EMI’s review of 3Q 2016 financials for the largest U.S. bank and credit card issuers revealed several trends:

Acceleration in outstandings growth. Average outstandings rose 6% y/y in 3Q16 for the 13 issuers in the study; this growth rate marks an increase from previous quarters (3% in 2Q16 and 2% in 1Q16).

- American Express reported a 14% y/y decline, due to the loss of the Costco and JetBlue portfolios; excluding these portfolios, it grew loans by 11%.

- Bank of America reported no change in average outstandings, ending a protracted period of loan declines due in large part to divestitures.

- Regional bank card issuers continue to focus their attention on cross-selling credit cards to existing clients. Regions grew outstandings by 11% and reported that its credit card penetration rate rose 130 basis points (bps) y/y to 18.2%.

Continued volume growth. EMI analyzed volume data for 8 leading issuers, and found cumulative y/y growth of 9% in 3Q16.

- American Express’s sale of the Costco card portfolio to Citi led to a 15% decline in its card volume, while Citi’s volume rose by 57%.

- Issuers are launching new rewards cards and enhancing existing rewards programs to drive additional volume. Discover reported that its rewards costs rose 13% y/y to $368 million in 3Q16, and its rewards rate rose by 13 basis points to 1.20%. However, Discover has been struggling to grow volumes in recent quarter, with y/y growth of just 2% in 3Q16, down from 4% in 1Q16 and 3% in 2Q16.

Ramp up of card account production. Related to—and encouraged by—the growth in outstandings, issuers are ramping up new card acquisition.

- Bank of America issued 1.32 million new U.S. consumer credit cards in 3Q16, the strongest quarterly performance since 2008.

- Chase benefited from the launch new cards (Sapphire Reserve and Freedom Preferred) to grow new card production 35% y/y to 2.7 million. Chase reported at the BancAnalysts Association of Boston Conference this week that it opened more than 1 million new Freedom Unlimited accounts in the five months following its launch.

- Issuers are investing more in marketing in order to drive growth. American Express grew its marketing and promotion spend 10% y/y for the first 9 months of the year, to $2.4 billion.

Charge-off rates remain very low. For many issuers, net charge-off rates continue to operate at or near historic lows, with seven issuers reporting rates below 3%.

- There is some evidence of upward movement in charge-off rates as issuers chase growth. 8 of the 12 issuers in the chart below reported y/y rises. And most issuers are reporting y/y rises in 30+ day delinquency rate (which have traditionally been an indicator of future charge-offs).

- However, issuers expect that rates will not rise significantly in the coming quarters. For example, Chase reported a charge-off rate of 2.51% in 3Q16, and projects that this rate will rise to about 2.75% in 2017.

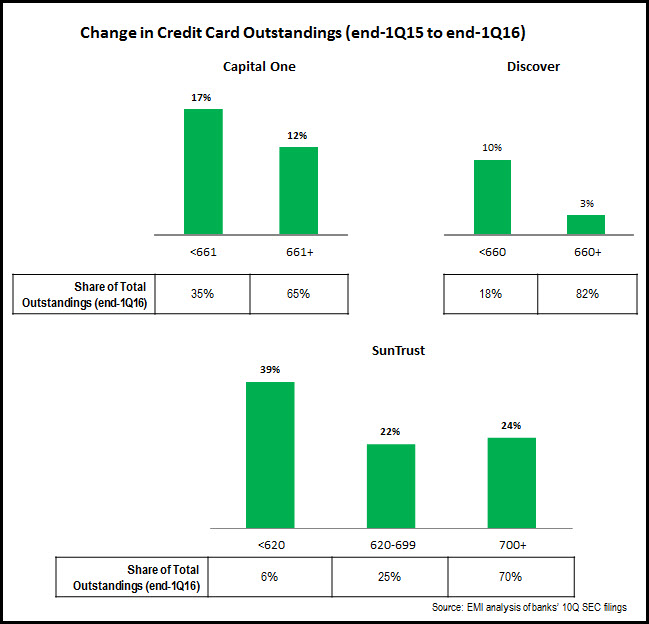

- Capital One did report a 66 bps y/y rise in its charge-off rate; this is related to the fact that it is continuing to target low-FICO segments; the <660 FICO score segment accounted for 36% of Capital One’s outstandings at the end of 3Q16, up from 34% at the end of 3Q15.