As consumers turn to digital banking channels for everyday banking – and for an increasing range of more complex banking interactions – the battle between digital challengers looking to enter and grab a share of the market and traditional banks seeking to optimize customer retention and engagement has intensified. With this in mind, the following are five key trends that emerged in the digital banking space during the 3rd quarter:

- Existing digital challengers are expanding their product portfolios and raising funding for further growth.

- Established digital banks are continuing to report strong customer growth. They are looking to enhance existing customer relationships by introducing new products.

- New product launches during the quarter included Acorns Early Smart Deposit; the Albert Cash checking account; a checking account and mobile app from Atmos Financial; the Douugh Wealth robo-advisor; as well as an instant payments feature from gohenry.

- Digital banks who raised funding in 3Q21 included Revolut and Varo (raised $510 million, valuing the company at $2.5 billion).

- New digital challengers are emerging. With relatively low barriers to entry, new digital banks continue to emerge, with many targeting specific market niches, such as the recent launch of Nerve, a challenger bank for musicians.

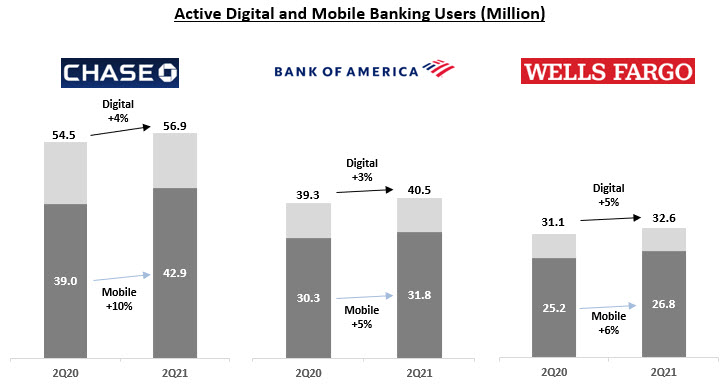

- Traditional banks are investing to build strong digital engagement. Banks have responded to the challenge posed by digital challengers by directing increased resources to develop features and tools that enhance the digital experience. To show progress on this, many banks are now publishing metrics not only on (digital/mobile) usage, but also on growing digital engagement:

- Bank of America reported Zelle P2P payment users rose 24% y/y to 15.1 million in 3Q21 and Zelle payment volume jumped by 54% to $60 billion.

- U.S. Bank reported that digital transactions accounted for 80% of total transactions in 3Q21, up from 67% in 3Q19.

- Huntington Bank reported that digitally-assisted mortgage applications accounted for 96% of total mortgage applications in 3Q21, up from just 9% in 3Q20.

- Traditional banks are developing their own digital banks. While many traditional banks are competing with digital challengers by enhancing their digital banking functionality, some are going further by

- Launching standalone digital banks: Cambridge Bank launched Ivy Bank, a digital-only division.

- Adding products to the digital bank’s offering: Citizens Access, Citizens’ national digital bank, is planning to introduce mortgage lending and student refinance by the end of 2021, as well as checking, home equity, credit card and wealth in 2022.

- Traditional banks remain committed to the digital-human channel model. Many banks have realized that the broad transition to digital channels for everyday banking transactions means that they can continue to serve a market with a less dense branch presence, so are cutting branches in existing markets. However, their continued reliance on branches is seen is the fact that many are opening branches in de novo markets (JPMorgan Chase is halfway through a plan to open 400 new branches by the end of 2022). Banks are also redesigning branches in existing markets to reposition them to take on new roles (e.g., advisory centers, brand beacons, community hubs, locations to showcase new innovations).