A recent EMI blog post highlighted commercial loan portfolio trends in the third quarter 2012 financial results for leading U.S. banks. Building on this, EMI analyzed recently-published FDIC data to gain insights into commercial loan portfolio trends for all U.S. banks:

- Larger banks are generating stronger C&I loan growth than smaller banks. According to the FDIC, total C&I loans rose 15% between end-3Q11 and end-3Q12. Banks with more than $1 billion in assets increased C&I loans by 16%. Banks with less than $1 billion in assets grew C&I loans by only 3% (banks with less than $100MM in assets actually reported a 1% decline in C&I loans).

- Larger banks have a higher C&I loan concentration. C&I loans account for 20% of total U.S. bank net loans. Not surprisingly, C&I loan concentrations are higher in banks with more than $1 billion in assets (21%) than in banks with less than $1 billion in assets (13%).

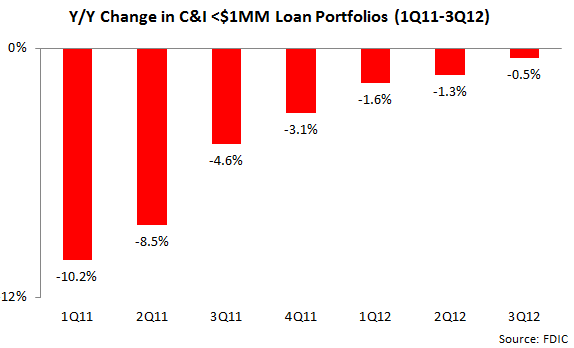

- Declines in small business loan portfolios are starting to bottom out. Small business loan portfolios (defined as C&I loans of less than $1 million) fell by 0.5% in the year to end-3Q12. However, the rate of decline has been slowing, as originations/renewals start to catch up with charge-offs/expirations.