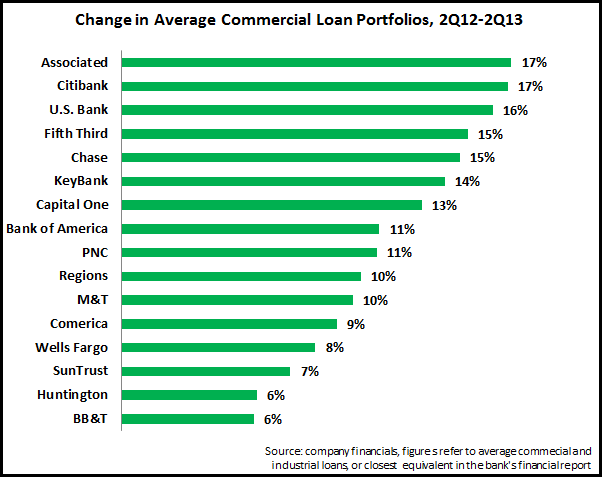

Second quarter 2013 financials for leading U.S. banks reveal continued strong growth in their commercial loan portfolios. The chart below shows that 11 of 16 banks studied reported double-digit growth rates, with an average increase of 11%. And most of the banks reported very strong commercial pipelines in the second quarter.

Some of this growth can be attributed to improved confidence among U.S. firms. In addition, banks are generating strong growth rates by targeting specific vertical industries that have high-growth potential and/or have been traditionally underserved by banks. These large U.S. banks can assign dedicated teams and create customized campaigns for different industries, which creates a competitive advantage over smaller banks who lack the necessary scale to justify this incremental sales and marketing investment.

However, increased competition in the commercial lending market (particularly in the general middle market sector) is contributing to declines in yields; each of the leading banks in the chart above who included commercial loan yield data in their 2Q13 financials, reports a significant y/y decline. On the other hand, commercial loan net charge-off rates are both lower than consumer loan charge-off rates and in many cases have fallen significantly over the past year.

In this high-potential, but increasingly competitive, commercial lending and banking environment, banks need to effectively direct their sales and marketing budgets to initiatives that can both continue to drive customer acquisition as well as optimize existing customer relationships. Initiatives include:

- Targeting: identify industry segments or geographic markets with strong commercial loan potential. Allocate sales and marketing resources based on market opportunity, competitive intensity, as well as the bank’s own strengths in these markets.

- Customer relationship optimization: leverage the full power of the bank by working with other units to generate customer referral and cross-sell streams.

- Performance benchmarking: assess commercial banking performance throughout the bank’s footprint. Diagnose reasons for the over- or under-performance of particular groups. Apply these insights to develop programs to raise overall performance.

- Loan usage stimulation: develop messaging to drive commercial loan utilization rates, which are currently low by historical standards.

- Content development: develop and deliver content that provides answers to customers’ financial needs and position the bank as a trusted financial advisor. Ensure the content addresses the different business and financial challenges of various targeted segments. Distribute the content through multiple delivery channels to reflect changes in how content is now consumed.

- Sales tool creation: Invest in sales force automation, sales support tools and training to ensure that commercial prospects are moved seamlessly through the sales funnel and generate a strong conversion rate.

-

Customer outreach: develop customer communications to support ensure that relationship managers proactively engage with customers on a regular basis, but in particular at critical stages of the customer life cycle (for example, during the first 90 days)

-

Inbound communications capture: provide a range of options for customers to contact the bank, and direct these customer queries to the most appropriate bank unit or individual.