan.

Regional banks leading the digital bank charge include:

- Citizens Bank: With national aspirations and low brand equity outside of its Northeast and Midwest footprint, Citizens Access offers this high-performing regional a “nationwide digital platform.” Launched in June 2018, Citizens Access had generated $5.8 billion in new customer deposits by the end of 2019. Next up, Citizens is talking expansion into business savings and digital lending.

- PNC expanded its digital banking capabilities in October 2018, leading with a high-yield savings account. Like several others, PNC has articulated a “thin network” strategy–combining digital bank investments with lean branch buildout in a few high-opportunity markets (in PNC’s case, Kansas City and Dallas).

- Union Bank: Another thin network player, MUFG Union Bank introduced a “hybrid digital bank” under a separate brand, PurePoint Financial, in 2017. With a NYC headquarters setting it apart from Union Bank’s West Coast heritage, the PurePoint positioning emphasizes its parent Mitsubishi’s size and global scale, and its 22 locations in Florida, Texas and Chicago. The requisite high-rate savings and CD offers are complemented with heavy financial education.

- Santander Bank recently announced plans for a digital bank later this year, but unlike others, plans to pilot in its Northeast footprint.

Monolines, Specialized Lenders Turn to Digital for Diversification

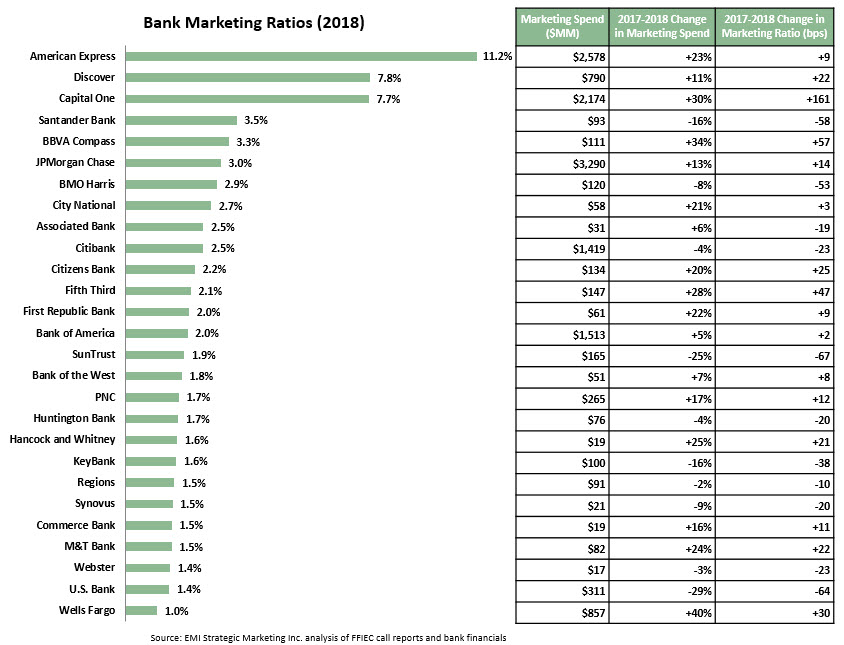

This category of financial firms includes dedicated credit card issuers with no branch presence (e.g., American Express, Discover), as well as banks with a strong heritage in card or other lending and who have a limited retail banking footprint (e.g., Capital One, Citi, Ally, CIT).

Marketing Priorities and Challenges:

- These banks have national lending franchises and strong brand equity. However, as their brands are often strongly associated with their lending operations, a key marketing challenge will be to expand consumer awareness of the bank as a provider of other banking and financial solutions.

- They will need to focus on data analysis, targeting, offer development and messaging to effectively cross-sell deposits and other products to their existing card/other loan client bases. This approach will also involve significant cooperation among different business units. Citi has been at the forefront in marketing deposit accounts to its 28 million credit cardholders and generated $4.7 billion in digital deposits in the first 9 months of 2019: two thirds of the deposits came from outside its six core banking markets.

Fintech Disruptors Continue to Emerge

Widespread availability of venture capital and private equity money continues to fuel a spate of fintechs entering the market, including Chime, N26, Radius Bank and Monzo. Many predecessor neobanks have been challenged to achieve scale, as the cost of customer acquisition in digital banking has continued to rise. Fintechs typically partner with a small bank or servicer to offer deposits, but some (such as Varo Money) are now looking for independent bank charters.

Marketing Priorities and Challenges:

- The digital bank upstarts tend to appeal to younger age segments who are both more accustomed to using technology to manage their financial needs and less loyal to traditional banks. These companies need to clearly understand how these younger segments consume media and make financial decisions and tailor their marketing investment and messaging accordingly.

- As “new kids on the block,” fintechs will need to develop solutions and marketing to differentiate themselves from both traditional banks and other challenger banks.

- The design and ongoing review of the digital user experience is critical, as this is the only platform consumers will have to interact with the bank. Some digital banks are not even offering phone-based customer service.

- While challenger banks have a number of advantages over traditional banks (such as higher rates on deposits), there are other areas where these newcomers are seen as inferior (for example, a recent Kantar study found that 47% of consumers completely trust traditional banks, but this falls to 19% for challenger banks). Challenger banks need to develop messaging to directly address these areas of vulnerability, and communicate consistently through all consumer touchpoints.