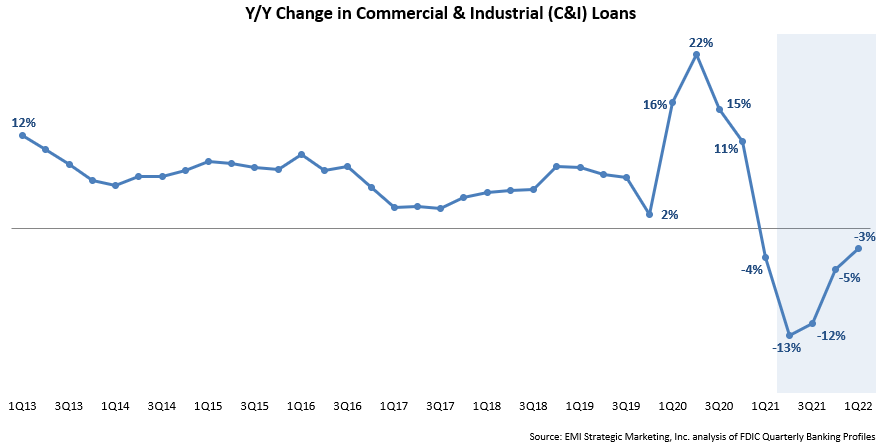

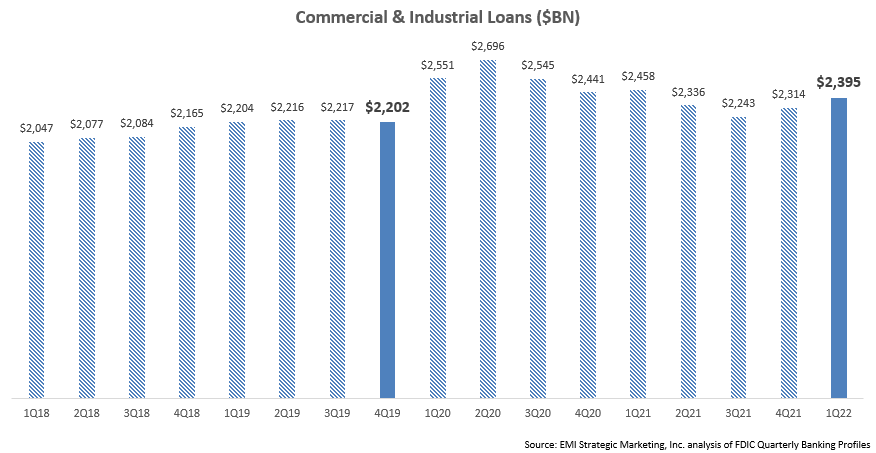

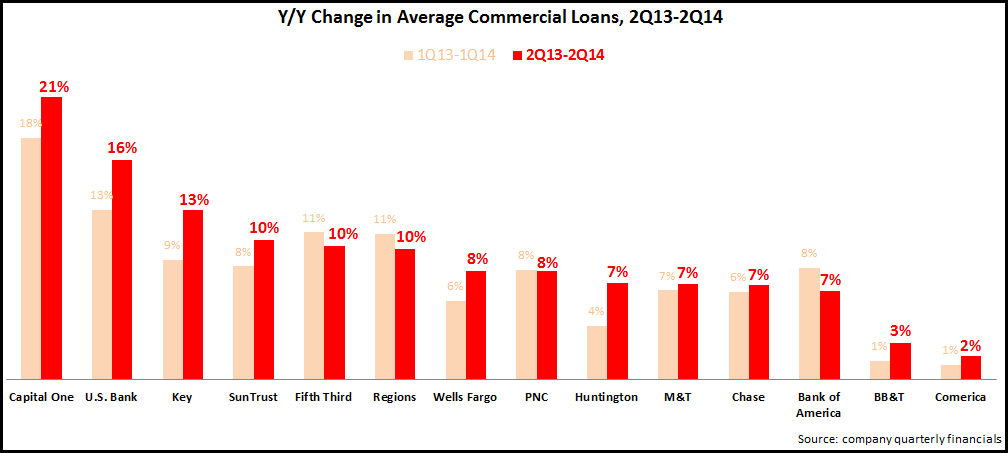

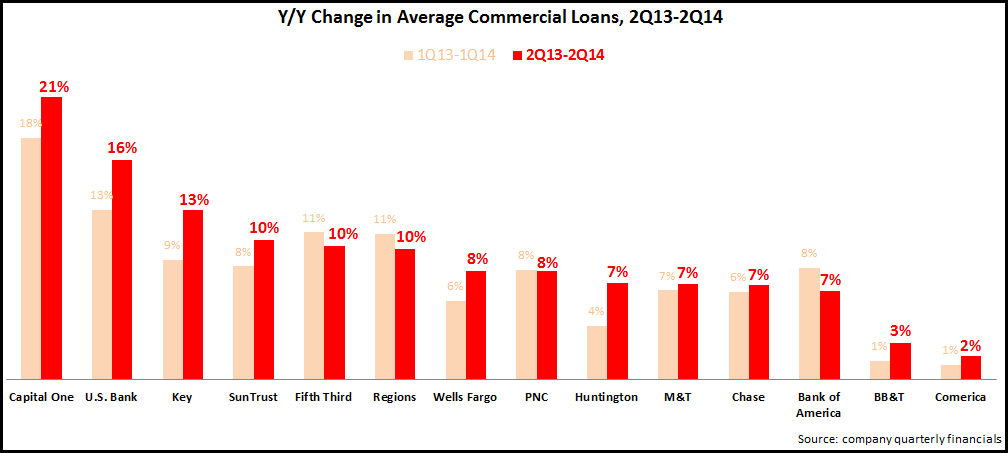

Strong growth in commercial lending for leading U.S. banks has offset declines in other loan categories in recent years, but coming into 2014, there was evidence that the rate of growth in commercial lending was tailing off. However, EMI’s analysis of second quarter 2014 financials for 14 leading banks shows that commercial loan growth remains robust. Average commercial loans rose 8.4% between 2Q13 and 2Q14, up from a 7.4% y/y growth rate in 1Q14.

10 of the 14 banks reported stronger y/y growth in 2Q14 compared to 1Q14. Most banks attributed the stronger growth to improved business confidence. Other factors that drove commercial loan growth included:

- Slow but steady growth in commercial loan utilization: for most banks, loan utilization is well below historic norms, but there has been a gradual improvement in this metric in recent quarters. Fifth Third reported that its commercial loan utilization rate rose from 30% in 1Q14 to 32% in 2Q14. Chase’s loan utilization grew three percentage points in the first half of 2014 to 33%, but this remains well below the 40% level that Chase considers to be the historic norm.

- Industry targeting propelling overall commercial loan growth. A number of leading banks attributed a significant part of their growth to their targeting of specific industry segments. Huntington Bank reported that half of its commercial loan growth came from targeted verticals. Comerica reported strong y/y growth in its technology and life sciences (+32%), as well as its energy (+10%) portfolios.

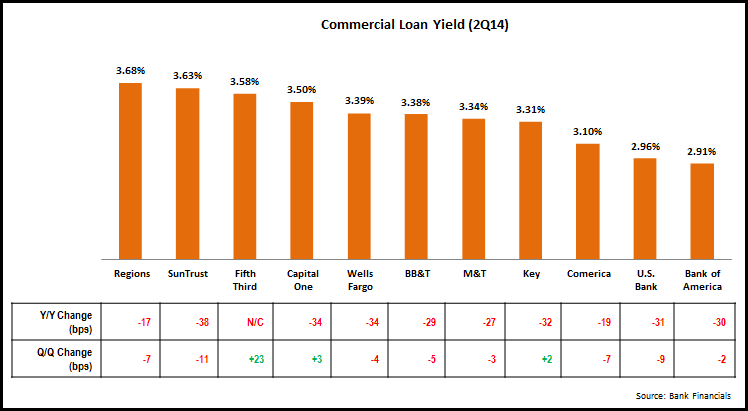

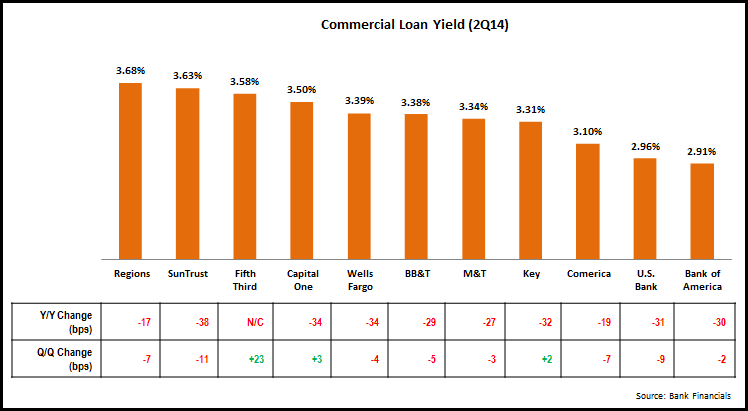

As banks have been pushing to grow their commercial loan portfolios in recent years, yields have been steadily decreasing. So, with banks continuing to report strong commercial loan growth in 2Q14, did loan yields continue to decline? The answer: yields continued to decline on a y/y basis for most banks, as the market remains very competitive. For the 11 leading banks in the chart below, 10 reported double-digit basis-point declines in commercial loan yields between 2Q13 and 2Q14. And two of the banks—U.S. Bank and Bank of America—now have yields below 3%. However, there are some signs that the decline in yields is beginning to taper off; three of the banks—Fifth Third, Capital One and Key—reported q/q increases in their commercial loan yields.

Assuming that economic growth and business confidence continue to grow, demand for commercial loans should also continue to remain robust. The following are four areas where banks should concentrate efforts in order to propel their commercial loan growth:

- Identify and target high-potential commercial segments. Banks need to look at both external and internal factors in identifying high-potential segments. The external factors include segment size and growth rates, as well as segment clusters within the bank’s commercial banking footprint. Internal factors include having the required in-house skills, experience and product solutions to effectively target these segments. Industry sector represents the most effective segmentation criterion, given the fact that companies within industries tend to have similar characteristics and needs. However, banks should also look to identify opportunities using other business segmentation criteria, such as ethnicity and gender.

- Develop consistent marketing for all commercial banking solutions. Due to their silo-ized structures and cultures, different groups within a commercial banking organization may develop their own marketing and sales communications, which can create confusion for clients. Banks should create an overall value proposition for their commercial banking operations, as well as guidelines for messaging and creative executions, to provide a unified face to the client.

- Capture cross-sell opportunities. Again due to their traditional structures and cultures, banks have often fallen short in developing synergies across business units and selling the entire bank to the customer. However, banks like Wells Fargo and Huntington have been steadily growing commercial cross-sell rates. Banks should build programs to grow referrals rates between different business units, and should incorporate both retention and cross-sell goals into commercial bankers’ compensation structures.

- Invest in Content marketing. In a world where we are overwhelmed with information, commercial clients will be attracted to a bank that can provide insights and advice on various topics. In developing content for commercial clients, the topics need to be of interest and importance to the client. They also need to be topics on which the bank can speak authoritatively. And lastly, banks need to take into account that the objective of content marketing is not to promote its products and solutions, but rather to position itself as a valuable source of intelligence and advice.