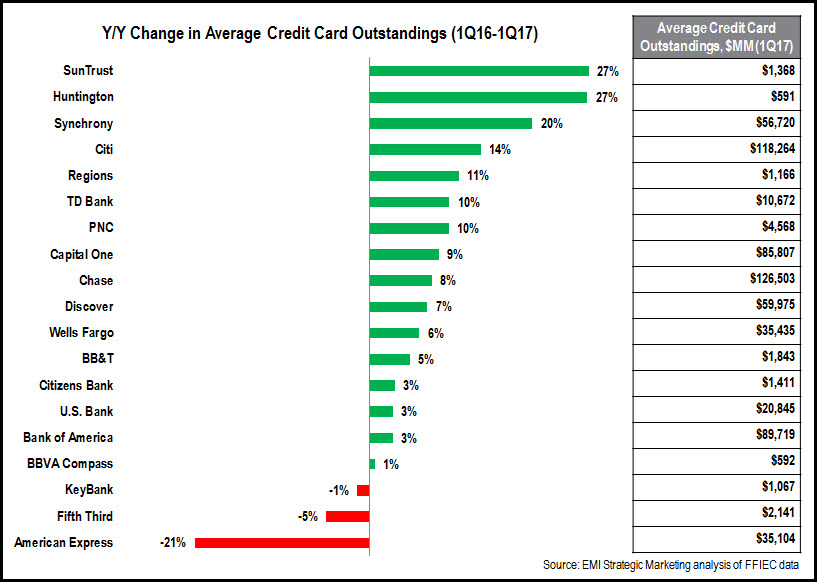

Most of the leading U.S. credit card issuers—portfolios of more than $500 million— reported y/y growth in their average credit card outstandings in the first quarter of 2017.

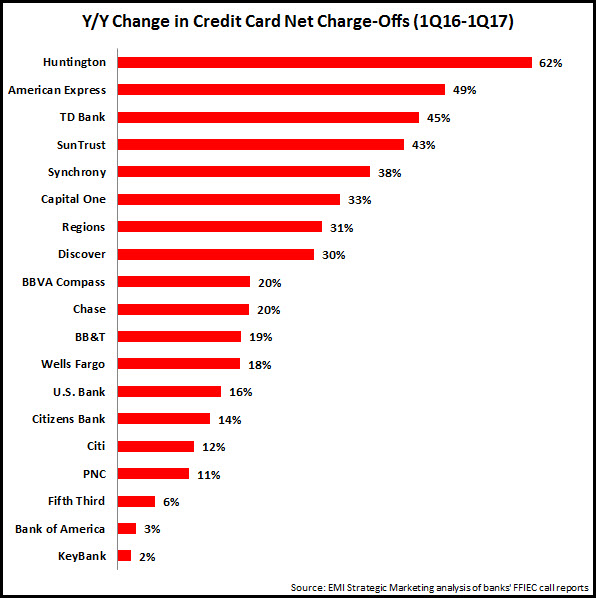

However, all of these issuers are also experiencing significant growth in credit card net charge-offs (gross charge-offs minus recoveries). Of the 19 issuers:

- 10 reported y/y charge-off increases of more than 20%.

- For 17, charge-off rises outpaced outstandings growth.

These recent significant increases in charge offs follow an extended period of declining charge-off rates in the aftermath of the 2008-9 Financial Crisis. During the 2010-2015 period, issuers tightened up their credit card underwriting considerably, and consumers moved away from racking up high levels of credit card debt. According to the FDIC, the credit card net charge-off rate fell from a recessionary high of more than 13% in 1Q10 to less than 3% in 3Q15. Since then, the rate rose slightly—to 3.16% in 4Q16—but still well below levels seen prior to the Financial Crisis. And five of the issuers in the chart above (Chase, Bank of America, Discover, BB&T and SunTrust) still had net charge-off rates of less than 3% in 1Q17.

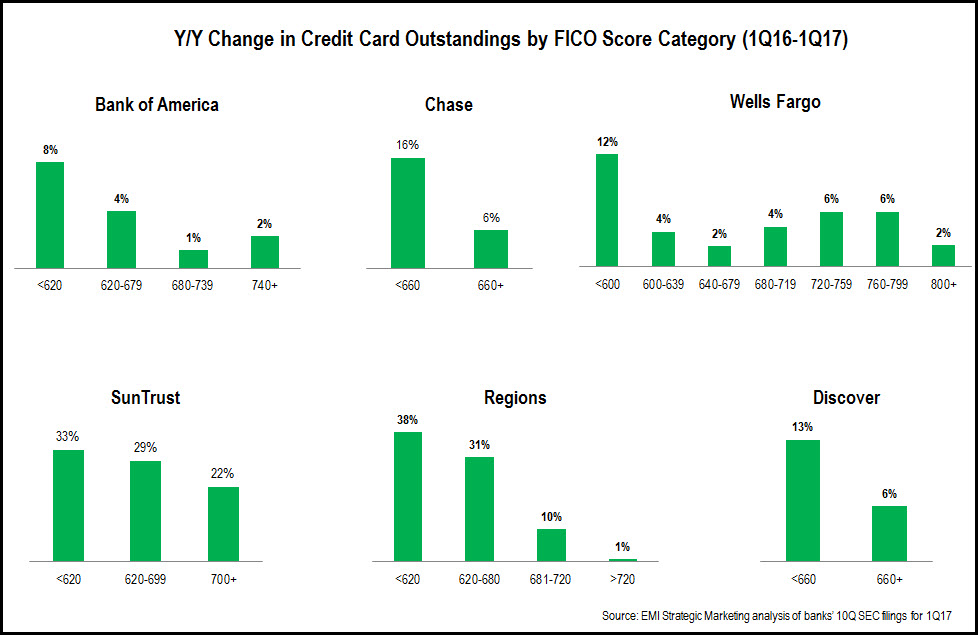

Even though current charge-off rates are low by historic averages, issuers must be careful not to allow charge-off momentum to grow to a problematic level. One area of potential concern: many leading credit card issuers are reporting strongest outstandings growth for their low FICO Score segments, which tend to have significantly higher credit risk profiles.

Of course, when focusing on growing credit card loans, issuers accept that charge offs will rise. However, they can help to ensure that these charge offs remain at a manageable level by:

- Maintaining underwriting discipline

- Avoiding a race to the bottom in credit card pricing; it’s notable that, according to CreditCards.com, the average credit card APR reached a record high of 15.80%)

- Providing content and tools to educate consumers on how to use credit cards responsibly

- Continuing to market credit cards as both payment tools and sources of credit