With the arrival of COVID-19, consumers have accelerated their transition to digital banking, which in turn has lowered barriers to entry into the consumer banking space.

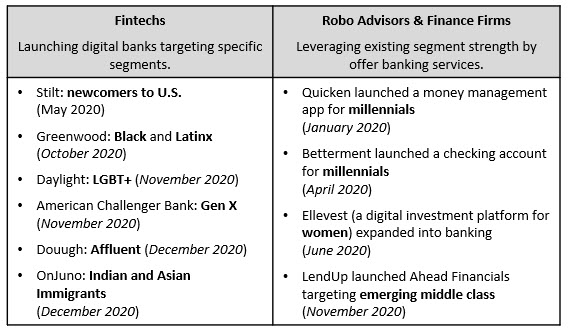

New entrants comprise both fintechs as well as other financial firms (e.g., robo advisors, financing providers) who have not previously offered banking services. These firms typically cannot compete with the brand equity, product range and heritage of the established retail banks. However, in this new environment, by identifying an attractive and/or underserved segment and building a tailored digital banking experience, new entrants can establish a market presence, while differentiating themselves from both incumbent banks and other new entrants.

The following is a snapshot of recent segment-specific initiatives by new entrants to enter the retail banking market:

For similar companies looking to break into the banking space, once you have identified your desired segment, you will need to tackle the following questions to determine your go-to-market strategy:

- What is the size and growth potential of the desired segment? Is it concentrated in certain geographic markets?

- Do people in this segment tend to have unique financial needs?

- How loyal are they to their current financial provider(s)?

- What are their preferred banking channels for conducting day-to-day banking activities, and for signing up for new solutions?

- What are their most important factors (e.g., price, customer service, convenience, innovation, security, sustainability) in selecting a financial product or provider?

- What are their preferred media and information channels?

- Do other financial firms current target this segment? If so, who are the standout providers? Are any new entrants targeting the segment?

- Outside of financial, which sectors (or individual firms) are best in class in targeting the segment? What are they doing that makes them successful?

- What capabilities do you current have in-house to initiate a segment-based strategy? What additional resources do you need?

Finally, it is important to note that established retail banks are endeavoring to counter the threat from new entrants with broad initiatives (e.g., enhancing the omnichannel experience) and segment-specific programs. For example, KeyBank recently announced plans to launch a national digital bank, targeting medical professionals. Expect to see more of the same in 2021.