How often has a high-performing salesperson been criticized for making too many prospecting calls? Most likely: almost never.

More importantly, how often has that same high-performing salesperson criticized themselves for too much prospecting and vowed to change their ways? That one is easy: NEVER.

And yet at EMI, we constantly talk to marketers who insist that they must self-regulate email deployment volume to avoid turning customers off, even if the emails are performing well. The marketers usually make one of the following arguments to justify this self-imposed limitation:

- “I hate getting too many emails.” This is about marketers projecting their own sensitivity and distaste for receiving too many emails onto customers.

- “We need to manage our long-term customer relationships.” This is about marketers wanting to be viewed as strategic players, not tactical executors.

Unfortunately, neither of these arguments holds up to scrutiny, leaving marketers to impair the role of emails – like the sales unicorn imagined at the beginning of this article – by curtailing their activity despite strong results. So here are five counter arguments against the case for establishing email volume limits:

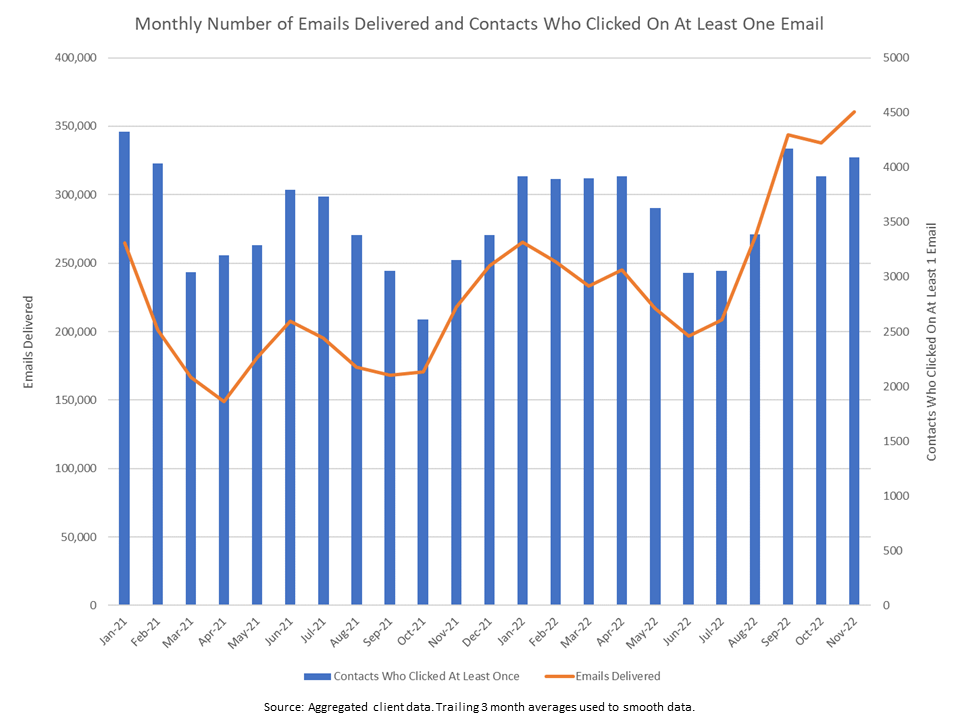

- It’s not based on data. It’s true that some email marketers make a volume limiting decision based on data analysis, though in our experience that is a rare breed – especially in B2B. The chart below shows a sample of the data we’ve collected in our work with clients. As you can see from the chart, it’s almost always the case that when you send more emails, you get more people to click. Setting aside the two arguments above, it should make intuitive sense that more emails delivered means more chances to see your emails and decide to click…and this chart supports that intuition.

- Your customers don’t actually pay as much attention to your emails as you do. You strategize, design, write, code and test every email that you send and are therefore intimately acquainted with and invested in each one. Your customers? Not so much. Most probably couldn’t accurately state how many emails you send because they get so many emails from so many companies that no one company stands out.

- People are busy and your emails aren’t really that important to them. You need to believe that every email you send is fantastic – well-written, solution-oriented, delivering valuable insights – and hopefully most are. But just because an email is worthy of attention doesn’t mean it will always get it, even from individuals who might have an interest. Your email is competing with the 1,000 other emails in their inbox, some from managers or customers about urgent business issues that will always take priority. In other words, an Open Rate of less than 100% is not a condemnation of your email quality or your email volume.

- Most of the time, it’s a question of quality, not quantity. Know when it’s annoying to get a lot of emails? It’s when the emails are a waste of the reader’s time: light on anything helpful or useful or interesting. If you’re sending out good content in well-constructed emails, there’s not much for your audience to complain about.

- You don’t get rewarded for not sending emails. Just like salespeople would never close a deal by NOT reaching out to a prospect, marketers will never drive awareness, interest or decisions by NOT sending emails. Nor will prospects remember that you haven’t sent them as many emails (see points 2 and 3 above) as your competitors. Mostly what they’ll do is not think about you or the solutions you offer.

The arguments supporting a self-imposed volume limit are seductive and, at their core, have good intentions – treat customers the way you’d want to be treated, respect their time and attention, only communicate when you have something important to say. What volume limits don’t recognize is that no company communicates with customers in a vacuum: every minute of every day marketers are competing for the attention of customers and prospects along with hundreds or thousands of other companies and internal demands. While it may seem like limiting email volume is a noble decision that reflects a customer-first attitude, the harsh reality is that when it comes to email marketing, nice marketers finish last.