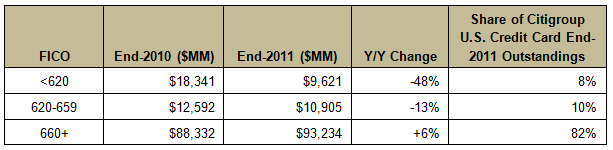

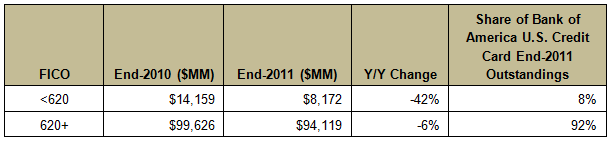

Over the past year, many leading U.S. credit card issuers have increased their focus on more affluent segments with new cards and offers. At the same time, these issuers have continued to try to reduce their exposure to consumers with low credit scores. A study of SEC filings for some of these issuers highlights the extent to which these efforts have led to significant shifts in the FICO distribution of their card portfolios.

- Although Citigroup’soverall U.S. credit card portfolio fell by 5%, its prime portfolio (660+ FICO) rose by 6%, while its subprime portfolio (<620) fell by a whopping 48%.

- Mirroring Citigroup, Bank of America’ssubprime portfolio fell by more than 40% in 2011.

- Unlike Citigroup and Bank of America, Chase does not publish outstandings data for different FICO segments, but it did report that its prime (600+ FICO) portfolio’s share of total U.S. credit card outstandings rose from 77.9% at the end of 2010 to 81.4% at the end of 2011.

Many issuers anticipate a return to credit card outstandings growth in 2012. Based on the evidence above, issuers will be focusing their efforts on the prime segment, with new products, bonus offers, attractive introductory offers, and perhaps even lower APRs. With recovery in both economic growth and consumer confidence, the decline in near-prime and subprime portfolios should also abate.