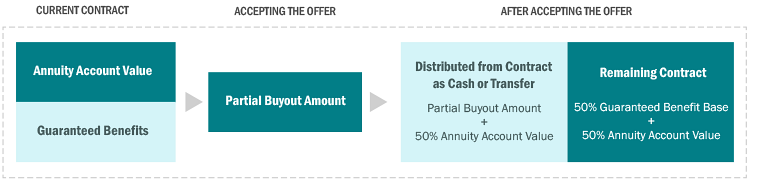

About the Partial Buyout Option

AXA Equitable developed the Partial Buyout Option for those who wish to retain a portion of their guaranteed benefits but still gain immediate access to a portion of their financial assets. Specifically, the contract holder would take 50% of the annuity account value from the contract (minus applicable prorated charges for the guaranteed benefits), together with the Partial Buyout offer amount, as a cash payment or transfer or exchange it to another financial product of their choice. In return, the current guaranteed benefit base would be reduced by 50%. The remaining 50% of the annuity account value would remain in the contract.

- The "Partial Buyout Offer Amount + 50% Annuity Account Value" must be taken immediately as cash or transferred to another financial product.

- Applicable prorated charges for the guaranteed benefits will be deducted from the annuity account value at the time of acceptance.

How the Partial Buyout Option works

If a client accepts this offer, AXA Equitable will:

- Reduce the GMIB and GMDB and standard death benefit (and EEB, if applicable) by 50%.

- Reduce the annuity account value by 50%.

- Distribute the offer amount plus 50% of the account value (minus 50% of any applicable charges for the guaranteed benefits) to your client as cash. It can also be exchanged or transferred to another financial product of their choosing, per the instructions detailed on the Acceptance Form.

Bear in mind, acceptance cannot be revoked once we’ve processed it.

With this option, your client must indicate on the acceptance form whether they wish to withdraw the offer amount plus the account value in cash, or exchange/transfer it to another financial product.

Evaluating the offer

This offer can be a great opportunity to meet with your clients, reevaluate their retirement income strategies, and reinforce your value as a trusted advisor. To help them navigate this very personal decision, consider the following reasons for which a client may or may not accept the offer.

Reasons for accepting the Partial Buyout Option

- Your clients need cash now, and the Partial Buyout offer is sufficient to cover this need.

- They still wish to retain some of the guaranteed minimum death benefit (and if applicable, its full roll-up rate) for their beneficiary(ies).

- They still wish to retain some of the guaranteed minimum income benefit (and its full roll-up rate) to fund or supplement their retirement income.

- They want to keep some of the guaranteed benefits, but also want the flexibility to transfer or exchange assets to another financial product that may be better suited to their new goals.

Reasons for not accepting the offer

- Their circumstances have not changed since they purchased the original contract, and the reasons that led them to select these guaranteed benefits are still applicable.

- They have no immediate need for cash and no desire to move their assets to another financial product.

- They are relying on the full guaranteed minimum income benefit to fund their retirement.

- They want to leave the full guaranteed minimum death benefit to their beneficiary(ies).

Other important considerations

There are a number of other personal questions that you and your clients should consider as you evaluate the offers.

- Do they expect to keep their contract long enough and live long enough to take full advantage of the guaranteed minimum income benefit?

- Is it still important to your client to bequest a guaranteed minimum death benefit?

- How likely is it that they will change their mind? Guaranteed benefits cannot be reinstated once the offer has been accepted. AXA Equitable may or may not make offers like this in the future.

- How do they expect the market to perform in the future?

- What are the tax implications of accepting this offer?

Options for clients who accept

Clients choosing to accept the Partial Buyout Option would keep 50% of their account value in the contract. The other 50% plus the offer amount must be taken out either as cash, or transferred or exchanged to another financial product. In order for AXA Equitable to properly process the Acceptance Form, clients must specify their preferred payment method on the Form.

This is an opportunity for you to assist them in redeploying those assets to meet their goals.

How we calculate the offer amount

The Partial Buyout offer amount is generally 50% of the Full Buyout offer amount. It is based on the actuarial calculation of the GMIB and GMDB contract reserves, which takes into account:

- The owner/annuitant’s life expectancy (based on age and gender)

- The current and projected annuity account value

- The current and projected GMIB and GMDB benefits

As with the Full Buyout Option, calculations are based on large blocks of business, so we do not consider any individual’s health or need for retirement income in making this offer. Because these factors can fluctuate daily, the offer amount will change each business day.

For most contract holders, the amount of the Partial Buyout offer is the greater of (i) approximately 35% of the actuarial valuation of the GMIB and GMDB reserves; and (ii) one year of charges for the guarantees based on the current benefit base.

For those who have withdrawn 25% of their annuity account value in any of the three previous full contract years ending on or before June 30, 2015 or in the partial contract year from the most recent contract date anniversary through June 30, 2015, the offer amount will be the greater of (i) approximately 12.5% of the actuarial valuation of the GMIB and GMDB reserves; or (ii) 50% of the annual fee rates for the guarantees multiplied by the respective current benefit base.

If your client has the EEB, the offer amount is increased by either 100% or 50% of the EEB fee rate multiplied by the current account value, depending on withdrawal history.

In general, the offer amount will be less than the difference between the value of the guaranteed benefits and the annuity account value. For more details on how the offer is calculated, review the prospectus supplement.

Why AXA Equitable is making this offer

The offer can be mutually beneficial to some contract holders and AXA Equitable. Contract holders whose financial needs have changed since they purchased the guarantees may have greater need for flexible access to their assets now than for maintaining future income guarantees. At the same time, AXA Equitable benefits because ongoing low interest rates make maintaining these benefits costly to us, and the credit amounts we are offering to clients are less than the amounts we’re currently setting aside to guarantee the benefits.

Details on AXA Equitable's financial strength ratings.