A review of various bank and credit card issuer presentations at the recent Barclays Global Financial Services conference revealed a number of trends that could have a significant impact on how credit cards are being marketed.

- Priority is cross-selling existing customers. Regional banks that have recently re-acquired their branded credit card portfolios (such as KeyBank and Huntington) are following the lead of Wells Fargo model, in cross-selling credit cards to existing customers (35% of Wells Fargo’s retail households have a Wells Fargo credit card).

- Regions Bank—which acquired its card portfolio two years ago—reported that its credit card penetration rate is now 13%, and it has ambitions to grow this to 20%. In addition, even issuers with a national credit card franchise are concentrating efforts on their own customer bases.

- U.S. Bank is increasingly focused on deepening customer relationships and has increased card penetration to 34%.

- And Bank of America claimed that 60% of new cards issued in the second quarter of 2013 were to existing customers.

- The online channel is now the most popular method for new account production. The popularity of the online channel for new cardholder acquisition is largely driven by its lower cost-per-acquisition relative to other channels, such as direct mail. It is also a by-product of consumers’ increased comfort with using electronic channels to manage their finances.

- American Express reported that more than 50% of card acquisition comes through online channels.

- 71% of Bank of America’s new U.S. consumers credit card accounts came from branch and online channels in 2Q13, compared to 57% in 2Q11.

- And these examples are consistent with recent data from Chase, who reported in 2Q13 that 53% of credit card accounts were acquired online.

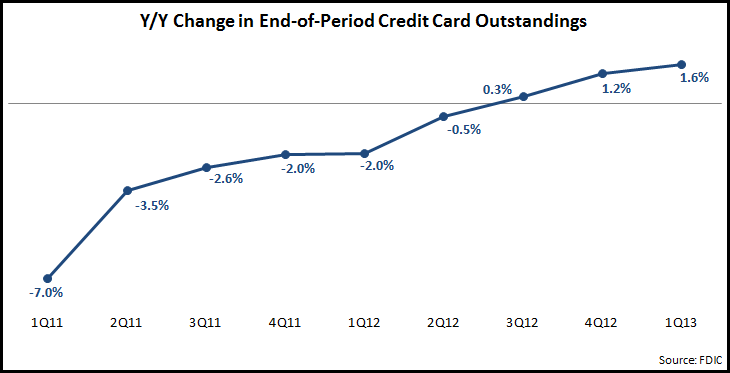

- Card issuance is growing.

- Bank of America claimed that its card issuance is at its highest level since 2008.

- This mirrors recent data from Experian, which found that overall bank card origination volume (based on credit issued) jumped 21% y/y to $69 billion in 2Q12, the highest level since the fourth quarter of 2008.

- Credit quality remains strong. Most issuers do not see any significant reversal in the continued downward trajectory in credit card charge-off and delinquency rates.

- The competitive battle is centered on rewards. Although most issuers now offer attractive teaser rates on their main cards, issuers are looking to differentiate and create a competitive advantage through their rewards programs.

- Discover said that “rewards is the new competitive landscape” and this realization influenced the launch of its Discover It card.

- U.S. Bank is looking to differentiate by taking its rewards program in-house, claiming that this will enable it improve redemption value, enhance the customer experience and customize rewards.