(The blog was originally posted in April 2021, and updated in July 2021.)

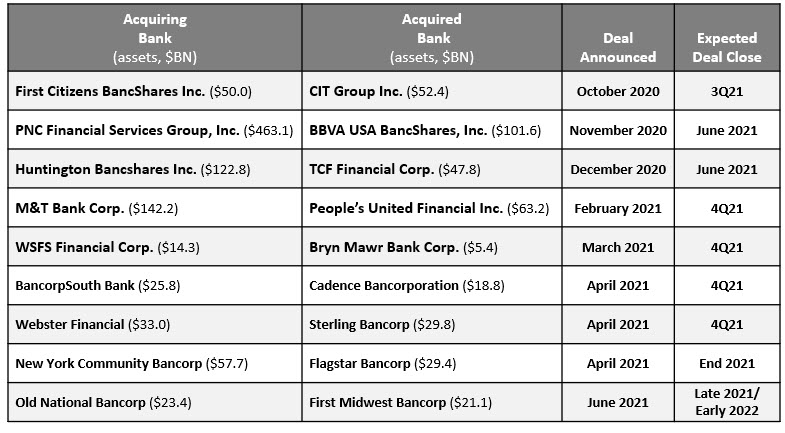

In recent months, there has been a series of significant U.S. bank M&A deals:

There has also been a regular stream of smaller bank acquisitions. Deals announced in recent weeks include:

- Valley National Bancorp ($41.2 billion in assets) and Westchester Bank Holding Corp. ($1.3 billion)

- SouthState Corp. ($40.4 billion) and Atlantic Capital Bancshares ($3.8 billion)

- FNB Corp ($38.4 billion) and Howard Bancorp ($2.6 billion)

- United Community Banks ($18.6 billion) and Aquesta Financial Holdings ($752 million)

- Columbia Banking System ($17.3 billion) and Bank of Commerce ($1.8 billion)

In addition, banks are not just acquiring other banks in their entirety, but are also acquiring financial assets to plug gaps in their geographic reach or product portfolios. Recent examples:

- In May 2021, Citizens Financial announced the acquisition of HSBC’s East Coast branch network as well as its national online deposit business.

- In June, Regions Bank announced the acquisition of EnerBank USA, a home improvement lender.

We expect M&A activity to remain elevated throughout 2021, driven by the following factors:

- The disruption in normal M&A activity in 2020 due to the COVID-19 pandemic likely means that potential deals put on ice over the past 12 months may come back to the fore.

- Multiple industry surveys show a strong appetite for bank deals.

- The current very-low interest rates will hinder organic growth opportunities.

- Regional banks want to build scale to compete with the super-regional and national banks.

- Acquisitions can help banks fill gaps in their product portfolio.

- Banks are also interested in divesting units that they do not consider to be part of their core operations, and these units may be attractive to other banks looking to expand in these areas.

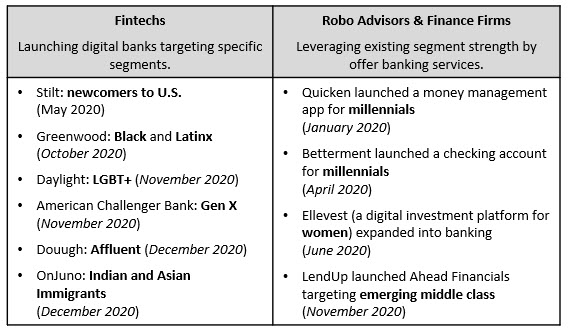

- The potential for more deals between banks and fintechs is great, as banks look to build their digital capabilities, and fintechs look to grow their banking operations.

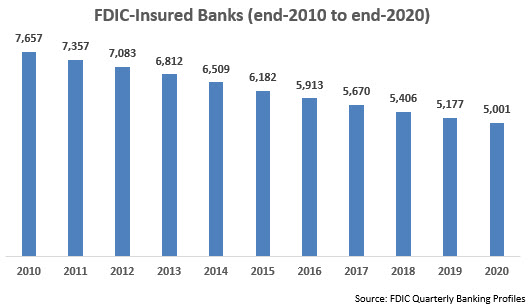

- There has been a long-term trend of bank consolidation. Although the number of U.S. banks has declined by 35% over the past decade, there is a broad consensus that there are still too many banks in the U.S.

In announcing their deals, bank have been highlighting a number of potential benefits and opportunities. The following are some key areas where marketing departments will play a crucial role to turn this potential into reality:

- Auditing of Marketing Assets…Including Personnel. Banks should conduct detailed audits to identify each bank’s relative strengths in various marketing categories (e.g., a legacy bank might be strong in content generation and social media, but weak in advertising campaigns and branch merchandise). It is also important to assess each marketing department’s levels of expertise and experience.

- Brand and Logo. The first question for marketing to address: what is the brand post-merger? Most mergers simply use the acquiring bank’s brand, but there are situations where the acquired bank has stronger brand equity. And there also also examples of merging banks creating a new brand (e.g., BB&T and SunTrust merging to form Truist).

- Positioning and Value Proposition. The merged bank’s marketing team will need to develop new positioning, value proposition and messaging that not only encapsulate the combined bank’s new identity and priorities, but that also aim to recognize the heritage of each bank.

- Customer Migration. One of greatest threats to a successful bank merger is the disruption and potential attrition in migrating clients to the new bank (with clients dealing with potential unfamiliar platforms, processes and personnel). To optimize retention, marketing needs to conduct a comprehensive audit of all customer touchpoints and develop a detailed plan to update all customer-facing systems, processes and correspondence.

- Branch Rationalization (and Investment). Bank mergers typically have specific cost-cutting objectives, and branch closures are one way to help achieve this objective, by eliminating overlapping branches and reducing branch density. However, the branch network will continues to perform key roles for bank in service, sales and marketing. The merger provides a perfect opportunity for banks to reposition, redesign and re-equip branches to perform these roles into the future.

In summary, marketing plays a critical role in ensuring the ultimate success of any bank merger. Furthermore, the head of marketing/CMO should have significant input into the merger process, both pre- and post-merger.