Over the past six months, EMI has monitored new credit card launches by leading issuers and identified 10 trends.

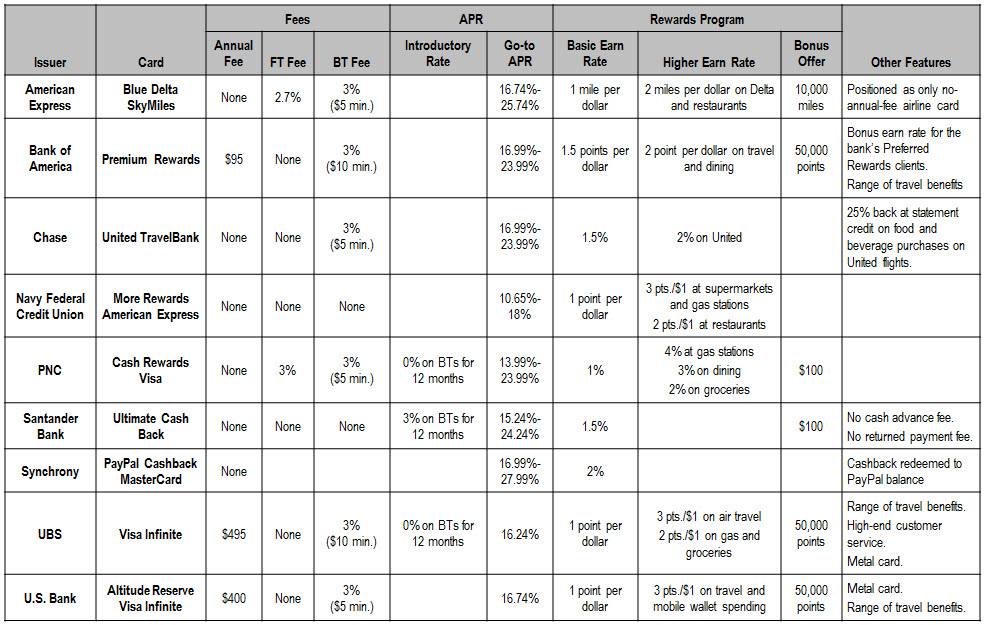

- Issuers are moving away from long-duration introductory rates on purchases and balance transfers (BTs), in particular on travel cards.

- A basic earn rate of more than 1% (or 1 mile/point per dollar) is common.

- Most cards are offering a higher earn rate for spending in specific categories.

- Bonus-earn categories tend to target travel, dining, gas station and supermarket spending.

- U.S. Bank Altitude Reserve Visa Infinite offers three points per dollar on mobile wallet spending.

- Issuers are not competing aggressively on APR.

- None of the cards had an APR below 10%; the lowest was the Navy FCU More Rewards American Express Card, with an APR range of 10.65%-18%.

- The two affluent cards with annual fees of $400+ (UBS Visa Infinite and U.S. Bank Altitude Reserve Visa Infinite) have a single APR.

- The two new affluent cards are metal.

- Many cards continue to promote acquisition-and-activation bonus offers

- Three premium cards (with annual fees) all offered 50,000 bonus points.

- Three other cards (with no annual fees) promoted bonus offers of 10,000 miles or $100.

- In a significant departure from the previous norm, two new no-annual-fee airline cards have been launched

- American Express launched Blue Delta SkyMiles.

- Chase introduced United TravelBank.

- For higher-end cards with annual fees, the robust travel benefits are emphasized over the rewards program as the core justification for the fees.

- No foreign transaction (FT) fees on travel cards is now becoming a standard feature.

- American Express remains an outlier, by continuing to apply a 2.7% FT fee on its travel cards.

- Most issuers continue to apply BT fees.

- However, Santander Bank’s Ultimate Cash Card is positioned as having no fees in multiple fee categories (annual, BT, cash advance, FT and returned payment).