In a previous post reviewing some of the data from the Pacific Crest SaaS company survey, we highlighted some of the sales and marketing strategies that distinguished higher growth companies from their slower-growing peers. This time, we’ll look at other data from the survey that reveals that for all SaaS companies, there are significant areas of missed opportunity.

The chart below speaks to the ability – or inability – of SaaS companies to upsell existing customers.

Across the entire sample population, the mean percentage of new annual contract value dollars coming from upselling existing customers is only 19%. Larger companies (20%) are no better than small companies (23%) who are themselves not much better than mid-size companies. With a business model that depends on future revenues to payback initial sales and service costs, there seems to be a significant missed opportunity for maximizing lifetime customer value. In addition to needing that upsell revenue to maximize profits, SaaS companies have a wealth of usage data that can and should be used to target upsell offers based on actual customer behavior.

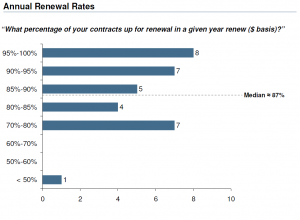

The next chart, which shows the distribution of respondents based on contract renewal percentage, also points to missed opportunities for maximizing lifetime customer value.

While this data isn’t segmented by size or growth attributes, the sheer fact that fewer than half the respondents achieve a 90% or greater renewal rate – and that 25% don’t even reach 80% – suggests a widespread lack of execution. Often, sales and service efforts are entirely focused on closing the deal and getting the customer up and running; ongoing support, nurturing, and engagement are neglected. To help correct this neglect, consider a service like Totango, which enable SaaS companies to monitor usage behavior and thus identify underutilization (which can lead to a lack of value recognition on the customer’s part at renewal time). Then create email campaigns that target the areas of underutilization with news about training and support options. Greater utilization leads to greater value recognition, which should have a significant positive impact on renewal rates.