The latest U.S. bank data published by the FDIC reveals that the protracted decline in credit card outstandings may be coming to an end, charge-off rates are continuing to fall, and credit card line utilization rates are relatively unchanged.

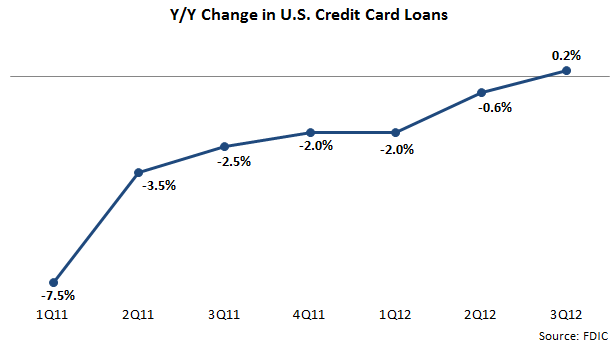

- Between end-3Q11 and end-3Q12, credit card outstandings rose by 0.2%. This small increase follows a steady series of y/y declines in the years following the financial crisis. The largest three issuers (Chase, Bank of America and Citibank), which still account for more than half of outstandings, reported a 7% y/y decline, as charge-offs and portfolio sales continue to outstrip new loan growth. On the other hand, large regional banks (see note at the bottom of the blog) increased outstandings 6% y/y, led by TD Bank (+22%) and SunTrust (+19%). Looking into 2013, it is likely that outstandings will grow modestly as regional banks and, to a lesser extent, “monolines” pursue loan growth, and as the top three issuers move towards the end of their portfolio deleveraging. However, much will depend on the demand for credit. This demand is significantly influenced by macroeconomic trends and consumer confidence, both of which are fragile at present.

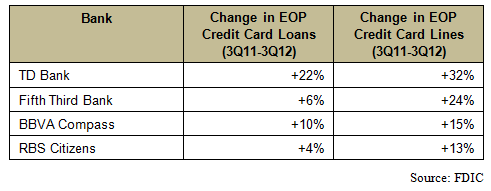

- Credit cards lines fell 2% in the year to end-3Q12. The top three issuers reduced card lines by 6% while regional banks increased lines by 8%. Movements in credit cards lines tend to match outstandings very closely. In 3Q12, credit card utilization (credit card outstandings as percentage of credit card lines) was 21.5%, and this measure has remained in the 20.5%-22.5% range in recent years. This consistent credit card utilization ratio implies that if issuers increase credit card lines, outstandings growth will follow. The following table highlights some regional banks that have grown credit card lines over the past year at double-digit rates:

- Credit card issuers continue to benefit from reductions in charge-offs, which fell 31% in the year to end-3Q12. The average charge-off rate fell 174 basis points (bps) y/y and 12 bps on a linked-quarter basis, to 4.04% in 3Q12. Charge-off rates are now at or below historic averages for many leading issuers, and are not expected to fall much further. In fact, as issuers look to build outstandings and grow revenues in 2013, there may be some upward pressure on charge-off rates, depending on how aggressively issuers open the lending spigot.

(Note: Regional bank category includes the following banks: Bank of the West, BB&T, BBVA Compass, BMO Harris , Fifth Third, PNC, RBS Citizens, Regions, SunTrust, TD Bank, U.S. Bank, and Wells Fargo.)

Subscribe