EMI analysis of the latest FDIC U.S. bank data for the first quarter of 2013 reveals a number of interesting trends in commercial and industrial (C&I) and small business lending:

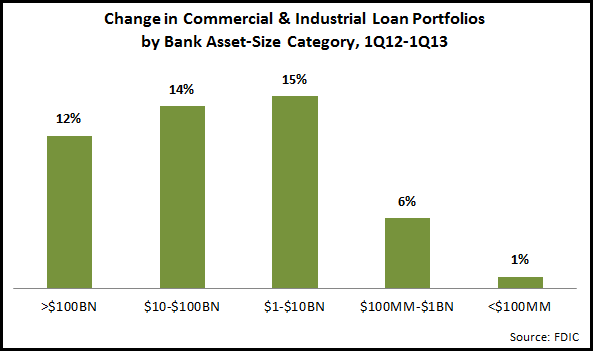

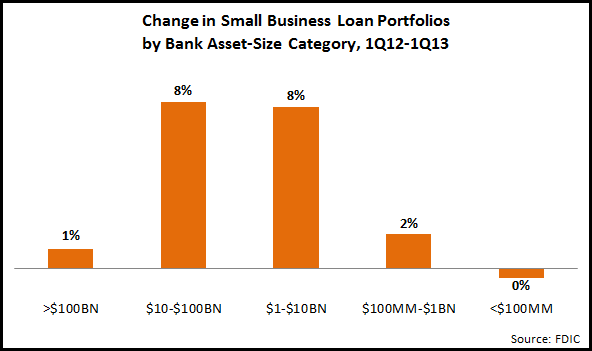

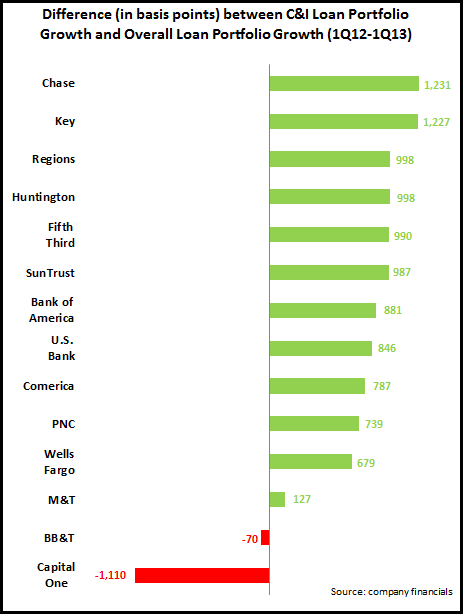

- U.S. banks’ C&I loan portfolios continued to grow at double-digit rates year-on-year (y/y) in 1Q13, rising 12%, the same rate of increase as in 4Q12. Commercial loan growth continues to outpace overall loan growth of 4% y/y. Small business loan portfolios (defined as C&I loans with values of less than $1 million) are finally showing signs of life, rising 2% y/y. This follows a 0.4% y/y increase in 4Q12, which was the first such increase in years, as reported in a February 2013 EMI blog post.

- Large banks dominate C&I lending. Of the 6,500 banks in the U.S., just 17 have more than $100 billion in assets. But these 17 banks account for 57% of total loans and 60% of C&I loans. In addition, the large banks (with assets of more than $1 billion) are reporting stronger growth in their C&I loan portfolios than their smaller counterparts.

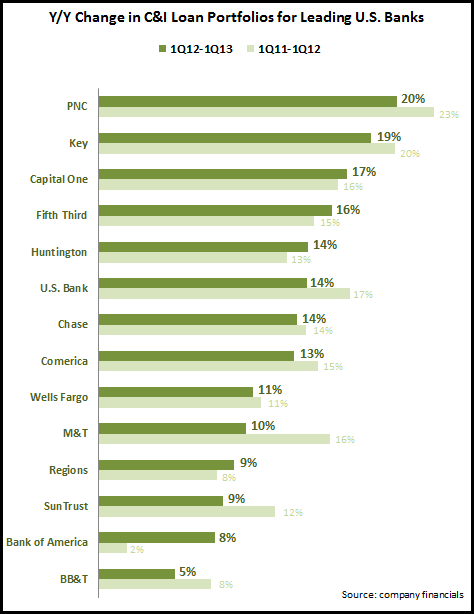

- Among the top 20 C&I loan portfolios, banks reporting above-average growth include:

- HSBC Bank USA (+27%)

- Bank of America (+22%): representing a significant growth rate for the bank, which has trailed other leading national banks for loan growth in recent years. The bank reported in the Financial Times in February 2013 that it was increasing investment in its commercial bank, including the addition of 50 bankers as a first step.

- Sovereign Bank (+21%)

- Fifth Third (+17%): benefiting from a focus on specific vertical markets, including the establishment of a new energy lending unit in late 2012. (See an EMI blog post from February 2013 on driving commercial loan growth through vertical industry targeting.)

- BB&T (+17%)

- KeyBank (+16%)

- Turning to small business loans, smaller banks with less than $1 billion in assets have a greater share of this market, accounting for 23% of all small business loans (compared to 11% of total loans). However, these banks trail the larger banks in terms of small business loan growth, and will need to reposition themselves (in areas like personal service and local presence) to capture a good share of any continued recovery in small business lending.

- The 20 banks with the largest small business loan portfolios grew their small business lending 4% y/y in 1Q13. Banks with above-average growth included:

- Ally (+44%)

- Wintrust (+14%)

- Huntington (+11%): has focused internal resources by making business loan commitments, as well as deploying additional small business bankers.

- TCF Bank (+11%)

- American Express (+9%): built on small business card lending.

See a recent EMI blog for examples of banks that are effectively marketing to their commercial banking clients and prospects.