After analyzing the 2Q13 financial results for the leading U.S. credit card issuers, EMI has identified some common themes and emerging trends.

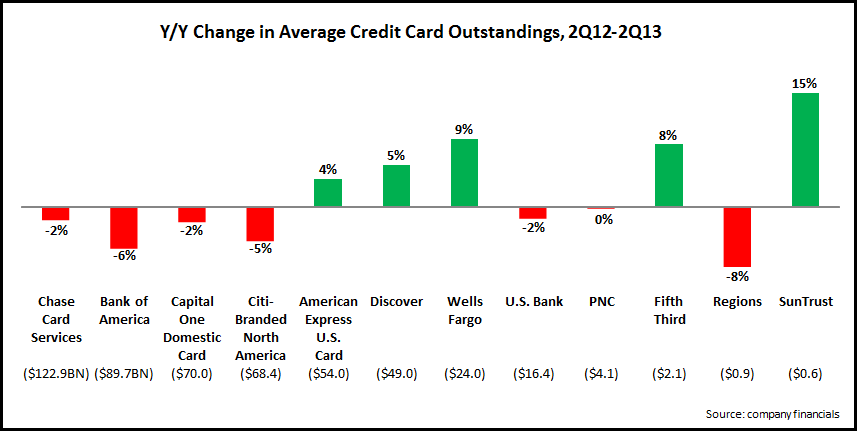

- Outstandings: At first glance, the continued decline in outstandings for the top issuers is consistent with trends we have seen in recent years. However, some of these issuers stated their belief that this extended sequence of declines is coming to an end. Chase claimed that its credit card outstandings have reach an inflection point and it expects growth in the coming quarters. Bank of America also emphasized signs of recent outstandings growth, and claimed that card issuance was at its highest level since 2008. During the quarter, strongest growth rates were reported by monolines and regional banks, but these smaller issuers may face renewed competition from the top issuers in the coming quarters. Some issuers reported yield declines in 2Q13, with Discover attributing a 24 basis point yield decline over the past year to an increase in promotional rate balances and a decline in higher rate balances.

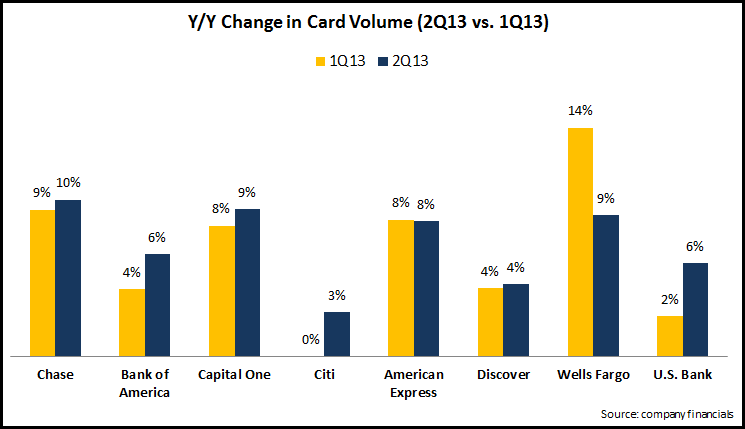

- Volume: Many of the leading issuers improved their card volume growth rates in the second quarter, as the economy continued to recovery, and as consumers responded to rewards-based promotions. In the coming quarters, expect issuers to continue to promote their rewards programs (in particular to attract more affluent cardholders), while increasing their focus on introductory offers and APRs as they seek to grow loans.

- Revenue: In recent years, credit card revenue growth has been anemic, as issuers have struggled with loan growth, and have had to adjust to new fee structures following the CARD Act. However, the latest financials provided some encouraging news. American Express grew net interest income 6% y/y (benefitting from a 4% rise in outstandings) while its noninterest income rose 5% (driven by an 8% rise in volume). Discover generated even stronger growth in both net interest income (+9%) and noninterest income (+14%). Given the fundamental changes to the card industry in recent years, expect issuers to continue to seek balanced overall revenue growth between net interest income and noninterest income, and avoid an over-dependence on either aggressive lending or fees to meet their revenue targets.

- Charge-Off and Delinquency Rates: Issuers continue to benefit from declines in charge-off rates. Of the 11 leading issuers who reported charge-off rates, 8 reported y/y declines, while one issuer was unchanged. Two issuers (American Express and Discover) had charge-off rates below 3%, while 5 other issuers (Chase, Citi, Fifth Third, PNC and Wells Fargo) had rates below 4%. In addition, 30+ day delinquency rates also continue to decline, with 8 of 9 issuers reporting y/y declines (the exception was Capital One, due to its acquisition of the HSBC portfolio).

Looking ahead, to the extent that issuers focus on outstandings growth (with more aggressive introductory offers on balance transfers, lower APRs and more relaxed underwriting standards), both charge-off and delinquency rates should rise from their current low levels. However, recent trends in outstandings and volume indicate that consumers increasingly see their credit cards as an efficient, convenient and more rewarding payment method, and less simply as an easy source of credit. Whether this is a temporary phenomenon in the aftermath of the financial crisis or a long-term change has profound consequences for how credit cards are positioned, promoted and priced.

Subscribe