As banks look at their advertising marketing spending, they are impacted by a number of different forces. On one hand, they are under pressure to reduce expenses in the absence of strong revenue growth. On the other, there are some signs of economic recovery (although dangers remain), as well as growing consumer and business confidence. If this confidence translates into growing demand for financial services, banks will want to be in a position to benefit from this market growth, and so will seek to grow their marketing investment. Another key issue for banks is how they direct their advertising/marketing spending, given the ongoing demise of traditional marketing categories, such as print, and the emergence of new media.

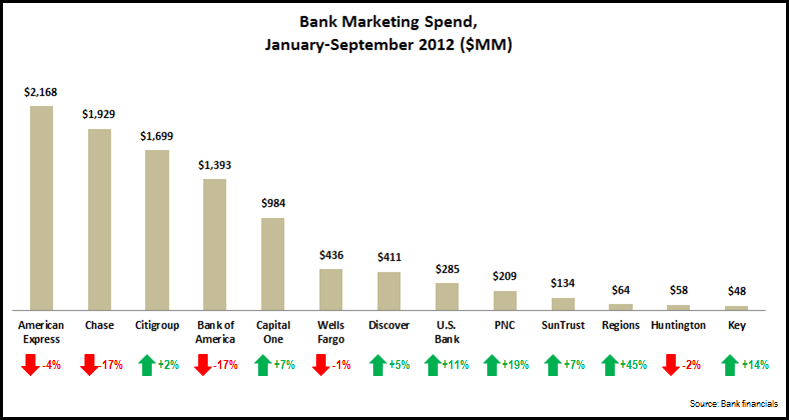

With these issues in mind, EMI Strategic Marketing studied marketing spend levels for 13 leading banks for the first 9 months of 2012, relative to the same period in 2011. Ours analysis reveals that:

- Overall marketing spend fell 5% y/y.

- 5 banks reduced spending, but, significantly, these included 4 of the top 6 banks.

- The largest percentage declines were reported by Chase and Bank of America, who both decreased spending 17%.

- Chase had the largest dollar decline, reducing spend by $400 million. However, it is notable that Chase’s 2012 decline follows a 77% rise in marketing spend between 2009 and 2011.

- Among the 8 banks increasing spending are:

- Regional banks PNC, Regions and KeyBank, who grew marketing spend by double-digit rates.

- Capital One, which has traditionally been a heavy advertiser, but dramatically scaled back its spending significantly in the wake of the financial crisis. Since then, it has gradually returned its advertising spend to pre-financial crisis levels.