Sometimes marketing inspiration and confirmation of instincts comes from places you wouldn’t normally look. This recent blog post on getelastic.com is case in point: http://www.getelastic.com/the-easiest-way-to-increase-conversion-by-20/. On the face of it, this post would seem to be quite far afield from the world of customer retention in B2B software, or any of the other B2B industries in which EMI works for that matter. And indeed there isn’t much that links lip gloss and software; but there is a link in the approach to solving marketing challenges.

The getelastic blog post starts off with a research-based data point: ecommerce customers are 20% more likely to purchase a product that has at least one customer review. Then, based on that data point, it presents several reasonable ways to obtain that key *first* review. The ways to do this are only important if you’re interested in driving web purchases. What’s important outside that context – and especially in a B2B context like CSM strategy for SaaS – is the way in which marketing research and analytics have identified an operational measure which becomes the strategic focus. Increasing web sales is obviously the business goal, but it’s so broad and influenced by so many factors that it’s unwieldy as an operational focus. By isolating one key factor that has a significant impact on the objective, exploration and testing of tactical options becomes significantly easier. In mathematical terms, you solve for “reviews” because you know that it will drive conversions.

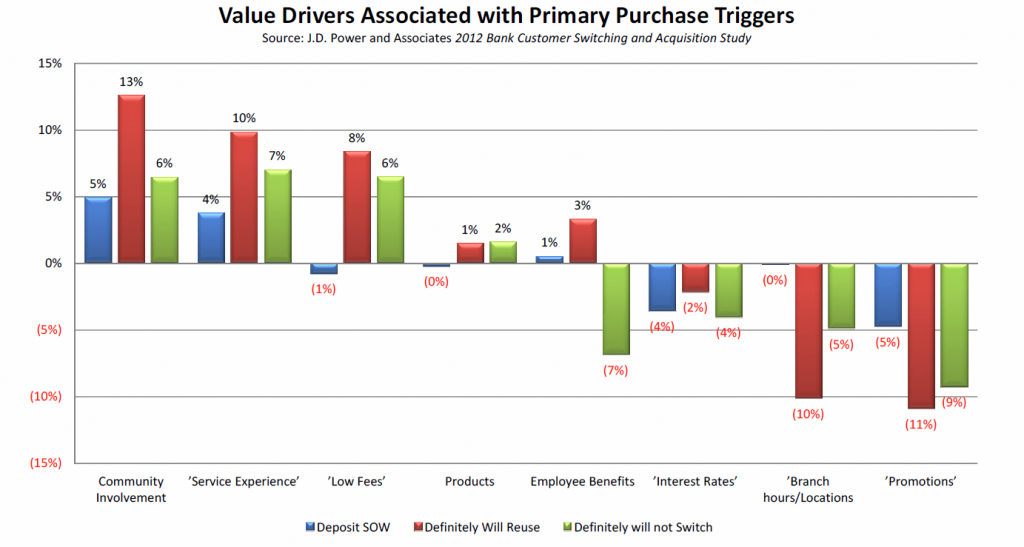

Take this approach out of the world of online sales of lip gloss and into the world of B2B software customer retention and it is still just as effective. Retention is impacted by a multitude of factors –satisfaction, perceived value, switching costs, depth and breadth of utilization – each of which can be affected by a set of strategies and tactics. To optimize retention, you must first sift through all the potential factors to identify those that actually have the greatest impact. Once you have effectively ranked the factors based on their likely impact, then you can develop retention marketing strategies – new communications approaches, new messaging, testing – that specifically and precisely aim to drive improvement in that factor.