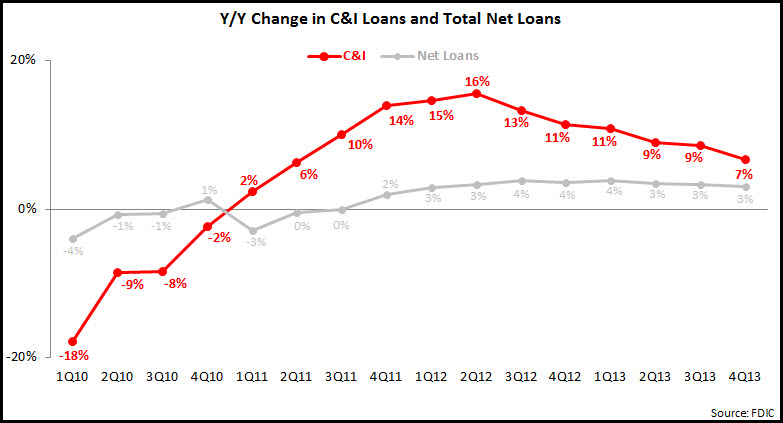

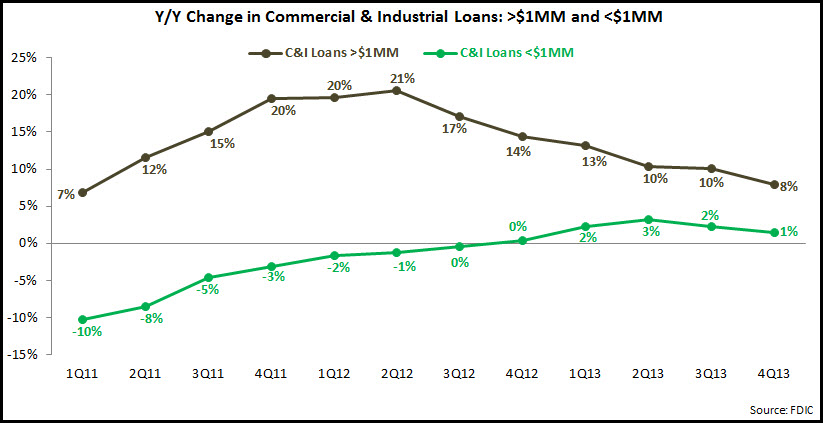

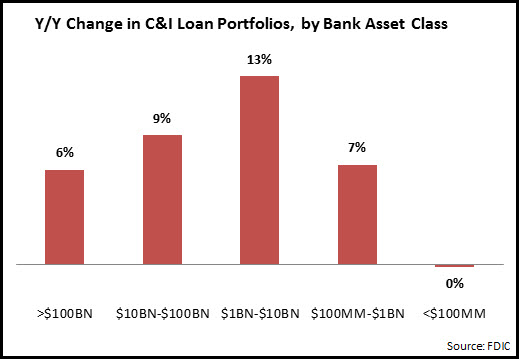

The growth rate in U.S. C&I loan portfolios has been decelerating in recent quarters (see EMI’s March 4th blog post). To buck this trend, banks are trying to identify and target vertical industries with significant growth potential and/or that have not been effectively targeted in the past.

The following charts show some industries where banks reported strong loan growth in 2013.

(The figures in parentheses show the index of industry-specific growth to overall commercial loan growth, with average growth = 100. For example, Fifth Third’s retail industry loan portfolio grew 26% between end-2012 and end-2013, which is almost five times higher than Fifth Third’s overall commercial loan growth of 5.4%.)

The following are some quick tips for banks to enhance their vertical industry targeting efforts:

The following are some quick tips for banks to enhance their vertical industry targeting efforts:

- Size the overall market within the bank’s footprint; identify clusters

- Assess industry health and growth potential by analyzing key performance metrics (e.g., gross output, profitability, business formation and survival rates, international trade volume)

- Identify unique financial needs, usage profiles and decision-making processes through a combination of primary and secondary research

- Develop targeted marketing campaigns, to include tailored content as well as investments in industry-specific media (events, trade publications, online and social media sites)

- Create, train and support dedicated industry teams; concentrate team deployment around clusters