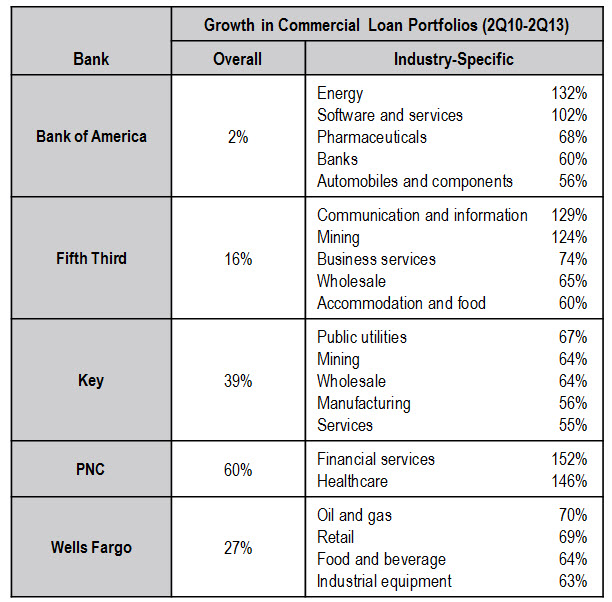

Over the past three years, the commercial sector has been the primary focus for bank loan growth efforts. In 2010 and 2011, strong commercial loan growth rates were generated as the economy recovered from the 2008-2009 financial crisis and subsequent recession. The commercial lending market started to get more competitive (as evident in declining yields), so many banks have turned to vertical industries to maintain and even accelerate commercial loan growth rates.

The following table summarizes vertical industry performance for some of the leading U.S. banks:

The following are 10 quick steps for banks to market effectively to specific vertical industries:

The following are 10 quick steps for banks to market effectively to specific vertical industries:

- Size the opportunity (industry size and growth rate)

- Profile the industry, covering growth prospects, key opportunities and threats, financial usage and needs, as well as the typical financial decision-making process

- Identify high-potential sub-sectors (with strong growth potential and unmet financial services needs)

- Identify industry clusters in particular geographies within in the bank’s footprint

- Analyze competitor industry-targeting initiatives

- Assess the bank’s current ability to meet customer’s financial needs; develop and implement strategies to fill product/service gaps in-house or via partnerships

- Develop a marketing plan around industry-specific media, such as trade publications, associations, events, and social media channels

- Deploy dedicated industry banking teams

- Create customized collateral and sales tools to support these teams

- Publish industry-specific content (videos, webinars, case studies, articles, newsletters, reports)