Many banks are amping up their investment in content development. This is being driven by growing customer demand for financial advice, changing customer perceptions of financial providers and a need to differentiate from both established and new competitors.

Traditional content channels for banks include content-and-advice portals, surveys, blogs and newsletters. But it’s becoming obvious that banks looking to develop a robust and client-centric strategy are leveraging both established and emerging contact forms and channels – including videos, infographics, webinars, podcasts and of course social media platforms

– to meet customers’ changing consumption patterns.

Established Content Forms/Channels

Portals

Most leading banks provide portals that offer a combination of advice and content tailored to specific customer segments, such as:

- Small business banking (Wells Fargo Works for Small Business)

- Commercial banking (Key Corporate Knowledge Center)

- Consumer banking (Santander Bank’s Prosper and Thrive)

- Wealth management (J.P. Morgan’s The Know)

Recently, bank-wide portals, which are then categorized into various business segments, have started to appear. Examples include U.S. Bank’s Financial IQ and Regions Bank’s Insights.

Surveys

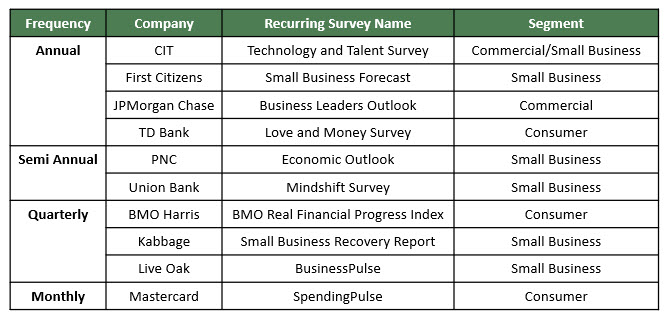

Banks have been using customer surveys for years to both gain insights into changing perceptions and behaviors, and to highlight the bank’s thought leadership in specific areas of the market. A growing trend is for banks to carry out recurring (annual, quarterly, monthly) surveys, which are designed to generate regular press coverage and ongoing customer engagement.

Newsletters

A number of banks have recurring newsletters that they either publish online or distribute via email to opted-in subscribers. Many of these newsletters are titled “Insights”, including Regions Bank’s Wealth Insights and Commercial Insights magazines, which reflect the content and branding on the bank’s Insights portal.

Blogs

Blogs are also well established. They tend to emphasize financial education and well-being, and often have appealing names, such as MoneyFit (BBVA), do it right (Ally) and MoneyLife (MoneyLion).

Emerging Content Forms/Channels

Banks are also starting to develop and promote content on emerging content channels, such as webinars, webcasts, podcasts, videos and social media.

Webinars and Webcasts

During the pandemic, as banks were unable to host live events, webinars and webcasts became a key channel to maintain customer and prospect engagement. These channels have been most prevalent in the commercial banking space with the rollouts of new webinar series by BMO Harris (Expert Conversations), JPMorgan Chase (Treasury & Technology Trends) and M&T Bank (Managing Through Challenging Times). In consumer banking, JPMorgan Chase launched the Chase Chats webcast series.

Podcasts

In the past year, many banks also developed podcast series – including Bank of America (Treasury Insights) and Regions (Commercial Insights) – for commercial banking clients.

Videos

Banks have been using video to spotlight local small business owners, while helping to promote the bank’s local connections. Examples include Huntington Bank’s Support Local video series featuring real small business owners and Webster Bank’s similar small business video series called The Moment.

Social Media Channels

Finally, banks are using their social media channels not only to promote content that is provided through other bank channels but also to present new content, which allows the bank to extend its reach to customers and prospects who might not use the other channels.

Key Takeaways

To develop a multifaceted content strategy, consider the following:

- Create a dedicated unit for continual content development, publication and promotion

- Understand target market content needs and consumption patterns

- Develop a consistent look-and-feel; create templates and guidelines to support seamless content provision

- Develop a communications plan to promote the value of content development to internal stakeholders

- Maintain ongoing customer engagement with recurring content (e.g., series of webinars, recurring surveys)

- Where appropriate, use the content as a prospecting tool by listing relevant executives (with titles, emails and direct phone numbers)

- Brand the content (e.g., give names to surveys, podcast/webinar series)

- Identify best practices within the banking industry and from other industry sectors

- Establish feedback channels to identify content needs and gaps