The NFIB recently published first-quarter 2012 data on U.S. commercial banks, which shows strong growth in commercial and industrial (C&I) lending, but continued decline in small business loan portfolios.

Overall, C&I loan portfolios at the end of 1Q 2012 were up 15% year-over-year (y/y). The growth was driven by the larger banks; banks with more than $1 billion in assets grew C&I loan portfolios rose 20%, while banks with less than $1 billion in assets increased C&I loans by just 2%. Most of the leading U.S. banks reported C&I loan growth rates of 20%+. American Express grew C&I loans 13%, indicating that its spend-centric approach is beginning to stimulate growth in business card outstandings. C&I growth was 2% between 4Q11 and 1Q12.

Small business loan portfolios (defined as C&I loans of less than $1 million) continued to decline, falling 1.6% y/y. However, banks with more than $10 billion in assets grew small business loans by 4.6%, indicating that these banks have increased their share of small business loans. However, the smaller community banks (with less than $100 million in assets) were the only bank-asset category to grow small business loans between end-4Q11 and end-1Q12.

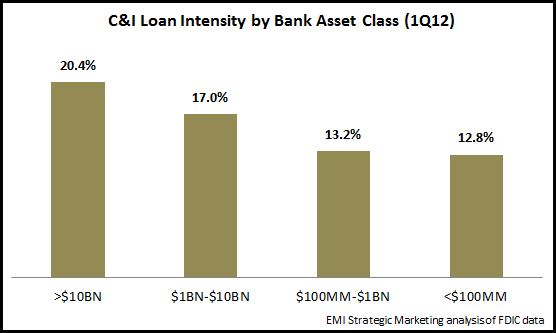

Our analysis also looked at loan intensity–C&I and small business loans’ share of overall bank loan portfolios. As expected, the larger banks have a higher C&I loan intensity, with this ratio declining steadily for smaller bank-asset categories.

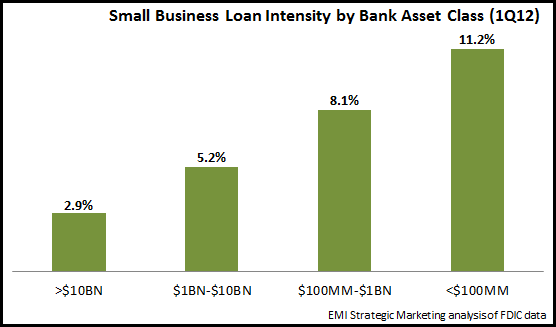

For small business loan intensity, we see the opposite trend. Smaller banks tend to have highest ratio of small business loans to total net loans, underscoring the importance of small business relationships to community banks.